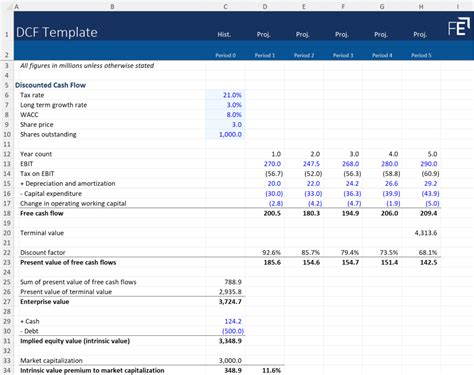

Discounted cash flow (DCF) analysis is a powerful tool used in finance to evaluate the present value of future cash flows. It's a crucial technique for investors, entrepreneurs, and businesses to make informed decisions about investments, mergers, and acquisitions. However, creating a DCF model from scratch can be a daunting task, especially for those without extensive financial modeling experience. This is where a discounted cash flow Excel template comes in handy.

In this article, we'll explore five ways to use a discounted cash flow Excel template for free, highlighting its benefits, and providing practical examples to get you started.

Why Use a Discounted Cash Flow Excel Template?

Before we dive into the ways to use a DCF Excel template, let's quickly discuss why it's essential to use one in the first place. A DCF template offers several benefits, including:

- Simplifies the calculation process: DCF analysis involves complex calculations, which can be prone to errors. A template helps simplify the process, reducing the risk of mistakes.

- Saves time: Creating a DCF model from scratch can be time-consuming. A template saves you time, allowing you to focus on more critical aspects of your analysis.

- Improves accuracy: A template ensures that your calculations are accurate and consistent, which is critical in financial analysis.

- Enhances collaboration: A template provides a standardized framework for your analysis, making it easier to collaborate with colleagues or stakeholders.

1. Evaluating Investment Opportunities

One of the most common uses of a DCF Excel template is to evaluate investment opportunities. By estimating the present value of future cash flows, you can determine whether an investment is worth pursuing. Here's an example:

Suppose you're considering investing in a new project with an initial investment of $100,000. The project is expected to generate cash flows of $20,000, $30,000, and $40,000 over the next three years, respectively. Using a DCF template, you can calculate the present value of these cash flows and determine whether the investment is viable.

2. Mergers and Acquisitions

A DCF Excel template can also be used to evaluate mergers and acquisitions. By estimating the present value of future cash flows, you can determine whether a potential acquisition is worth pursuing. Here's an example:

Suppose you're considering acquiring a company with expected cash flows of $50,000, $60,000, and $70,000 over the next three years, respectively. Using a DCF template, you can calculate the present value of these cash flows and determine whether the acquisition is viable.

3. Business Valuation

A DCF Excel template can be used to estimate the value of a business. By estimating the present value of future cash flows, you can determine the intrinsic value of a company. Here's an example:

Suppose you're considering valuing a company with expected cash flows of $100,000, $120,000, and $150,000 over the next three years, respectively. Using a DCF template, you can calculate the present value of these cash flows and estimate the value of the company.

4. Project Finance

A DCF Excel template can be used to evaluate project finance opportunities. By estimating the present value of future cash flows, you can determine whether a project is viable. Here's an example:

Suppose you're considering financing a project with an initial investment of $500,000. The project is expected to generate cash flows of $100,000, $150,000, and $200,000 over the next three years, respectively. Using a DCF template, you can calculate the present value of these cash flows and determine whether the project is viable.

5. Real Estate Investment

A DCF Excel template can be used to evaluate real estate investment opportunities. By estimating the present value of future cash flows, you can determine whether a real estate investment is viable. Here's an example:

Suppose you're considering investing in a rental property with an initial investment of $200,000. The property is expected to generate cash flows of $50,000, $60,000, and $70,000 over the next three years, respectively. Using a DCF template, you can calculate the present value of these cash flows and determine whether the investment is viable.

Gallery of Discounted Cash Flow Examples

FAQs

What is a discounted cash flow (DCF) analysis?

+A DCF analysis is a method of evaluating the present value of future cash flows.

What are the benefits of using a DCF Excel template?

+A DCF template simplifies the calculation process, saves time, improves accuracy, and enhances collaboration.

How do I use a DCF Excel template to evaluate investment opportunities?

+Estimate the present value of future cash flows using the template, and determine whether the investment is viable.

In conclusion, a discounted cash flow Excel template is a powerful tool for evaluating investment opportunities, mergers and acquisitions, business valuation, project finance, and real estate investment. By using a DCF template, you can simplify the calculation process, save time, improve accuracy, and enhance collaboration. Whether you're an investor, entrepreneur, or business professional, a DCF template is an essential tool to have in your toolkit.