As we navigate the complexities of modern banking, it's essential to stay vigilant against potential scams and fraudulent activities. Navy Federal Bank, one of the world's largest credit unions, is not immune to these threats. In this article, we'll delve into the world of fake Navy Federal Bank statements, exploring the reasons behind their creation, the dangers they pose, and most importantly, provide you with five ways to identify them.

Fake bank statements are a type of phishing scam where scammers create counterfeit documents that mimic the real thing. These statements are designed to trick you into divulging sensitive information, such as your account credentials or personal identification numbers. The consequences of falling victim to these scams can be severe, ranging from financial loss to identity theft.

So, why do scammers target Navy Federal Bank specifically? The answer lies in the credit union's massive membership base, which includes millions of military personnel, veterans, and their families. This demographic is often seen as a lucrative target for scammers, who exploit the trust and loyalty that comes with being a member of a reputable financial institution.

Now, let's move on to the five ways to identify fake Navy Federal Bank statements:

1. Verify the Statement's Authenticity

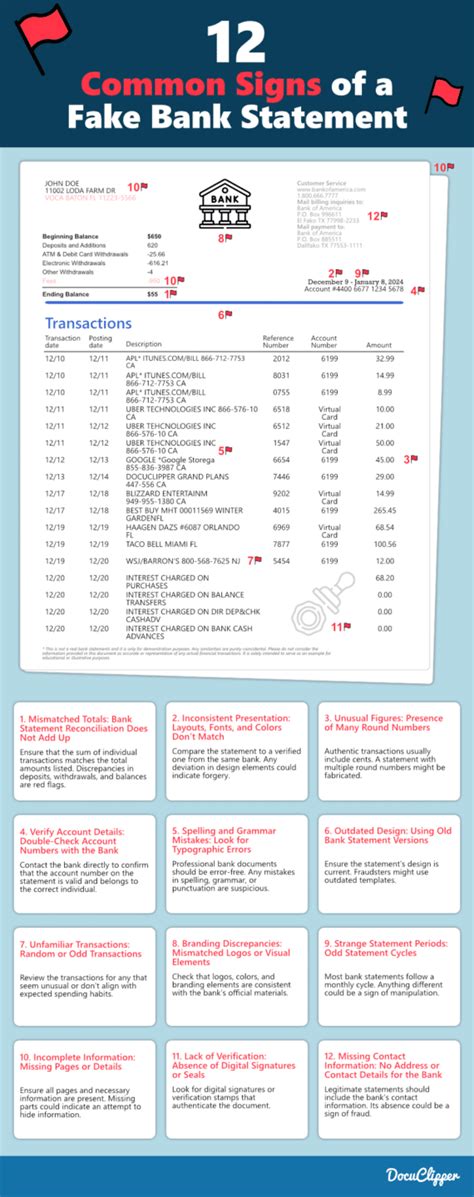

When you receive a bank statement, take a moment to verify its authenticity. Check the statement's layout, formatting, and overall design. Does it match the typical layout of your previous statements? Are there any grammatical errors or typos? If the statement appears unusual or unprofessional, it may be a fake.

Red Flags to Watch Out For:

- Unusual or missing logos

- Poor formatting or layout

- Grammatical errors or typos

- Missing or incorrect account information

2. Check for Spelling and Grammar Mistakes

Legitimate bank statements are typically free of spelling and grammar mistakes. If you notice any errors, it could be a sign that the statement is fake. Be wary of statements with awkward phrasing, missing articles, or incorrect verb tenses.

Tips for Spotting Errors:

- Read the statement carefully, paying attention to each sentence

- Check for consistency in formatting and font styles

- Look for missing or incorrect punctuation

3. Look for Inconsistencies in Your Account Information

Fake bank statements often contain inconsistencies in your account information. Check your statement carefully to ensure that your name, address, and account numbers are accurate. If you notice any discrepancies, it may be a fake statement.

What to Check:

- Your name and address

- Your account numbers and types

- Your transaction history and balances

4. Be Wary of Suspicious Links or Attachments

Fake bank statements may contain suspicious links or attachments that are designed to trick you into divulging sensitive information. Be cautious of links that ask you to verify your account information or download attachments that seem unusual.

Red Flags to Watch Out For:

- Links that ask you to verify your account information

- Attachments that seem unusual or unprofessional

- Links that redirect you to unfamiliar websites

5. Verify the Statement's Source

Finally, verify the statement's source to ensure that it's legitimate. Check the statement's return address, email address, or phone number to ensure that it matches Navy Federal Bank's official contact information.

Tips for Verifying the Source:

- Check the return address or email address

- Verify the phone number or website URL

- Contact Navy Federal Bank directly to confirm the statement's authenticity

In conclusion, identifying fake Navy Federal Bank statements requires vigilance and attention to detail. By following these five tips, you can protect yourself from phishing scams and ensure the security of your financial information. Remember to always verify the statement's authenticity, check for spelling and grammar mistakes, look for inconsistencies in your account information, be wary of suspicious links or attachments, and verify the statement's source.

If you suspect that you've received a fake bank statement, contact Navy Federal Bank immediately to report the incident. Stay safe, and stay informed!

What is a fake bank statement?

+A fake bank statement is a counterfeit document that mimics a real bank statement. It's designed to trick you into divulging sensitive information, such as your account credentials or personal identification numbers.

How do I verify the authenticity of a bank statement?

+To verify the authenticity of a bank statement, check the statement's layout, formatting, and overall design. Look for any grammatical errors or typos. If the statement appears unusual or unprofessional, it may be a fake.

What should I do if I suspect I've received a fake bank statement?

+If you suspect you've received a fake bank statement, contact Navy Federal Bank immediately to report the incident. They'll guide you through the next steps to ensure your account's security.