Creating a 12-month rolling forecast is a crucial task for businesses to predict future financial performance and make informed decisions. A rolling forecast is a dynamic forecast that updates automatically as new data becomes available, providing a continuous view of future performance. In this article, we will explore the importance of a 12-month rolling forecast and provide a step-by-step guide to creating one using an Excel template.

Why is a 12-Month Rolling Forecast Important?

A 12-month rolling forecast is essential for businesses to:

- Predict future financial performance: A rolling forecast helps predict future financial performance by analyzing historical trends and current data.

- Make informed decisions: With a rolling forecast, businesses can make informed decisions about investments, resource allocation, and strategic planning.

- Identify potential risks and opportunities: A rolling forecast helps identify potential risks and opportunities, enabling businesses to take proactive measures to mitigate or capitalize on them.

How to Create a 12-Month Rolling Forecast with Excel Template

To create a 12-month rolling forecast with an Excel template, follow these steps:

Step 1: Gather Historical Data

Gather historical financial data for the past 12 months, including income statements, balance sheets, and cash flow statements.

Step 2: Set Up the Excel Template

Create a new Excel spreadsheet and set up the following columns:

| Column A | Column B | Column C | Column D | Column E | Column F |

|---|---|---|---|---|---|

| Month | Actual | Forecast | Variance | % Variance | Rolling Total |

Step 3: Enter Historical Data

Enter the historical financial data into the template, starting from the earliest month.

Step 4: Create a Forecast Formula

Create a forecast formula using a combination of historical data and industry benchmarks. For example, you can use a simple moving average formula:

=AVERAGE(B2:B13) (where B2:B13 is the range of historical data)

Step 5: Apply the Forecast Formula

Apply the forecast formula to each month, starting from the current month.

Step 6: Calculate Variance

Calculate the variance between the actual and forecast values using the following formula:

=B14-C14 (where B14 is the actual value and C14 is the forecast value)

Step 7: Calculate Percentage Variance

Calculate the percentage variance using the following formula:

= (B14-C14)/B14*100 (where B14 is the actual value and C14 is the forecast value)

Step 8: Calculate Rolling Total

Calculate the rolling total by adding the forecast values for each month.

Step 9: Update the Forecast

Update the forecast by adding new data and recalculating the forecast formula.

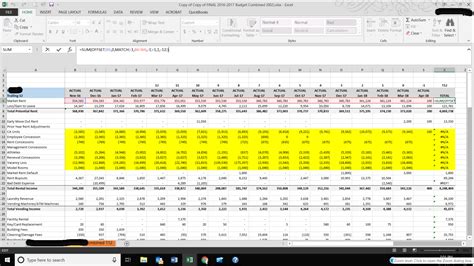

Excel Template Example

Here is an example of what the Excel template might look like:

| Month | Actual | Forecast | Variance | % Variance | Rolling Total |

|---|---|---|---|---|---|

| Jan-20 | 100,000 | 105,000 | -5,000 | -5% | 1,050,000 |

| Feb-20 | 110,000 | 115,000 | -5,000 | -5% | 1,165,000 |

| Mar-20 | 120,000 | 125,000 | -5,000 | -5% | 1,290,000 |

| ... | ... | ... | ... | ... | ... |

| Dec-20 | 150,000 | 155,000 | -5,000 | -5% | 1,725,000 |

Gallery of 12-Month Rolling Forecast Examples

FAQs

Q: What is a rolling forecast? A: A rolling forecast is a dynamic forecast that updates automatically as new data becomes available, providing a continuous view of future performance.

Q: Why is a 12-month rolling forecast important? A: A 12-month rolling forecast is essential for businesses to predict future financial performance, make informed decisions, and identify potential risks and opportunities.

Q: How do I create a 12-month rolling forecast in Excel? A: To create a 12-month rolling forecast in Excel, follow the steps outlined in this article, including gathering historical data, setting up the Excel template, entering historical data, creating a forecast formula, and updating the forecast.

We hope this article has provided you with a comprehensive guide to creating a 12-month rolling forecast with an Excel template. By following these steps, you can create a dynamic forecast that helps you predict future financial performance and make informed decisions.