Bank reconciliation is a crucial process that helps businesses and individuals ensure the accuracy of their financial records. It involves comparing the transactions recorded in the company's general ledger with those reported by the bank. This process helps identify any discrepancies or errors that may have occurred, ensuring that the financial statements are accurate and reliable.

In this article, we will discuss the importance of bank reconciliation, its benefits, and provide five free bank reconciliation templates in Excel that you can use to streamline your financial management.

Why is Bank Reconciliation Important?

Bank reconciliation is essential for several reasons:

- Ensures Accuracy: Bank reconciliation helps ensure that the financial records are accurate and reliable. It detects any errors or discrepancies that may have occurred during the transaction process.

- Prevents Fraud: Bank reconciliation can help prevent fraudulent activities by identifying any unauthorized transactions.

- Improves Financial Management: Bank reconciliation helps businesses and individuals manage their finances effectively by providing a clear picture of their financial situation.

- Enhances Compliance: Bank reconciliation helps businesses comply with regulatory requirements by ensuring that their financial records are accurate and reliable.

Benefits of Using Bank Reconciliation Templates in Excel

Using bank reconciliation templates in Excel can provide several benefits, including:

- Saves Time: Bank reconciliation templates can save time by automating the reconciliation process.

- Improves Accuracy: Bank reconciliation templates can improve accuracy by reducing the risk of human error.

- Enhances Productivity: Bank reconciliation templates can enhance productivity by allowing users to focus on other financial management tasks.

- Provides Flexibility: Bank reconciliation templates can provide flexibility by allowing users to customize the template to suit their specific needs.

5 Free Bank Reconciliation Templates in Excel

Here are five free bank reconciliation templates in Excel that you can use to streamline your financial management:

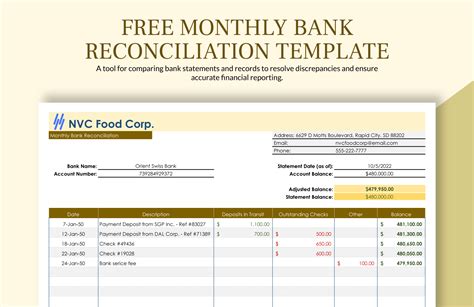

Template 1: Basic Bank Reconciliation Template

This template provides a basic framework for bank reconciliation. It includes columns for date, description, debit, credit, and balance.

Template 2: Advanced Bank Reconciliation Template

This template provides an advanced framework for bank reconciliation. It includes columns for date, description, debit, credit, balance, and reconciliation status.

Template 3: Bank Reconciliation Template with Multiple Accounts

This template provides a framework for bank reconciliation with multiple accounts. It includes columns for account number, date, description, debit, credit, and balance.

Template 4: Bank Reconciliation Template with Reconciliation Statement

This template provides a framework for bank reconciliation with a reconciliation statement. It includes columns for date, description, debit, credit, balance, and reconciliation status.

Template 5: Automated Bank Reconciliation Template

This template provides an automated framework for bank reconciliation. It includes formulas and macros that automate the reconciliation process.

How to Use the Bank Reconciliation Templates

To use the bank reconciliation templates, follow these steps:

- Download the template that suits your needs.

- Enter your bank statement data into the template.

- Enter your general ledger data into the template.

- Compare the two sets of data to identify any discrepancies.

- Reconcile the discrepancies by adjusting the general ledger or bank statement data.

Tips and Best Practices

Here are some tips and best practices to keep in mind when using bank reconciliation templates:

- Use a standardized template: Use a standardized template to ensure consistency and accuracy.

- Reconcile regularly: Reconcile your bank statement regularly to detect any errors or discrepancies.

- Use automation: Use automation to streamline the reconciliation process and reduce the risk of human error.

- Keep records: Keep records of all reconciliation activities to ensure compliance and auditing purposes.

Conclusion

Bank reconciliation is a critical process that helps businesses and individuals ensure the accuracy of their financial records. Using bank reconciliation templates in Excel can provide several benefits, including saving time, improving accuracy, and enhancing productivity. By using the five free bank reconciliation templates provided in this article, you can streamline your financial management and ensure compliance with regulatory requirements.

Gallery of Bank Reconciliation Templates

FAQ Section

What is bank reconciliation?

+Bank reconciliation is the process of comparing the transactions recorded in the company's general ledger with those reported by the bank.

Why is bank reconciliation important?

+Bank reconciliation is important because it helps ensure the accuracy of financial records, prevents fraud, and enhances financial management.

What are the benefits of using bank reconciliation templates?

+The benefits of using bank reconciliation templates include saving time, improving accuracy, and enhancing productivity.