As a business owner, managing prepaid expenses can be a daunting task. Prepaid expenses are funds paid in advance for goods or services that will be used in the future. These expenses can be challenging to track and reconcile, especially when using traditional accounting methods. However, with the help of an Excel reconciliation template, you can streamline your prepaid expenses and ensure accuracy in your financial records.

Prepaid expenses are common in various industries, such as insurance premiums, rent, and utility deposits. These expenses are initially recorded as assets on the balance sheet, but as the goods or services are consumed, they are expensed and matched against revenue. The key to managing prepaid expenses is to ensure that the expenses are accurately recorded and reconciled in a timely manner.

The Benefits of Using an Excel Reconciliation Template for Prepaid Expenses

Using an Excel reconciliation template for prepaid expenses offers several benefits, including:

- Improved Accuracy: An Excel reconciliation template helps ensure that prepaid expenses are accurately recorded and reconciled, reducing the risk of errors and discrepancies.

- Increased Efficiency: The template automates the reconciliation process, saving time and reducing manual effort.

- Enhanced Visibility: The template provides a clear and transparent view of prepaid expenses, enabling you to track and manage them more effectively.

- Better Financial Reporting: Accurate and timely reconciliation of prepaid expenses ensures that financial reports are reliable and trustworthy.

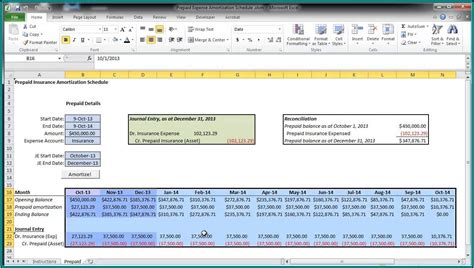

How to Create an Excel Reconciliation Template for Prepaid Expenses

Creating an Excel reconciliation template for prepaid expenses involves several steps:

Step 1: Set Up the Template

Create a new Excel spreadsheet and set up a template with the following columns:

- Date: Record the date of the prepaid expense

- Description: Describe the prepaid expense

- Amount: Record the amount of the prepaid expense

- Account: Identify the account associated with the prepaid expense

- Vendor: Identify the vendor or supplier associated with the prepaid expense

Step 2: Record Prepaid Expenses

Record each prepaid expense in the template, including the date, description, amount, account, and vendor.

Step 3: Reconcile Prepaid Expenses

Reconcile the prepaid expenses by matching the expenses against the corresponding invoices or receipts. Update the template to reflect the reconciled amounts.

Step 4: Review and Verify

Regularly review and verify the prepaid expenses to ensure accuracy and completeness.

Tips for Using an Excel Reconciliation Template for Prepaid Expenses

Here are some tips for using an Excel reconciliation template for prepaid expenses:

- Use a Standardized Template: Use a standardized template to ensure consistency and accuracy in recording and reconciling prepaid expenses.

- Regularly Review and Verify: Regularly review and verify prepaid expenses to ensure accuracy and completeness.

- Use Automation: Use automation features in Excel to streamline the reconciliation process and reduce manual effort.

Common Challenges in Managing Prepaid Expenses

Managing prepaid expenses can be challenging, especially when using traditional accounting methods. Some common challenges include:

- Accuracy and Completeness: Ensuring accuracy and completeness in recording and reconciling prepaid expenses can be time-consuming and prone to errors.

- Timeliness: Ensuring that prepaid expenses are reconciled in a timely manner can be challenging, especially when dealing with multiple vendors and suppliers.

- Visibility: Obtaining a clear and transparent view of prepaid expenses can be difficult, especially when using traditional accounting methods.

Best Practices for Managing Prepaid Expenses

Here are some best practices for managing prepaid expenses:

- Use a Centralized System: Use a centralized system to record and reconcile prepaid expenses, ensuring accuracy and completeness.

- Regularly Review and Verify: Regularly review and verify prepaid expenses to ensure accuracy and completeness.

- Use Automation: Use automation features to streamline the reconciliation process and reduce manual effort.

Conclusion

Managing prepaid expenses can be challenging, but with the help of an Excel reconciliation template, you can streamline your prepaid expenses and ensure accuracy in your financial records. By following the steps outlined in this article, you can create an effective Excel reconciliation template for prepaid expenses and improve your financial management.

Take Action Today

Create an Excel reconciliation template for prepaid expenses and start streamlining your financial management today. Regularly review and verify your prepaid expenses to ensure accuracy and completeness. Use automation features to reduce manual effort and improve efficiency.

FAQ Section

Q: What is a prepaid expense?

A prepaid expense is a payment made in advance for goods or services that will be used in the future.

Q: How do I record a prepaid expense in Excel?

Record a prepaid expense in Excel by creating a new row in the template and entering the date, description, amount, account, and vendor associated with the expense.

Q: How do I reconcile prepaid expenses in Excel?

Reconcile prepaid expenses in Excel by matching the expenses against the corresponding invoices or receipts and updating the template to reflect the reconciled amounts.

Q: What are some common challenges in managing prepaid expenses?

Common challenges in managing prepaid expenses include ensuring accuracy and completeness, timeliness, and visibility.

Q: What are some best practices for managing prepaid expenses?

Best practices for managing prepaid expenses include using a centralized system, regularly reviewing and verifying expenses, and using automation features to streamline the reconciliation process.