In today's business world, partnerships are a common way for entrepreneurs to share the risks and rewards of building a company. However, as businesses grow and evolve, partners may have different visions or goals, leading to a desire to buy out one or more partners. A partnership buyout agreement is a critical document that outlines the terms and conditions of such a transaction. In this article, we will explore five essential tips for a smooth partnership buyout agreement.

Partnerships are built on trust, mutual respect, and a shared vision. However, when a buyout is on the horizon, emotions can run high, and relationships can become strained. It's essential to approach the negotiation process with a clear head, a level of professionalism, and a willingness to listen to all parties involved. The goal of a partnership buyout agreement is to create a mutually beneficial arrangement that allows the partnership to continue operating smoothly while ensuring the departing partner's interests are protected.

A well-structured partnership buyout agreement can help avoid costly disputes and ensure a smooth transition. However, the process can be complex, and the stakes are high. In this article, we will explore five essential tips for a smooth partnership buyout agreement.

Tip 1: Define the Terms of the Buyout

The first step in creating a partnership buyout agreement is to define the terms of the buyout. This includes the purchase price, payment terms, and any conditions that must be met before the buyout can proceed. It's essential to be clear and specific about the terms to avoid misunderstandings or disputes down the line.

Some key considerations when defining the terms of the buyout include:

- The purchase price: This should be based on the fair market value of the partnership, taking into account factors such as revenue, profitability, and growth potential.

- Payment terms: The agreement should outline the payment terms, including the amount, frequency, and duration of payments.

- Conditions: The agreement may include conditions that must be met before the buyout can proceed, such as the sale of a specific asset or the resolution of outstanding disputes.

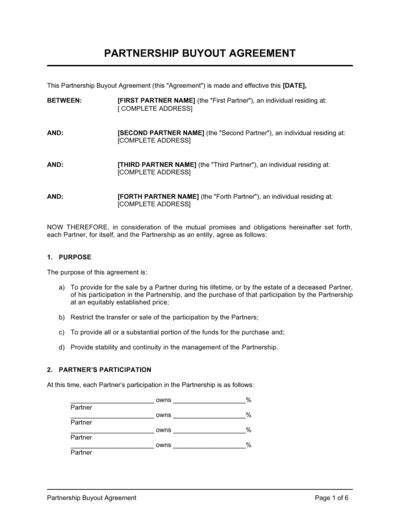

Example of a Partnership Buyout Agreement Template

Here is an example of a partnership buyout agreement template:

"This Partnership Buyout Agreement ('Agreement') is made and entered into on [DATE] ('Effective Date') by and between [PARTNER'S NAME] ('Buyer') and [PARTNER'S NAME] ('Seller').

The Buyer agrees to purchase from the Seller the entire interest in the partnership, including all assets, liabilities, and obligations, for a total purchase price of $[PURCHASE PRICE].

The purchase price will be paid in [NUMBER] installments, with the first payment due on [DATE] and subsequent payments due on [DATE].

This Agreement is contingent upon the Seller's satisfaction of the following conditions:

- The sale of the partnership's assets to the Buyer

- The resolution of all outstanding disputes between the partners

Upon satisfaction of the conditions, the Buyer will pay the purchase price in accordance with the payment terms outlined above.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

[BUYER'S SIGNATURE]

[SELLER'S SIGNATURE]"

Tip 2: Consider the Tax Implications

A partnership buyout can have significant tax implications for both the buyer and seller. It's essential to consider these implications when negotiating the terms of the buyout.

Some key tax considerations include:

- Capital gains tax: The seller may be subject to capital gains tax on the sale of their partnership interest.

- Depreciation: The buyer may be able to depreciate the assets acquired in the buyout, which can reduce their taxable income.

- Partnership tax allocation: The partnership's tax allocation may need to be adjusted to reflect the change in ownership.

Tax Planning Strategies for Partnership Buyouts

Here are some tax planning strategies to consider:

- Use a tax-deferred exchange: The seller may be able to defer capital gains tax by using a tax-deferred exchange, such as a Section 1031 exchange.

- Allocate tax basis: The buyer and seller can allocate the tax basis of the partnership's assets to minimize tax liabilities.

- Use a partnership tax allocation: The partnership can allocate tax liabilities and benefits to the buyer and seller to reflect their respective interests.

Tip 3: Protect Confidential Information

A partnership buyout agreement should include provisions to protect confidential information. This includes trade secrets, business strategies, and other sensitive information that could harm the partnership if disclosed.

Some key considerations when protecting confidential information include:

- Non-disclosure agreements: The buyer and seller should sign non-disclosure agreements to protect confidential information.

- Confidentiality clauses: The partnership buyout agreement should include confidentiality clauses to prevent the disclosure of sensitive information.

- Return of confidential information: The agreement should require the buyer and seller to return all confidential information to the partnership upon completion of the buyout.

Example of a Confidentiality Clause

Here is an example of a confidentiality clause:

"The parties agree to keep confidential all information and documents disclosed in connection with the buyout, including but not limited to trade secrets, business strategies, and financial information.

The parties agree not to disclose any confidential information to any third party without the prior written consent of the other party.

Upon completion of the buyout, the parties agree to return all confidential information to the partnership."

Tip 4: Consider the Impact on Employees

A partnership buyout can have a significant impact on employees, particularly if the buyer plans to make changes to the business. It's essential to consider the impact on employees when negotiating the terms of the buyout.

Some key considerations when considering the impact on employees include:

- Employee retention: The buyer may want to consider offering retention bonuses or other incentives to key employees to ensure their continued employment.

- Severance packages: The buyer may need to offer severance packages to employees who are terminated as a result of the buyout.

- Business continuity: The buyer should consider the impact of the buyout on business continuity and take steps to minimize disruption to employees and customers.

Example of an Employee Retention Plan

Here is an example of an employee retention plan:

"The buyer agrees to offer retention bonuses to key employees who remain employed with the partnership for a period of [TIME] after the completion of the buyout.

The retention bonuses will be paid in [NUMBER] installments, with the first payment due on [DATE] and subsequent payments due on [DATE].

The buyer agrees to provide severance packages to employees who are terminated as a result of the buyout, including [NUMBER] weeks of pay and [NUMBER] months of benefits continuation."

Tip 5: Seek Professional Advice

A partnership buyout agreement is a complex document that requires the input of various professionals, including lawyers, accountants, and business advisors. It's essential to seek professional advice to ensure that the agreement is comprehensive and protects the interests of all parties involved.

Some key considerations when seeking professional advice include:

- Lawyer review: The partnership buyout agreement should be reviewed by a lawyer to ensure that it complies with all relevant laws and regulations.

- Accounting advice: An accountant should be consulted to ensure that the agreement is tax-efficient and complies with all accounting standards.

- Business advice: A business advisor should be consulted to ensure that the agreement reflects the commercial realities of the buyout.

Example of a Professional Services Agreement

Here is an example of a professional services agreement:

"The buyer agrees to engage the services of [LAWYER'S NAME] to review the partnership buyout agreement and provide legal advice.

The buyer agrees to engage the services of [ACCOUNTANT'S NAME] to provide accounting advice and ensure that the agreement is tax-efficient.

The buyer agrees to engage the services of [BUSINESS ADVISOR'S NAME] to provide business advice and ensure that the agreement reflects the commercial realities of the buyout."

Gallery of Partnership Buyout Agreement:

FAQ Section:

What is a partnership buyout agreement?

+A partnership buyout agreement is a document that outlines the terms and conditions of a buyout, including the purchase price, payment terms, and any conditions that must be met before the buyout can proceed.

Why is it essential to consider the tax implications of a partnership buyout?

+A partnership buyout can have significant tax implications for both the buyer and seller. It's essential to consider these implications to minimize tax liabilities and ensure that the buyout is tax-efficient.

What is the importance of protecting confidential information in a partnership buyout agreement?

+Protecting confidential information is essential to prevent the disclosure of sensitive information that could harm the partnership. The agreement should include provisions to protect confidential information, including non-disclosure agreements and confidentiality clauses.