Are you tired of struggling with cash flow management in your business? Do you find it difficult to create a cash flow template in Excel that meets your needs? You're not alone. Many entrepreneurs and small business owners face challenges when it comes to managing their company's cash flow. In this article, we'll provide you with 5 easy UCA ( Uniform Cash Analysis) cash flow template Excel solutions that will help you streamline your financial management and make informed decisions.

The Importance of Cash Flow Management

Cash flow management is a critical aspect of running a successful business. It involves tracking the inflows and outflows of cash and making sure that your company has enough liquidity to meet its financial obligations. Effective cash flow management can help you avoid cash shortages, reduce debt, and make strategic decisions about investments and growth.

What is UCA Cash Flow Template?

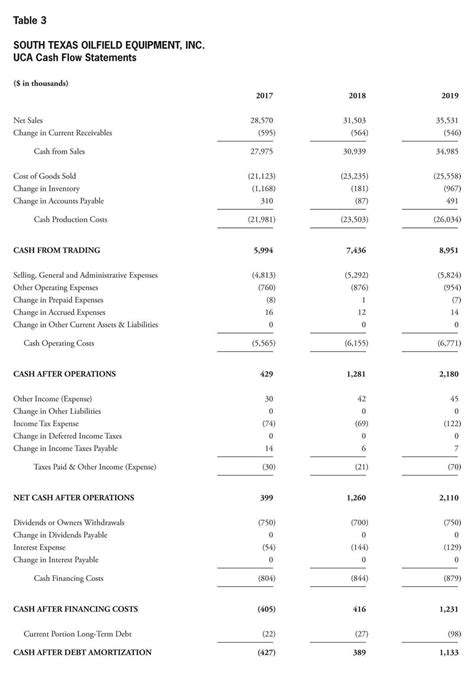

The Uniform Cash Analysis (UCA) cash flow template is a widely used framework for analyzing and managing cash flow. It provides a standardized approach to cash flow analysis, making it easier to compare and contrast different financial scenarios. The UCA template typically includes the following components:

- Beginning cash balance

- Cash inflows (e.g., sales, accounts receivable)

- Cash outflows (e.g., accounts payable, salaries)

- Net change in cash

- Ending cash balance

5 Easy UCA Cash Flow Template Excel Solutions

Here are 5 easy UCA cash flow template Excel solutions that you can use to manage your business's cash flow:

Solution 1: Simple UCA Cash Flow Template

This template provides a basic UCA cash flow analysis framework that you can use to track your company's cash inflows and outflows. It includes the following columns:

- Beginning cash balance

- Cash inflows

- Cash outflows

- Net change in cash

- Ending cash balance

You can simply enter your company's financial data into the template and it will automatically calculate the net change in cash and ending cash balance.

Solution 2: UCA Cash Flow Template with Budgeting

This template includes a budgeting component that allows you to track your company's actual cash flows against its budgeted cash flows. It includes the following columns:

- Beginning cash balance

- Cash inflows (actual and budgeted)

- Cash outflows (actual and budgeted)

- Net change in cash (actual and budgeted)

- Ending cash balance (actual and budgeted)

You can use this template to identify areas where your company's actual cash flows are deviating from its budgeted cash flows.

Solution 3: UCA Cash Flow Template with Rolling Forecast

This template includes a rolling forecast component that allows you to forecast your company's cash flows over a 12-month period. It includes the following columns:

- Beginning cash balance

- Cash inflows (actual and forecasted)

- Cash outflows (actual and forecasted)

- Net change in cash (actual and forecasted)

- Ending cash balance (actual and forecasted)

You can use this template to forecast your company's cash flows and identify potential cash shortages or surpluses.

Solution 4: UCA Cash Flow Template with Accounts Receivable and Payable

This template includes accounts receivable and payable components that allow you to track your company's cash inflows and outflows related to these accounts. It includes the following columns:

- Beginning cash balance

- Cash inflows (accounts receivable)

- Cash outflows (accounts payable)

- Net change in cash

- Ending cash balance

You can use this template to track your company's accounts receivable and payable and identify potential cash flow issues related to these accounts.

Solution 5: UCA Cash Flow Template with Debt Repayment

This template includes a debt repayment component that allows you to track your company's cash outflows related to debt repayment. It includes the following columns:

- Beginning cash balance

- Cash inflows

- Cash outflows (debt repayment)

- Net change in cash

- Ending cash balance

You can use this template to track your company's debt repayment and identify potential cash flow issues related to debt repayment.

Conclusion

Effective cash flow management is critical to the success of any business. The 5 easy UCA cash flow template Excel solutions provided in this article can help you streamline your financial management and make informed decisions. Whether you're looking for a simple UCA cash flow template or a more advanced template with budgeting, rolling forecast, accounts receivable and payable, or debt repayment components, we've got you covered. Try out one of these templates today and take the first step towards improving your company's cash flow management.

Gallery of UCA Cash Flow Templates

FAQ

What is UCA cash flow template?

+The Uniform Cash Analysis (UCA) cash flow template is a widely used framework for analyzing and managing cash flow.

Why is cash flow management important?

+Cash flow management is critical to the success of any business. It involves tracking the inflows and outflows of cash and making sure that your company has enough liquidity to meet its financial obligations.

How do I use the UCA cash flow template?

+You can use the UCA cash flow template to track your company's cash inflows and outflows, identify potential cash flow issues, and make informed decisions about investments and growth.