Technology Credit Union, also known as Tech CU, is a not-for-profit financial cooperative that has been serving the financial needs of individuals and businesses in the San Francisco Bay Area since 1960. With over 80,000 members and assets exceeding $2.5 billion, Tech CU has established itself as a reputable and trustworthy financial institution. In this article, we will provide an in-depth review of Technology Credit Union, including its products, services, fees, and ratings.

What is Technology Credit Union?

Technology Credit Union is a member-owned financial cooperative that operates on a not-for-profit basis. This means that any profits generated by the credit union are reinvested in the organization to benefit its members, rather than being distributed to external shareholders. Tech CU offers a wide range of financial products and services, including checking and savings accounts, credit cards, loans, and investment services.

Products and Services

Technology Credit Union offers a diverse range of financial products and services designed to meet the needs of its members. Some of the most notable products and services include:

- Checking and Savings Accounts: Tech CU offers a variety of checking and savings accounts, including traditional accounts, money market accounts, and youth accounts.

- Credit Cards: Tech CU offers a range of credit cards, including cashback, rewards, and low-interest cards.

- Loans: Tech CU offers a variety of loan products, including personal loans, auto loans, home loans, and student loans.

- Investment Services: Tech CU offers investment services, including brokerage accounts, retirement accounts, and financial planning.

- Online Banking: Tech CU offers online banking services, including bill pay, fund transfers, and account management.

Checking Accounts

Tech CU offers several checking account options, including:

- Free Checking: A basic checking account with no monthly maintenance fees.

- Premium Checking: A checking account with additional features, including reimbursement of ATM fees and discounts on loans.

- Student Checking: A checking account designed for students, with features including no monthly maintenance fees and a debit card.

Fees and Charges

Like any financial institution, Technology Credit Union charges fees and charges for certain services. Some of the most notable fees include:

- Monthly Maintenance Fees: Some checking accounts come with monthly maintenance fees, which can be waived by meeting certain requirements, such as maintaining a minimum balance or setting up direct deposit.

- ATM Fees: Tech CU charges fees for using out-of-network ATMs, which can be reimbursed with certain checking accounts.

- Loan Fees: Tech CU charges fees for certain loan products, including origination fees and late payment fees.

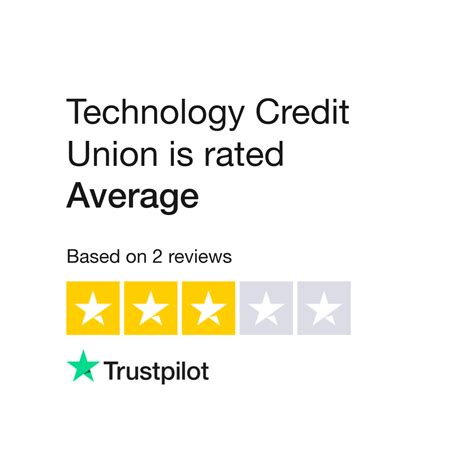

Ratings and Reviews

Technology Credit Union has received positive ratings and reviews from its members and independent reviewers. Some of the most notable ratings include:

- NerdWallet: 4.5/5 stars

- Credit Union Journal: 4.5/5 stars

- Google Reviews: 4.4/5 stars

Pros and Cons

Like any financial institution, Technology Credit Union has its pros and cons. Some of the most notable advantages include:

- High-Quality Products and Services: Tech CU offers a wide range of high-quality financial products and services.

- Competitive Rates: Tech CU offers competitive rates on loans and deposit accounts.

- Excellent Customer Service: Tech CU is known for its excellent customer service, with friendly and helpful staff.

However, some of the most notable disadvantages include:

- Limited Branch and ATM Network: Tech CU has a limited branch and ATM network, which may not be convenient for members who travel frequently.

- Fees and Charges: Tech CU charges fees and charges for certain services, which may not be ideal for members who are sensitive to fees.

Gallery of Technology Credit Union

FAQs

What is Technology Credit Union?

+Technology Credit Union is a not-for-profit financial cooperative that serves the financial needs of individuals and businesses in the San Francisco Bay Area.

What products and services does Tech CU offer?

+Tech CU offers a wide range of financial products and services, including checking and savings accounts, credit cards, loans, and investment services.

How do I become a member of Tech CU?

+To become a member of Tech CU, you must meet certain eligibility requirements, such as living or working in the San Francisco Bay Area or being a member of a participating organization.

Overall, Technology Credit Union is a reputable and trustworthy financial institution that offers a wide range of high-quality financial products and services. With its competitive rates, excellent customer service, and convenient online banking platform, Tech CU is an excellent choice for individuals and businesses in the San Francisco Bay Area.