The concept of double entry accounting has been around for centuries, and its importance in modern accounting practices cannot be overstated. In today's digital age, utilizing a double entry accounting Excel template can greatly simplify the process of managing your finances. In this article, we will delve into the world of double entry accounting, its benefits, and how to download a free Excel template to help you get started.

What is Double Entry Accounting?

Double entry accounting is a method of bookkeeping where each financial transaction is recorded in two separate accounts. This approach ensures that the accounting equation (Assets = Liabilities + Equity) remains balanced, providing a clear picture of a company's financial situation. The double entry system involves recording each transaction as both a debit and a credit, which helps to maintain the accuracy and integrity of the financial records.

Benefits of Double Entry Accounting

The double entry accounting system offers numerous benefits, including:

- Improved accuracy: By recording each transaction twice, the risk of errors is significantly reduced.

- Enhanced financial reporting: Double entry accounting provides a clear picture of a company's financial situation, making it easier to prepare financial statements.

- Better decision-making: With accurate and reliable financial data, businesses can make informed decisions about investments, funding, and other financial matters.

Why Use a Double Entry Accounting Excel Template?

A double entry accounting Excel template can greatly simplify the process of managing your finances. Here are some benefits of using a template:

- Convenience: An Excel template provides a pre-designed format for recording financial transactions, saving time and effort.

- Accuracy: The template ensures that each transaction is recorded correctly, reducing the risk of errors.

- Customization: Excel templates can be easily customized to meet the specific needs of your business.

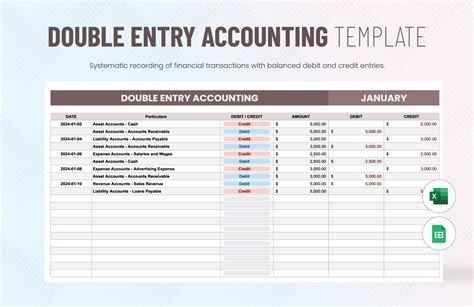

Features of a Double Entry Accounting Excel Template

A good double entry accounting Excel template should include the following features:

- A chart of accounts: A list of all the accounts used to record financial transactions.

- A journal: A record of all financial transactions, including debits and credits.

- A ledger: A record of all accounts, including their balances.

- Financial statements: Templates for preparing balance sheets, income statements, and cash flow statements.

How to Download a Free Double Entry Accounting Excel Template

There are many websites that offer free double entry accounting Excel templates. Here are a few options:

- Microsoft Office Templates: Microsoft offers a range of free Excel templates, including a double entry accounting template.

- Vertex42: Vertex42 provides a free double entry accounting template that includes a chart of accounts, journal, and ledger.

- AccountingCoach: AccountingCoach offers a free double entry accounting template that includes financial statements and a chart of accounts.

How to Use a Double Entry Accounting Excel Template

Using a double entry accounting Excel template is relatively straightforward. Here are the steps to follow:

- Download the template: Choose a template that meets your needs and download it to your computer.

- Set up the chart of accounts: Customize the chart of accounts to include all the accounts used by your business.

- Record transactions: Record each financial transaction in the journal, including debits and credits.

- Post transactions to the ledger: Post each transaction to the corresponding account in the ledger.

- Prepare financial statements: Use the template to prepare financial statements, including balance sheets, income statements, and cash flow statements.

Tips for Using a Double Entry Accounting Excel Template

Here are some tips for using a double entry accounting Excel template:

- Customize the template: Customize the template to meet the specific needs of your business.

- Use formulas: Use formulas to automate calculations and reduce errors.

- Regularly review and update: Regularly review and update the template to ensure accuracy and compliance with accounting standards.

Common Mistakes to Avoid When Using a Double Entry Accounting Excel Template

Here are some common mistakes to avoid when using a double entry accounting Excel template:

- Inconsistent accounting: Ensure that the template is set up to follow consistent accounting principles.

- Errors in formulas: Check formulas regularly to ensure accuracy and avoid errors.

- Inadequate documentation: Ensure that the template includes adequate documentation to support financial transactions.

Best Practices for Using a Double Entry Accounting Excel Template

Here are some best practices for using a double entry accounting Excel template:

- Regularly back up data: Regularly back up data to prevent loss in case of a system failure.

- Use password protection: Use password protection to prevent unauthorized access to the template.

- Regularly review and update: Regularly review and update the template to ensure accuracy and compliance with accounting standards.

Conclusion

In conclusion, a double entry accounting Excel template can be a valuable tool for managing your finances. By understanding the benefits and features of a template, and following best practices for use, you can ensure accurate and reliable financial data. Remember to customize the template to meet the specific needs of your business, and regularly review and update to ensure accuracy and compliance with accounting standards.

What is double entry accounting?

+Double entry accounting is a method of bookkeeping where each financial transaction is recorded in two separate accounts.

What are the benefits of using a double entry accounting Excel template?

+A double entry accounting Excel template can simplify the process of managing your finances, improve accuracy, and enhance financial reporting.

How do I use a double entry accounting Excel template?

+Download the template, set up the chart of accounts, record transactions, post transactions to the ledger, and prepare financial statements.