Managing payroll for truck drivers can be a complex task due to the unique aspects of their compensation, such as mileage reimbursement, hours worked, and varying pay rates. However, using an Excel template can simplify this process, ensuring accuracy and efficiency. In this article, we will explore how to create and use a truck driver payroll template in Excel, highlighting its benefits and providing a step-by-step guide to making the most out of this tool.

The Importance of Accurate Payroll Management

Accurate payroll management is crucial for any business, especially for companies that employ truck drivers. Incorrect calculations or missed payments can lead to legal issues, decreased employee morale, and even turnover. Given the complexities of truck driver compensation, a well-designed payroll template can significantly reduce the risk of errors.

Benefits of Using a Truck Driver Payroll Template in Excel

Using a payroll template specifically designed for truck drivers in Excel offers several benefits, including:

- Efficiency: Automates calculations, reducing the time spent on payroll processing.

- Accuracy: Minimizes the chance of human error in calculations.

- Flexibility: Easily customizable to accommodate different pay structures and rules.

- Transparency: Provides clear records of payroll data for both employers and employees.

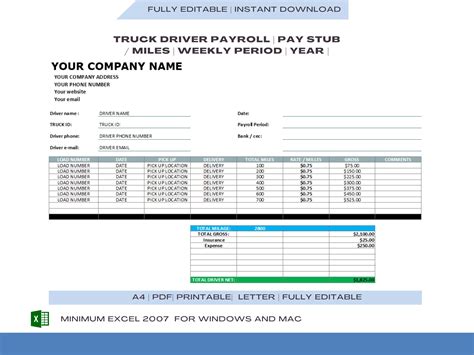

Creating a Basic Truck Driver Payroll Template in Excel

While pre-made templates can be found online, creating a basic template from scratch allows for customization to your company's specific needs. Here's a step-by-step guide to creating a basic truck driver payroll template:

1. Setting Up the Template Structure

- Open Excel: Start with a blank Excel workbook.

- Name Sheets: Rename the sheets for easier navigation, e.g., "Payroll Data," "Payroll Calculation," and "Summary."

2. Designing the Payroll Data Sheet

- Employee Information: Create columns for employee names, IDs, pay rates, and any other relevant details.

- Pay Period: Include columns for the start and end dates of the pay period.

- Hours Worked: Designate columns for regular hours, overtime hours, and any specific types of pay (e.g., loading/unloading).

- Mileage: If applicable, add columns for total miles driven and reimbursement rates.

3. Setting Up the Payroll Calculation Sheet

- Import Data: Use Excel formulas to import data from the "Payroll Data" sheet.

- Calculate Pay: Design formulas to calculate pay based on hours worked, pay rates, and any mileage reimbursement.

4. Creating a Summary Sheet

- Overview: Use this sheet to provide a summary of payroll data, including total pay, taxes withheld, and net pay.

Using the Truck Driver Payroll Template

- Input Data: Enter employee information, hours worked, mileage, and any other necessary data into the "Payroll Data" sheet.

- Calculate Payroll: Excel automatically calculates payroll based on the formulas set up in the "Payroll Calculation" sheet.

- Review and Adjust: Check the calculations for accuracy and make any necessary adjustments.

- Generate Pay Stubs: Use the data from the template to generate pay stubs for employees.

Tips for Customizing Your Template

- Automate as Much as Possible: Use Excel formulas to automate calculations and data transfer.

- Consider Using Macros: For complex operations or repeated tasks, consider creating macros.

- Regularly Update: Keep your template updated with any changes in pay rates, laws, or company policies.

Gallery of Truck Driver Payroll Templates

FAQs

What is the best way to calculate mileage reimbursement for truck drivers?

+The best way to calculate mileage reimbursement is by using the IRS standard mileage rate. However, companies may choose to reimburse based on actual expenses or a flat rate per mile.

How often should payroll for truck drivers be processed?

+Payroll for truck drivers should be processed as frequently as is feasible for the company, but at least on a bi-weekly basis to ensure compliance with labor laws.

What information should be included in a truck driver's pay stub?

+A truck driver's pay stub should include details such as gross pay, taxes withheld, deductions, and net pay. Additionally, any specific payments like mileage reimbursement should be itemized.

By following these steps and tips, you can create a comprehensive truck driver payroll template in Excel that streamlines your payroll process, ensuring accuracy and efficiency. Whether you're a small fleet owner or a large logistics company, this template can be tailored to meet your specific needs, saving you time and reducing the risk of payroll errors.