When it comes to saving money, one of the most popular options is a certificate of deposit (CD) offered by a credit union. CDs provide a low-risk investment opportunity with fixed returns, making them an attractive choice for those looking to grow their savings over time. In this article, we'll delve into the world of tech credit union CD rates, exploring the top options for savers and what to consider when choosing the right CD for your financial goals.

The Benefits of Credit Union CDs

Before we dive into the top tech credit union CD rates, let's take a look at the benefits of credit union CDs in general. Here are a few reasons why CDs are a popular choice among savers:

- Low risk: CDs are insured by the National Credit Union Administration (NCUA), which means your deposits are protected up to $250,000. This makes CDs a low-risk investment option.

- Fixed returns: CDs offer a fixed interest rate for a specified term, which can range from a few months to several years. This means you can earn a predictable return on your investment.

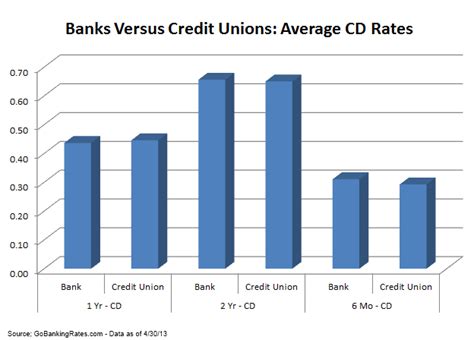

- Higher interest rates: Credit unions often offer higher interest rates on CDs compared to traditional banks, making them a more attractive option for savers.

- Flexibility: CDs come in a variety of terms, allowing you to choose the one that best fits your financial goals and timeline.

Top Tech Credit Union CD Rates

Now that we've covered the benefits of credit union CDs, let's take a look at some of the top tech credit union CD rates available. Keep in mind that rates are subject to change and may not be available in all states.

1. Alliant Credit Union

- APY: 4.75%

- Term: 5-year CD

- Minimum deposit: $1,000

- Maximum deposit: $250,000

Alliant Credit Union is a digital-only credit union that offers competitive rates on its CDs. With a 5-year CD, you can earn an APY of 4.75% with a minimum deposit of $1,000.

2. Navy Federal Credit Union

- APY: 4.65%

- Term: 7-year CD

- Minimum deposit: $1,000

- Maximum deposit: $250,000

Navy Federal Credit Union is one of the largest credit unions in the world, offering a range of CDs with competitive rates. Its 7-year CD offers an APY of 4.65% with a minimum deposit of $1,000.

3. Connexus Credit Union

- APY: 4.60%

- Term: 5-year CD

- Minimum deposit: $5,000

- Maximum deposit: $250,000

Connexus Credit Union is a digital-only credit union that offers a range of CDs with competitive rates. Its 5-year CD offers an APY of 4.60% with a minimum deposit of $5,000.

4. Bethpage Federal Credit Union

- APY: 4.55%

- Term: 5-year CD

- Minimum deposit: $500

- Maximum deposit: $250,000

Bethpage Federal Credit Union is a credit union based in New York that offers a range of CDs with competitive rates. Its 5-year CD offers an APY of 4.55% with a minimum deposit of $500.

Things to Consider When Choosing a CD

When choosing a CD, there are several things to consider to ensure you find the right one for your financial goals. Here are a few factors to keep in mind:

- Interest rate: Look for a CD with a competitive interest rate that aligns with your financial goals.

- Term: Choose a CD with a term that fits your timeline. Keep in mind that longer terms often offer higher interest rates, but you'll face penalties for early withdrawal.

- Minimum deposit: Check the minimum deposit required to open a CD. Some credit unions may have higher minimums than others.

- Maximum deposit: Make sure the credit union allows you to deposit the amount you need. Some credit unions may have lower maximums than others.

- Fees: Check for any fees associated with the CD, such as maintenance fees or early withdrawal fees.

Gallery of Credit Union CDs

Here's a gallery of credit union CDs, featuring a range of options from top credit unions.

Frequently Asked Questions

Here are some frequently asked questions about credit union CDs.

What is a credit union CD?

+A credit union CD is a type of savings account offered by a credit union that provides a fixed interest rate for a specified term.

How do credit union CDs work?

+Credit union CDs work by allowing you to deposit a sum of money for a specified term in exchange for a fixed interest rate.

What are the benefits of credit union CDs?

+The benefits of credit union CDs include low risk, fixed returns, higher interest rates, and flexibility.

In conclusion, credit union CDs offer a low-risk investment opportunity with fixed returns, making them an attractive choice for those looking to grow their savings over time. By considering factors such as interest rate, term, minimum deposit, and fees, you can find the right CD for your financial goals. Remember to always do your research and compare rates before making a decision.