Double entry accounting is a fundamental concept in accounting that involves recording each financial transaction twice, once as a debit and once as a credit. This method provides a complete picture of a company's financial situation and helps ensure the accuracy and reliability of financial statements. Microsoft Excel is a popular tool for implementing double entry accounting, and in this article, we will explore five ways to master double entry accounting in Excel.

The importance of double entry accounting cannot be overstated. It provides a systematic approach to recording financial transactions, allowing accountants and bookkeepers to track the flow of money within an organization. By using Excel to implement double entry accounting, businesses can streamline their accounting processes, reduce errors, and make more informed financial decisions.

However, mastering double entry accounting in Excel requires a combination of accounting knowledge and Excel skills. In the following sections, we will provide step-by-step instructions and examples to help you master double entry accounting in Excel.

1. Setting Up a Chart of Accounts

A chart of accounts is a list of all the accounts used by a business to record financial transactions. It is the foundation of double entry accounting and is essential for accurately tracking financial transactions in Excel. To set up a chart of accounts in Excel, follow these steps:

- Create a new worksheet in Excel and title it "Chart of Accounts."

- Create columns for the account number, account name, and account type (asset, liability, equity, revenue, or expense).

- Enter the account numbers and names for each account, using a consistent numbering system.

- Identify the account type for each account, using the following abbreviations: A (asset), L (liability), E (equity), R (revenue), and E (expense).

Here is an example of what a chart of accounts might look like in Excel:

| Account Number | Account Name | Account Type |

|---|---|---|

| 1000 | Cash | A |

| 1010 | Accounts Receivable | A |

| 1020 | Inventory | A |

| 2000 | Accounts Payable | L |

| 2010 | Salaries Payable | L |

| 3000 | Common Stock | E |

| 4000 | Sales Revenue | R |

| 5000 | Cost of Goods Sold | E |

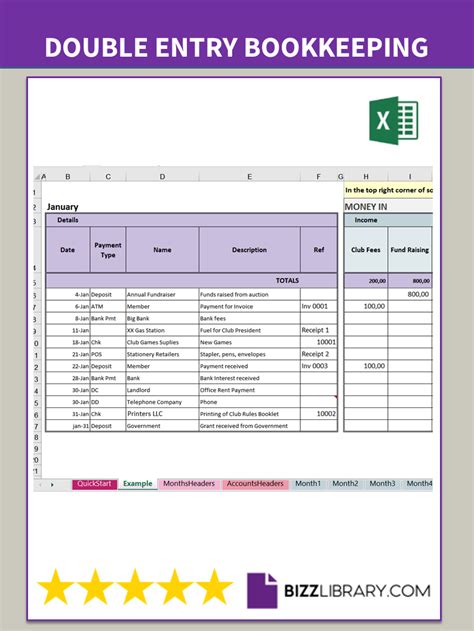

2. Recording Financial Transactions

Once you have set up a chart of accounts, you can begin recording financial transactions in Excel. To record a financial transaction, follow these steps:

- Identify the accounts affected by the transaction.

- Determine the debit and credit amounts for each account.

- Enter the transaction in the Excel worksheet, using the account numbers and debit and credit amounts.

Here is an example of how to record a financial transaction in Excel:

| Date | Account Number | Debit | Credit |

|---|---|---|---|

| 2023-02-01 | 1000 (Cash) | $1,000 | |

| 2023-02-01 | 4000 (Sales Revenue) | $1,000 |

Debit and Credit Rules

To ensure accuracy and consistency when recording financial transactions, it is essential to follow the debit and credit rules. These rules are as follows:

- Debits increase asset accounts and decrease liability and equity accounts.

- Credits decrease asset accounts and increase liability and equity accounts.

- Debits increase expense accounts and decrease revenue accounts.

- Credits decrease expense accounts and increase revenue accounts.

By following these rules, you can ensure that your financial transactions are accurately recorded and that your financial statements are reliable.

3. Preparing Financial Statements

Financial statements are used to communicate a company's financial performance and position to stakeholders. There are four primary financial statements: the balance sheet, income statement, cash flow statement, and statement of stockholders' equity. To prepare financial statements in Excel, follow these steps:

- Use the chart of accounts and financial transactions to prepare the balance sheet.

- Use the income statement formula to prepare the income statement.

- Use the cash flow statement formula to prepare the cash flow statement.

- Use the statement of stockholders' equity formula to prepare the statement of stockholders' equity.

Here is an example of how to prepare a balance sheet in Excel:

| Account Number | Account Name | Debit | Credit | Balance |

|---|---|---|---|---|

| 1000 | Cash | $1,000 | $1,000 | |

| 1010 | Accounts Receivable | $5,000 | $5,000 | |

| 1020 | Inventory | $10,000 | $10,000 | |

| 2000 | Accounts Payable | $5,000 | ($5,000) | |

| 2010 | Salaries Payable | $10,000 | ($10,000) | |

| 3000 | Common Stock | $100,000 | $100,000 |

4. Analyzing Financial Performance

Analyzing financial performance is essential for making informed business decisions. To analyze financial performance in Excel, follow these steps:

- Use financial ratios to evaluate a company's liquidity, profitability, and efficiency.

- Use trend analysis to identify changes in financial performance over time.

- Use benchmarking to compare a company's financial performance to industry averages.

Here is an example of how to calculate the current ratio in Excel:

| Formula | Calculation |

|---|---|

| Current Ratio | Current Assets / Current Liabilities |

| ($1,000 + $5,000 + $10,000) / ($5,000 + $10,000) | |

| 16,000 / 15,000 | |

| 1.07 |

5. Automating Accounting Processes

Automating accounting processes can save time and reduce errors. To automate accounting processes in Excel, follow these steps:

- Use formulas and functions to automate calculations.

- Use macros to automate repetitive tasks.

- Use Excel add-ins to automate accounting processes.

Here is an example of how to use a formula to automate a calculation:

| Formula | Calculation |

|---|---|

| =SUM(B2:B10) | Sum of Debits |

| $10,000 |

In conclusion, mastering double entry accounting in Excel requires a combination of accounting knowledge and Excel skills. By following the steps outlined in this article, you can set up a chart of accounts, record financial transactions, prepare financial statements, analyze financial performance, and automate accounting processes in Excel.

We hope this article has been informative and helpful. If you have any questions or need further clarification on any of the topics discussed, please do not hesitate to ask.

Gallery of Double Entry Accounting in Excel

What is double entry accounting?

+Why is double entry accounting important?

+How do I set up a chart of accounts in Excel?

+To set up a chart of accounts in Excel, create a new worksheet and title it "Chart of Accounts." Create columns for the account number, account name, and account type, and enter the account numbers and names for each account.