Reconciliation is a crucial process in accounting that ensures the accuracy and reliability of financial statements. One of the most effective tools for reconciliation is the General Ledger (GL) Reconciliation Template in Excel. In this article, we will explore the benefits of using a GL Reconciliation Template in Excel and provide a step-by-step guide on how to create and use it.

What is GL Reconciliation?

General Ledger Reconciliation is the process of verifying the accuracy of financial transactions recorded in the General Ledger account against the corresponding transactions recorded in external statements, such as bank statements or credit card statements. This process helps to identify and correct any discrepancies or errors in the financial records, ensuring that the financial statements are accurate and reliable.

Benefits of Using a GL Reconciliation Template in Excel

Using a GL Reconciliation Template in Excel offers several benefits, including:

- Improved accuracy: The template helps to identify and correct errors and discrepancies in the financial records, ensuring that the financial statements are accurate and reliable.

- Time-saving: The template automates the reconciliation process, reducing the time and effort required to complete the task.

- Increased efficiency: The template provides a standardized format for reconciliation, making it easier to identify and resolve discrepancies.

- Enhanced transparency: The template provides a clear and transparent record of the reconciliation process, making it easier to track and audit financial transactions.

Creating a GL Reconciliation Template in Excel

Creating a GL Reconciliation Template in Excel is a straightforward process that requires some basic knowledge of Excel. Here are the steps to follow:

Step 1: Set up the Template

- Open a new Excel workbook and create a new sheet.

- Set up the template by creating columns for the following:

- Date

- Description

- Debit

- Credit

- Balance

- External Statement Balance

- Reconciliation Difference

Step 2: Enter Data

- Enter the data from the General Ledger account into the template, including the date, description, debit, credit, and balance.

- Enter the external statement balance and the reconciliation difference.

Step 3: Format the Template

- Format the template to make it easier to read and understand.

- Use Excel formulas to calculate the reconciliation difference and highlight any discrepancies.

Step 4: Automate the Reconciliation Process

- Use Excel macros or formulas to automate the reconciliation process.

- Set up the template to automatically update the reconciliation difference and highlight any discrepancies.

Using the GL Reconciliation Template

Using the GL Reconciliation Template is a straightforward process that requires some basic knowledge of Excel. Here are the steps to follow:

Step 1: Enter New Data

- Enter new data into the template, including the date, description, debit, credit, and balance.

- Enter the external statement balance and the reconciliation difference.

Step 2: Reconcile the Accounts

- Use the template to reconcile the accounts by comparing the General Ledger balance with the external statement balance.

- Identify and correct any discrepancies or errors in the financial records.

Step 3: Review and Verify

- Review and verify the reconciliation process to ensure that the financial statements are accurate and reliable.

- Use the template to track and audit financial transactions.

Tips and Variations

Here are some tips and variations to consider when using the GL Reconciliation Template:

- Use multiple templates for different accounts or departments.

- Customize the template to meet specific business needs.

- Use Excel add-ins or plugins to enhance the reconciliation process.

- Use the template to reconcile other types of accounts, such as credit card statements or loan statements.

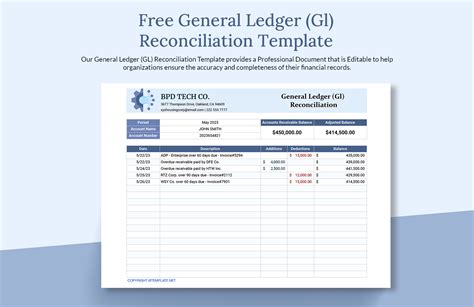

Gallery of GL Reconciliation Templates

FAQs

What is GL Reconciliation?

+GL Reconciliation is the process of verifying the accuracy of financial transactions recorded in the General Ledger account against the corresponding transactions recorded in external statements, such as bank statements or credit card statements.

What are the benefits of using a GL Reconciliation Template in Excel?

+The benefits of using a GL Reconciliation Template in Excel include improved accuracy, time-saving, increased efficiency, and enhanced transparency.

How do I create a GL Reconciliation Template in Excel?

+To create a GL Reconciliation Template in Excel, set up the template by creating columns for the date, description, debit, credit, balance, external statement balance, and reconciliation difference. Enter data into the template and format it to make it easier to read and understand.

Conclusion

In conclusion, using a GL Reconciliation Template in Excel is an effective way to ensure the accuracy and reliability of financial statements. By following the steps outlined in this article, you can create and use a GL Reconciliation Template to reconcile your accounts and identify any discrepancies or errors in the financial records.