As the world grapples with the challenges of climate change, a new generation of venture capitalists is emerging to support innovative solutions that can help reduce our carbon footprint and create a more sustainable future. Climate tech VCs are investing heavily in startups that are developing cutting-edge technologies to address the climate crisis, from renewable energy and energy storage to sustainable agriculture and carbon capture.

These VCs are not only driven by a desire to make a positive impact on the environment, but also by the potential for significant financial returns. Climate tech is a rapidly growing market, with investments in the sector increasing by over 50% in 2020 alone. As the demand for sustainable solutions continues to grow, climate tech VCs are well-positioned to reap the rewards of their investments.

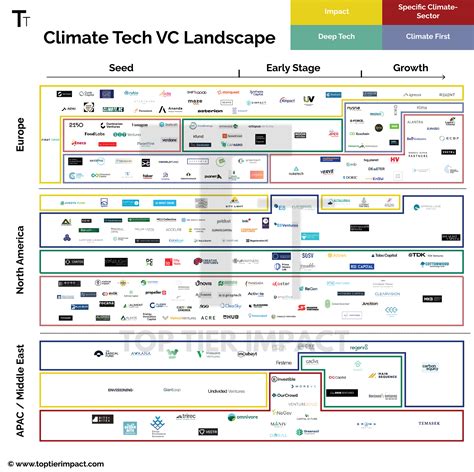

Top Climate Tech VCs to Watch

From Silicon Valley to Europe, there are numerous climate tech VCs that are making a significant impact in the industry. Here are some of the top climate tech VCs to watch:

1. Khosla Ventures

Khosla Ventures is a well-known VC firm that has been investing in climate tech startups for over a decade. Founded by Vinod Khosla, the firm has invested in companies such as Tesla, Nest, and Instacart. Khosla Ventures has a strong focus on sustainability and has invested in numerous climate tech startups, including those in the renewable energy, energy storage, and sustainable agriculture sectors.

2. Lightspeed Venture Partners

Lightspeed Venture Partners is a leading VC firm that has invested in some of the most successful climate tech startups, including Nest, SolarCity, and QuantumScape. The firm has a dedicated sustainability practice and has invested in numerous companies that are working on innovative climate tech solutions.

3. Breakthrough Energy Ventures

Breakthrough Energy Ventures is a VC firm that was founded by Bill Gates and a group of other high-profile investors. The firm is dedicated to investing in climate tech startups that have the potential to significantly reduce greenhouse gas emissions. Breakthrough Energy Ventures has invested in companies such as Carbon Engineering, which is working on a technology to capture CO2 from the air.

4. Union Square Ventures

Union Square Ventures is a VC firm that has invested in numerous climate tech startups, including those in the renewable energy, energy storage, and sustainable agriculture sectors. The firm has a strong focus on sustainability and has invested in companies such as Farmers Business Network, which is working on a platform to help farmers reduce their environmental impact.

5. Northvolt

Northvolt is a European VC firm that is dedicated to investing in climate tech startups. The firm has invested in companies such as Northvolt AB, which is working on a technology to produce sustainable lithium-ion batteries. Northvolt has also invested in other climate tech startups, including those in the renewable energy and energy storage sectors.

Investment Strategies

Climate tech VCs are using a variety of investment strategies to support startups in the sector. Here are some of the most common strategies:

1. Seed Funding

Many climate tech VCs are providing seed funding to early-stage startups. This type of funding is critical for startups that are just beginning to develop their products and services.

2. Series A Funding

Series A funding is another common strategy used by climate tech VCs. This type of funding is typically provided to startups that have already developed a product or service and are looking to scale their business.

3. Impact Investing

Impact investing is a strategy that is used by some climate tech VCs to invest in startups that have the potential to make a significant positive impact on the environment. This type of investing is focused on supporting startups that are working on innovative climate tech solutions.

4. Corporate Venture Capital

Corporate venture capital is another strategy that is used by some climate tech VCs. This type of investing involves partnering with large corporations to invest in startups that are working on climate tech solutions.

Climate Tech Sectors to Watch

There are numerous climate tech sectors that are attracting significant investment from VCs. Here are some of the most promising sectors:

1. Renewable Energy

Renewable energy is one of the most promising climate tech sectors. This sector includes companies that are working on solar, wind, hydro, and geothermal energy solutions.

2. Energy Storage

Energy storage is another critical sector in the climate tech industry. This sector includes companies that are working on battery storage solutions, hydrogen fuel cells, and other energy storage technologies.

3. Sustainable Agriculture

Sustainable agriculture is a sector that is gaining significant attention from climate tech VCs. This sector includes companies that are working on sustainable farming practices, vertical farming, and other innovative agricultural solutions.

4. Carbon Capture

Carbon capture is a sector that is critical to reducing greenhouse gas emissions. This sector includes companies that are working on technologies to capture CO2 from the air, as well as companies that are working on carbon utilization technologies.

Gallery of Climate Tech Innovations

Frequently Asked Questions

What is climate tech?

+Climate tech refers to the use of technology to reduce greenhouse gas emissions and mitigate the impacts of climate change.

What are some examples of climate tech startups?

+Examples of climate tech startups include companies working on renewable energy, energy storage, sustainable agriculture, and carbon capture technologies.

How can I invest in climate tech startups?

+You can invest in climate tech startups through venture capital firms, impact investing funds, or by investing directly in startups.

As the world continues to grapple with the challenges of climate change, the importance of climate tech VCs will only continue to grow. By supporting innovative startups that are working on climate tech solutions, these VCs are helping to create a more sustainable future for all of us.