Creating a professional invoice is a crucial step in ensuring timely payments and maintaining a positive reputation for sole proprietors. A well-designed invoice template can help streamline the billing process, reduce errors, and improve cash flow. In this article, we will explore the essential elements of a sole proprietor invoice template, provide tips on how to create one, and discuss the benefits of using a template.

Benefits of Using a Sole Proprietor Invoice Template

Using a sole proprietor invoice template offers numerous benefits, including:

- Saves time: A template eliminates the need to start from scratch each time you create an invoice, saving you time and effort.

- Reduces errors: A template helps ensure consistency and accuracy in your invoicing, reducing the risk of errors and misunderstandings.

- Improves professionalism: A well-designed template presents a professional image, enhancing your credibility and reputation with clients.

- Enhances organization: A template helps you stay organized, keeping track of payments, expenses, and client information in one place.

Essential Elements of a Sole Proprietor Invoice Template

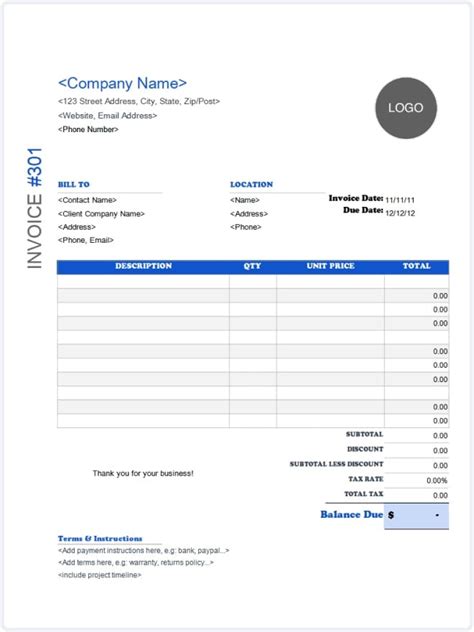

A sole proprietor invoice template should include the following essential elements:

- Business Information: Include your business name, address, phone number, and email address.

- Invoice Number: Assign a unique invoice number to each invoice to help track payments and expenses.

- Date: Include the date the invoice was created or the date payment is due.

- Client Information: List the client's name, address, and contact information.

- Services or Products: Describe the services or products provided, including quantities and rates.

- Payment Terms: Specify the payment terms, including the due date, payment methods, and any late fees.

- Total Amount: Calculate the total amount due, including taxes and any discounts.

Tips for Creating a Sole Proprietor Invoice Template

To create an effective sole proprietor invoice template, follow these tips:

- Keep it Simple: Use a clean and simple design, avoiding clutter and unnecessary information.

- Use a Standard Font: Choose a standard font, such as Arial or Times New Roman, to ensure readability.

- Include a Clear Call-to-Action: Specify the payment methods and due date to encourage prompt payment.

- Use a Template Software: Utilize template software, such as Microsoft Word or Google Docs, to create and customize your template.

- Review and Update: Regularly review and update your template to ensure it remains accurate and effective.

Best Practices for Using a Sole Proprietor Invoice Template

To get the most out of your sole proprietor invoice template, follow these best practices:

- Use it Consistently: Use your template for all invoices to maintain consistency and professionalism.

- Customize it: Tailor your template to fit your business needs and branding.

- Proofread: Carefully proofread each invoice to ensure accuracy and attention to detail.

- Send it Promptly: Send invoices promptly to ensure timely payment and maintain a positive cash flow.

By following these tips and best practices, you can create an effective sole proprietor invoice template that streamlines your billing process, reduces errors, and improves your professional image.

Common Mistakes to Avoid When Creating a Sole Proprietor Invoice Template

- Inconsistent branding: Failing to maintain consistent branding throughout the template can undermine your professional image.

- Insufficient information: Omitting essential information, such as payment terms or client contact details, can lead to confusion and delayed payments.

- Poor design: Using a cluttered or poorly designed template can make it difficult for clients to understand and respond to the invoice.

Benefits of Digital Invoicing for Sole Proprietors

- Increased efficiency: Digital invoicing automates many tasks, freeing up time for more critical business activities.

- Improved accuracy: Digital invoicing reduces the risk of errors and discrepancies, ensuring accurate and timely payments.

- Enhanced security: Digital invoicing provides a secure and reliable way to send and receive payments, reducing the risk of fraud and theft.

By understanding the benefits and best practices of digital invoicing, sole proprietors can optimize their billing process, improve cash flow, and enhance their professional reputation.

Frequently Asked Questions

Q: What is a sole proprietor invoice template? A: A sole proprietor invoice template is a pre-designed document that sole proprietors can use to create professional invoices for their clients.

Q: What are the benefits of using a sole proprietor invoice template? A: Using a sole proprietor invoice template saves time, reduces errors, and improves professionalism.

Q: What are the essential elements of a sole proprietor invoice template? A: A sole proprietor invoice template should include business information, invoice number, date, client information, services or products, payment terms, and total amount.

Q: How can I create a sole proprietor invoice template? A: You can create a sole proprietor invoice template using template software, such as Microsoft Word or Google Docs, and customize it to fit your business needs and branding.

Q: What are the best practices for using a sole proprietor invoice template? A: Use the template consistently, customize it, proofread, and send it promptly to ensure timely payment and maintain a positive cash flow.

By following these tips and best practices, sole proprietors can create an effective invoice template that streamlines their billing process, reduces errors, and improves their professional image.