Pay stubs are an essential part of employee compensation, providing a clear and concise breakdown of earnings, deductions, and other relevant information. Creating a pay stub from scratch can be a daunting task, especially for small businesses or solo entrepreneurs. Fortunately, there are many easy-to-use pay stub templates available in Excel that can save time and reduce errors.

In this article, we will explore five easy-to-use pay stub templates in Excel, including their features, benefits, and step-by-step instructions on how to use them.

The Importance of Pay Stubs

Before we dive into the templates, let's briefly discuss the importance of pay stubs. Pay stubs serve as a record of employee compensation, providing a detailed breakdown of:

- Gross earnings

- Deductions (taxes, benefits, etc.)

- Net pay

- Pay period

- Employee information (name, address, etc.)

Pay stubs are essential for employees to understand their compensation and ensure accuracy. They also help employers maintain compliance with labor laws and regulations.

5 Easy Pay Stub Templates in Excel

Here are five easy-to-use pay stub templates in Excel, each with its unique features and benefits:

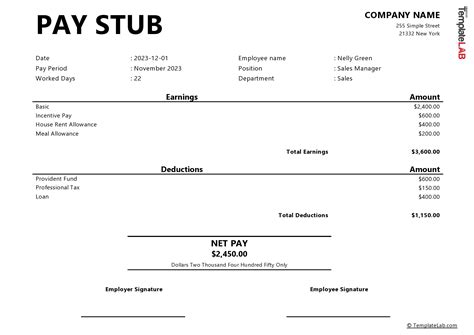

Template 1: Basic Pay Stub Template

This template provides a simple and straightforward design, perfect for small businesses or solo entrepreneurs. It includes the following features:

- Employee information (name, address, etc.)

- Pay period

- Gross earnings

- Deductions (taxes, benefits, etc.)

- Net pay

To use this template, simply download and open the file in Excel. Enter the employee's information, pay period, and gross earnings. The template will automatically calculate the deductions and net pay.

Step-by-Step Instructions:

- Download the template from the link provided.

- Open the file in Excel.

- Enter the employee's information (name, address, etc.).

- Enter the pay period.

- Enter the gross earnings.

- The template will automatically calculate the deductions and net pay.

Template 2: Advanced Pay Stub Template

This template provides a more detailed breakdown of employee compensation, including:

- Employee information (name, address, etc.)

- Pay period

- Gross earnings

- Deductions (taxes, benefits, etc.)

- Net pay

- Year-to-date (YTD) earnings

- Benefits information (health, dental, etc.)

To use this template, simply download and open the file in Excel. Enter the employee's information, pay period, and gross earnings. The template will automatically calculate the deductions, net pay, and YTD earnings.

Step-by-Step Instructions:

- Download the template from the link provided.

- Open the file in Excel.

- Enter the employee's information (name, address, etc.).

- Enter the pay period.

- Enter the gross earnings.

- The template will automatically calculate the deductions, net pay, and YTD earnings.

- Enter the benefits information (health, dental, etc.).

Template 3: Pay Stub Template with Leave Tracking

This template provides a comprehensive breakdown of employee compensation, including leave tracking:

- Employee information (name, address, etc.)

- Pay period

- Gross earnings

- Deductions (taxes, benefits, etc.)

- Net pay

- Leave balance (vacation, sick, etc.)

To use this template, simply download and open the file in Excel. Enter the employee's information, pay period, and gross earnings. The template will automatically calculate the deductions, net pay, and leave balance.

Step-by-Step Instructions:

- Download the template from the link provided.

- Open the file in Excel.

- Enter the employee's information (name, address, etc.).

- Enter the pay period.

- Enter the gross earnings.

- The template will automatically calculate the deductions, net pay, and leave balance.

- Enter the leave information (vacation, sick, etc.).

Template 4: Pay Stub Template with Reimbursement Tracking

This template provides a detailed breakdown of employee compensation, including reimbursement tracking:

- Employee information (name, address, etc.)

- Pay period

- Gross earnings

- Deductions (taxes, benefits, etc.)

- Net pay

- Reimbursement information (mileage, expenses, etc.)

To use this template, simply download and open the file in Excel. Enter the employee's information, pay period, and gross earnings. The template will automatically calculate the deductions, net pay, and reimbursement information.

Step-by-Step Instructions:

- Download the template from the link provided.

- Open the file in Excel.

- Enter the employee's information (name, address, etc.).

- Enter the pay period.

- Enter the gross earnings.

- The template will automatically calculate the deductions, net pay, and reimbursement information.

- Enter the reimbursement information (mileage, expenses, etc.).

Template 5: Pay Stub Template with Tax Information

This template provides a comprehensive breakdown of employee compensation, including tax information:

- Employee information (name, address, etc.)

- Pay period

- Gross earnings

- Deductions (taxes, benefits, etc.)

- Net pay

- Tax information (federal, state, etc.)

To use this template, simply download and open the file in Excel. Enter the employee's information, pay period, and gross earnings. The template will automatically calculate the deductions, net pay, and tax information.

Step-by-Step Instructions:

- Download the template from the link provided.

- Open the file in Excel.

- Enter the employee's information (name, address, etc.).

- Enter the pay period.

- Enter the gross earnings.

- The template will automatically calculate the deductions, net pay, and tax information.

- Enter the tax information (federal, state, etc.).

Gallery of Pay Stub Templates

Frequently Asked Questions

What is a pay stub?

+A pay stub is a document that provides a detailed breakdown of an employee's compensation, including gross earnings, deductions, and net pay.

Why do I need a pay stub template?

+A pay stub template helps you create accurate and professional pay stubs, saving you time and reducing errors.

Can I customize the pay stub template?

+Yes, you can customize the pay stub template to fit your specific needs and branding.

By using one of these easy pay stub templates in Excel, you can create accurate and professional pay stubs, saving you time and reducing errors. Whether you're a small business owner or a solo entrepreneur, these templates are perfect for managing employee compensation and ensuring compliance with labor laws and regulations.