As a working parent, it can be a challenge to balance your career and family responsibilities. One way to make things easier is by hiring a babysitter to take care of your little ones while you're away. However, when it comes to claiming childcare expenses on your Flexible Spending Account (FSA), it's essential to have the right receipts to ensure reimbursement.

In this article, we'll explore the five essential babysitter receipts you need for FSA reimbursement, along with some valuable tips to help you navigate the process.

Why Are Babysitter Receipts Important for FSA Reimbursement?

When you contribute to an FSA, you set aside pre-tax dollars to pay for qualified healthcare expenses, including childcare costs. To claim reimbursement for babysitting expenses, you need to provide your FSA administrator with receipts that meet specific requirements. Without these receipts, you risk not getting reimbursed for your expenses.

5 Essential Babysitter Receipts for FSA Reimbursement

Here are the five essential babysitter receipts you need for FSA reimbursement:

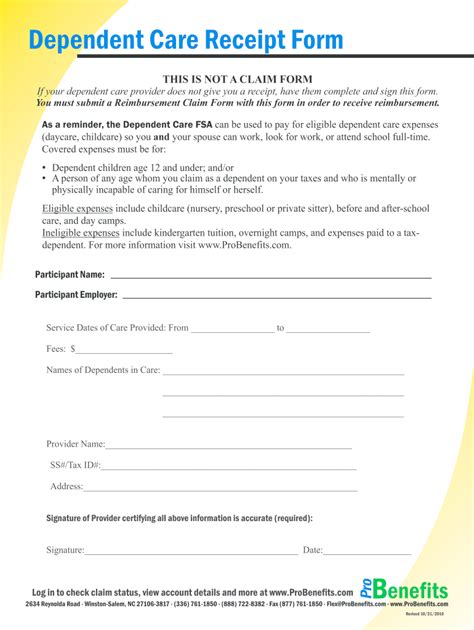

- Receipts with the Babysitter's Name and Address

To qualify for reimbursement, your receipts should include the babysitter's name and address. This information helps your FSA administrator verify the identity of the caregiver and ensure that the services were provided by an eligible individual.

- Receipts with the Date and Time of Care

Your receipts should include the date and time of care provided by the babysitter. This information helps your FSA administrator determine the total amount of qualified expenses and ensures that the care was provided during a specific period.

- Receipts with a Description of Services Provided

Your receipts should include a description of the services provided by the babysitter. This information helps your FSA administrator understand the type of care provided and ensure that it meets the qualified expense requirements.

- Receipts with the Total Amount Paid

Your receipts should include the total amount paid to the babysitter. This information helps your FSA administrator determine the total amount of qualified expenses and ensures that you're reimbursed for the correct amount.

- Receipts with a Signature from the Babysitter

Finally, your receipts should include a signature from the babysitter. This information helps your FSA administrator verify that the services were provided by an eligible individual and ensures that the care was provided with your consent.

Tips for Navigating the FSA Reimbursement Process

Here are some valuable tips to help you navigate the FSA reimbursement process:

- Keep accurate records: Keep accurate records of your babysitter receipts, including the date, time, and total amount paid.

- Verify eligibility: Verify that your babysitter is eligible to provide care under your FSA plan.

- Submit receipts promptly: Submit your receipts promptly to avoid delays in reimbursement.

- Check your FSA plan: Check your FSA plan to ensure that you understand the qualified expense requirements and reimbursement process.

Gallery of Babysitter Receipts

Frequently Asked Questions

What is a qualified childcare expense for FSA reimbursement?

+A qualified childcare expense for FSA reimbursement includes costs for care provided by a babysitter, daycare center, or after-school program.

What is the maximum amount I can contribute to an FSA?

+The maximum amount you can contribute to an FSA varies depending on your employer's plan. Typically, the limit is $5,000 per year.

Can I use my FSA funds to pay for summer camp?

+Yes, you can use your FSA funds to pay for summer camp, but only if the camp provides childcare services and is not primarily for entertainment or education.

In conclusion, having the right babysitter receipts is essential for FSA reimbursement. By following these tips and understanding what makes a qualified childcare expense, you can ensure that you're reimbursed for your babysitting expenses and make the most of your FSA benefits.