As a business owner or independent contractor, managing your finances and filing taxes can be a daunting task. One crucial document you'll need to file is the 1099-NEC, which reports non-employee compensation. To simplify the process, we'll provide you with a comprehensive guide on how to use a free 1099-NEC Excel template download.

What is a 1099-NEC Form?

The 1099-NEC form is used to report non-employee compensation, such as freelance work, independent contracting, and other types of income. This form is typically used by businesses to report payments made to independent contractors and freelancers.

Why Do I Need a 1099-NEC Excel Template?

Using a 1099-NEC Excel template can save you time and effort in preparing and filing your taxes. Here are some benefits of using a template:

- Simplified Data Entry: A template helps you organize your data in a logical and structured way, making it easier to enter information.

- Accuracy: A template reduces errors and ensures that you don't miss any important information.

- Time-Saving: With a template, you can quickly and easily prepare your 1099-NEC forms, saving you time and effort.

- Compliance: A template helps you comply with IRS regulations and ensures that you're reporting your income correctly.

Where to Find a Free 1099-NEC Excel Template Download

There are several websites that offer free 1099-NEC Excel template downloads. Here are a few options:

- IRS Website: The IRS website offers a free 1099-NEC template that you can download and use.

- Microsoft Excel Templates: Microsoft Excel offers a range of free templates, including a 1099-NEC template.

- Third-Party Websites: There are several third-party websites that offer free 1099-NEC Excel templates, such as Vertex42 and Excel Templates.

How to Use a 1099-NEC Excel Template

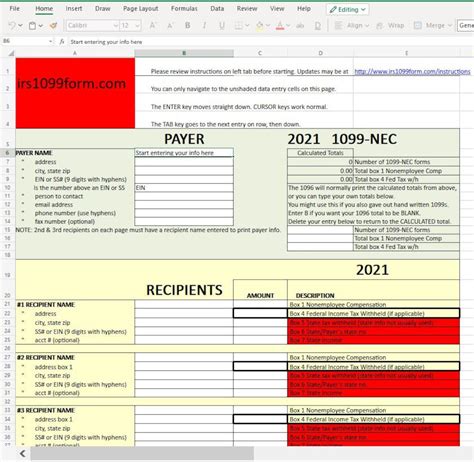

Using a 1099-NEC Excel template is straightforward. Here's a step-by-step guide:

- Download the Template: Download the 1099-NEC Excel template from a reputable website.

- Open the Template: Open the template in Microsoft Excel.

- Enter Your Data: Enter your data into the template, including your business information, payer information, and recipient information.

- Enter Payment Information: Enter the payment information, including the payment amount and payment date.

- Calculate Totals: The template will automatically calculate the totals for you.

- Print the Form: Print the completed form on IRS-approved paper.

Tips for Using a 1099-NEC Excel Template

Here are some tips for using a 1099-NEC Excel template:

- Use IRS-Approved Paper: Make sure to print the form on IRS-approved paper.

- Double-Check Your Data: Double-check your data to ensure accuracy and completeness.

- Keep Records: Keep records of your 1099-NEC forms for at least three years.

- File on Time: File your 1099-NEC forms on time to avoid penalties and fines.

Benefits of Using a 1099-NEC Excel Template

Using a 1099-NEC Excel template offers several benefits, including:

- Increased Efficiency: A template saves you time and effort in preparing and filing your taxes.

- Improved Accuracy: A template reduces errors and ensures that you're reporting your income correctly.

- Compliance: A template helps you comply with IRS regulations and ensures that you're filing your taxes correctly.

- Cost-Effective: Using a template is cost-effective, as you don't need to purchase specialized software or hire a tax professional.

Conclusion

Managing your finances and filing taxes can be a daunting task, but using a free 1099-NEC Excel template download can simplify the process. By using a template, you can save time and effort, improve accuracy, and ensure compliance with IRS regulations. Remember to always use IRS-approved paper, double-check your data, and keep records of your 1099-NEC forms.

Gallery of 1099-NEC Excel Templates

FAQs

What is a 1099-NEC form?

+The 1099-NEC form is used to report non-employee compensation, such as freelance work, independent contracting, and other types of income.

Why do I need a 1099-NEC Excel template?

+A 1099-NEC Excel template can save you time and effort in preparing and filing your taxes, improve accuracy, and ensure compliance with IRS regulations.

Where can I find a free 1099-NEC Excel template download?

+You can find free 1099-NEC Excel template downloads on the IRS website, Microsoft Excel templates, and third-party websites such as Vertex42 and Excel Templates.