In today's digital age, technology plays a vital role in shaping our financial lives. Tech CU, a credit union based in Milpitas, California, is at the forefront of this revolution. As a financial institution, Tech CU Milpitas has a significant impact on the financial well-being of its members. In this article, we will explore five ways Tech CU Milpitas affects your finances and why it's an essential player in the financial industry.

Tech CU's Innovative Approach to Banking

Tech CU has been a pioneer in the credit union industry, offering innovative financial products and services that cater to the evolving needs of its members. With a strong focus on technology, Tech CU has made it possible for members to manage their finances efficiently, anytime and anywhere.

Impact on Your Finances

Here are five ways Tech CU Milpitas impacts your finances:

1. Convenient Banking Services

Tech CU offers a range of convenient banking services that make it easy for members to manage their finances. With online banking, mobile banking, and a network of ATMs, members can access their accounts, transfer funds, and pay bills from anywhere. This convenience factor not only saves time but also reduces the need for physical visits to the branch, making it an attractive option for those with busy lifestyles.

2. Competitive Interest Rates

Tech CU offers competitive interest rates on its deposit accounts, including savings accounts, certificates, and IRAs. This means that members can earn a higher return on their deposits, which can help to grow their savings over time. Additionally, Tech CU's competitive interest rates on loans, including auto loans, personal loans, and mortgages, make it an attractive option for those looking to borrow.

3. Financial Education and Resources

Tech CU is committed to providing its members with the financial education and resources they need to make informed decisions about their money. Through its website, social media, and community outreach programs, Tech CU offers a range of financial education resources, including webinars, workshops, and online tutorials. This empowers members to take control of their finances and make smart financial decisions.

4. Community Involvement

Tech CU is deeply committed to the communities it serves. Through its community outreach programs, Tech CU supports local charities, sponsors community events, and provides financial education to underserved populations. This community involvement not only benefits the community but also demonstrates Tech CU's commitment to its members and the broader community.

5. Personalized Service

Tech CU prides itself on providing personalized service to its members. With a team of experienced financial professionals, Tech CU offers tailored financial solutions that meet the unique needs of each member. Whether it's providing financial guidance, helping with loan applications, or simply answering questions, Tech CU's personalized service sets it apart from larger financial institutions.

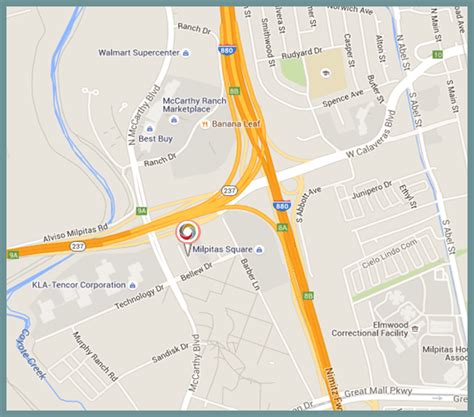

Gallery of Tech CU Milpitas

In conclusion, Tech CU Milpitas has a significant impact on the financial lives of its members. With its innovative approach to banking, convenient services, competitive interest rates, financial education resources, community involvement, and personalized service, Tech CU sets itself apart from other financial institutions. Whether you're looking to save, borrow, or invest, Tech CU Milpitas is an excellent choice for those seeking a financial partner that truly cares about their financial well-being.

We invite you to share your thoughts on how Tech CU Milpitas has impacted your finances. Have you had a positive experience with Tech CU? Share your story in the comments below. If you have any questions or would like to learn more about Tech CU's services, feel free to ask.

What is Tech CU Milpitas?

+Tech CU Milpitas is a credit union based in Milpitas, California, that offers a range of financial products and services to its members.

What types of accounts does Tech CU offer?

+Tech CU offers a range of deposit accounts, including savings accounts, certificates, and IRAs, as well as loan products, including auto loans, personal loans, and mortgages.

How do I become a member of Tech CU?

+To become a member of Tech CU, you can visit their website or visit a branch in person. You will need to provide identification and meet certain eligibility requirements.