As a business owner, keeping track of your finances is crucial for making informed decisions and ensuring the success of your company. However, managing finances can be a daunting task, especially for small businesses or solo entrepreneurs. That's where a Google Sheets ledger template comes in – a simple, yet powerful tool for easy accounting.

In this article, we'll explore the benefits of using a Google Sheets ledger template, its features, and how to set one up for your business. We'll also discuss some best practices for maintaining accurate and up-to-date financial records.

Why Use a Google Sheets Ledger Template?

A ledger template is a pre-designed spreadsheet that helps you track and record your business's financial transactions. Using a Google Sheets ledger template offers several benefits, including:

- Easy to set up and use: Google Sheets is a cloud-based spreadsheet program that's free to use and accessible from anywhere. You don't need to have extensive accounting knowledge to use a ledger template.

- Collaboration: Multiple users can access and edit the same spreadsheet in real-time, making it easy to collaborate with team members or accountants.

- Automatic calculations: Google Sheets can perform calculations automatically, reducing errors and saving time.

- Scalability: A Google Sheets ledger template can grow with your business, accommodating an increasing number of transactions and accounts.

Features of a Google Sheets Ledger Template

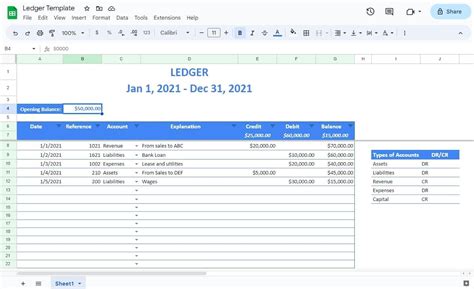

A standard Google Sheets ledger template typically includes the following features:

- Chart of accounts: A list of all your business's accounts, including assets, liabilities, equity, revenue, and expenses.

- Transaction log: A table where you record each financial transaction, including date, description, debit, and credit amounts.

- Account balances: A summary of each account's current balance, updated automatically as you enter new transactions.

- Financial statements: Pre-built templates for generating balance sheets, income statements, and cash flow statements.

How to Set Up a Google Sheets Ledger Template

Setting up a Google Sheets ledger template is a straightforward process. Here's a step-by-step guide:

- Create a new Google Sheet: Go to Google Drive and create a new spreadsheet. Give it a name, such as "Business Ledger."

- Set up the chart of accounts: Create a table with the following columns: Account Name, Account Type (Asset, Liability, Equity, Revenue, or Expense), and Account Number.

- Create the transaction log: Create a new table with the following columns: Date, Description, Debit, Credit, and Account Name.

- Set up account balances: Create a summary table that displays each account's current balance.

- Customize the template: Add or remove accounts, transaction columns, or financial statements as needed.

Best Practices for Maintaining Accurate Financial Records

To get the most out of your Google Sheets ledger template, follow these best practices:

- Enter transactions regularly: Update your ledger template regularly to ensure accurate and up-to-date financial records.

- Use clear and concise descriptions: When entering transactions, use clear and concise descriptions to help you identify the transaction later.

- Use account numbers: Assign account numbers to each account to help you quickly identify and reference them.

- Reconcile accounts regularly: Reconcile your accounts regularly to ensure accuracy and detect any discrepancies.

Common Mistakes to Avoid

When using a Google Sheets ledger template, avoid the following common mistakes:

- Inconsistent formatting: Use consistent formatting throughout your ledger template to make it easier to read and understand.

- Incorrect account numbers: Double-check account numbers to avoid incorrect postings.

- Missing transactions: Regularly review your ledger template to ensure all transactions are accounted for.

Tips for Customizing Your Ledger Template

To get the most out of your Google Sheets ledger template, consider the following customization tips:

- Add custom accounts: Add custom accounts to track specific expenses or revenue streams.

- Use conditional formatting: Use conditional formatting to highlight important information, such as overdue invoices or low account balances.

- Create custom financial statements: Create custom financial statements to help you analyze your business's performance.

Conclusion

A Google Sheets ledger template is a powerful tool for easy accounting and financial management. By following the steps outlined in this article, you can set up a ledger template that meets your business's unique needs. Remember to enter transactions regularly, use clear and concise descriptions, and reconcile accounts regularly to ensure accurate and up-to-date financial records.

Gallery of Google Sheets Ledger Templates

FAQ

What is a ledger template?

+A ledger template is a pre-designed spreadsheet that helps you track and record your business's financial transactions.

How do I set up a Google Sheets ledger template?

+Set up a new Google Sheet, create a chart of accounts, transaction log, and account balances, and customize the template as needed.

What are the benefits of using a Google Sheets ledger template?

+The benefits include ease of use, collaboration, automatic calculations, and scalability.