Managing your finances effectively is crucial for achieving financial stability and security. One of the most effective ways to do this is by creating a budget that works for you. A biweekly budget excel template can be a valuable tool in helping you track your income and expenses, making it easier to stay on top of your finances.

In today's fast-paced world, it's easy to lose track of where your money is going. With a biweekly budget excel template, you can easily categorize your expenses, identify areas where you can cut back, and make informed decisions about your financial future.

The Benefits of Using a Biweekly Budget Excel Template

There are several benefits to using a biweekly budget excel template. Here are just a few:

- Easy to use: A biweekly budget excel template is easy to use, even if you have no prior experience with budgeting or excel.

- Customizable: You can customize the template to fit your specific financial needs and goals.

- Helps you track expenses: A biweekly budget excel template helps you track your expenses, making it easier to identify areas where you can cut back.

- Helps you stay on top of bills: A biweekly budget excel template helps you stay on top of your bills, ensuring that you never miss a payment.

How to Create a Biweekly Budget Excel Template

Creating a biweekly budget excel template is easy. Here's a step-by-step guide to help you get started:

Step 1: Determine Your Income

The first step in creating a biweekly budget excel template is to determine your income. This includes all sources of income, including your salary, investments, and any side hustles.

Step 2: Identify Your Expenses

The next step is to identify your expenses. This includes all of your monthly bills, such as rent/mortgage, utilities, and groceries.

Step 3: Categorize Your Expenses

Once you have identified your expenses, it's time to categorize them. This will help you see where your money is going and identify areas where you can cut back.

Step 4: Set Financial Goals

The final step is to set financial goals. This could be anything from saving for a down payment on a house to paying off debt.

Using a Biweekly Budget Excel Template to Track Your Expenses

A biweekly budget excel template can be a valuable tool in helping you track your expenses. Here's how to use it:

Step 1: Enter Your Income

The first step is to enter your income into the template. This includes all sources of income, including your salary, investments, and any side hustles.

Step 2: Enter Your Expenses

The next step is to enter your expenses into the template. This includes all of your monthly bills, such as rent/mortgage, utilities, and groceries.

Step 3: Track Your Expenses

Once you have entered your income and expenses into the template, it's time to track your expenses. This will help you see where your money is going and identify areas where you can cut back.

Step 4: Make Adjustments

The final step is to make adjustments to your budget as needed. This could include cutting back on expenses or finding ways to increase your income.

Tips for Using a Biweekly Budget Excel Template

Here are a few tips for using a biweekly budget excel template:

- Be realistic: Make sure your budget is realistic and takes into account all of your expenses.

- Track your expenses regularly: Regularly tracking your expenses will help you stay on top of your finances and identify areas where you can cut back.

- Make adjustments as needed: Don't be afraid to make adjustments to your budget as needed. This could include cutting back on expenses or finding ways to increase your income.

Common Mistakes to Avoid When Using a Biweekly Budget Excel Template

Here are a few common mistakes to avoid when using a biweekly budget excel template:

- Not tracking expenses regularly: Failing to track your expenses regularly can lead to overspending and financial difficulties.

- Not making adjustments as needed: Failing to make adjustments to your budget as needed can lead to financial difficulties.

- Not being realistic: Creating a budget that is not realistic can lead to financial difficulties.

Conclusion

A biweekly budget excel template can be a valuable tool in helping you track your income and expenses, making it easier to stay on top of your finances. By following the steps outlined in this article, you can create a budget that works for you and helps you achieve your financial goals.

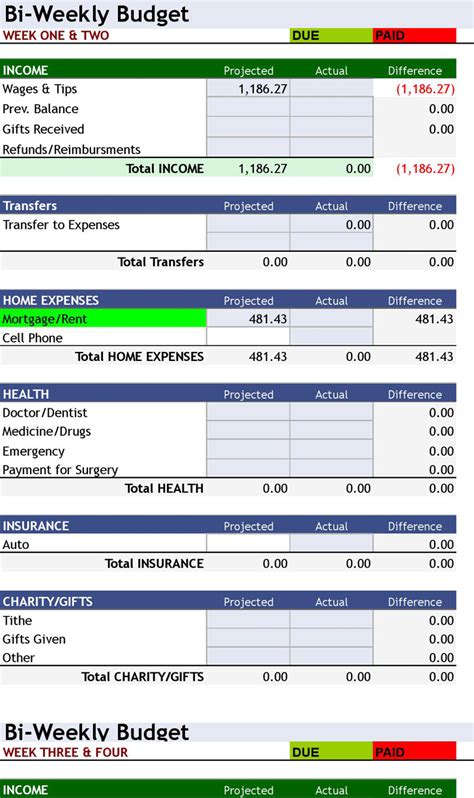

Gallery of Biweekly Budget Excel Templates

FAQ

Q: What is a biweekly budget excel template?

A: A biweekly budget excel template is a tool used to track income and expenses on a biweekly basis.

Q: How do I create a biweekly budget excel template?

A: To create a biweekly budget excel template, you will need to determine your income, identify your expenses, categorize your expenses, and set financial goals.

Q: What are the benefits of using a biweekly budget excel template?

A: The benefits of using a biweekly budget excel template include easy tracking of expenses, identification of areas where you can cut back, and making informed decisions about your financial future.

Q: What are some common mistakes to avoid when using a biweekly budget excel template?

A: Some common mistakes to avoid when using a biweekly budget excel template include not tracking expenses regularly, not making adjustments as needed, and not being realistic.