In today's economy, buying a car can be a significant investment. With the rising costs of vehicles, financing options have become a crucial aspect of the purchasing process. One popular option is a Tech Cu Car Loan, which offers competitive rates and flexible terms. However, understanding the intricacies of car loan rates can be overwhelming, especially for first-time buyers.

In this article, we will delve into the world of Tech Cu Car Loan rates, explaining the key factors that influence them, the benefits of choosing this type of loan, and providing valuable insights to help you make informed decisions.

What are Tech Cu Car Loan Rates?

Tech Cu Car Loan rates refer to the interest rates offered by Tech Credit Union (Tech Cu) for car loans. These rates are determined by various factors, including the borrower's credit score, loan term, vehicle type, and market conditions. Tech Cu Car Loan rates are competitive and designed to provide affordable financing options for car buyers.

Factors Affecting Tech Cu Car Loan Rates

Several factors influence Tech Cu Car Loan rates, including:

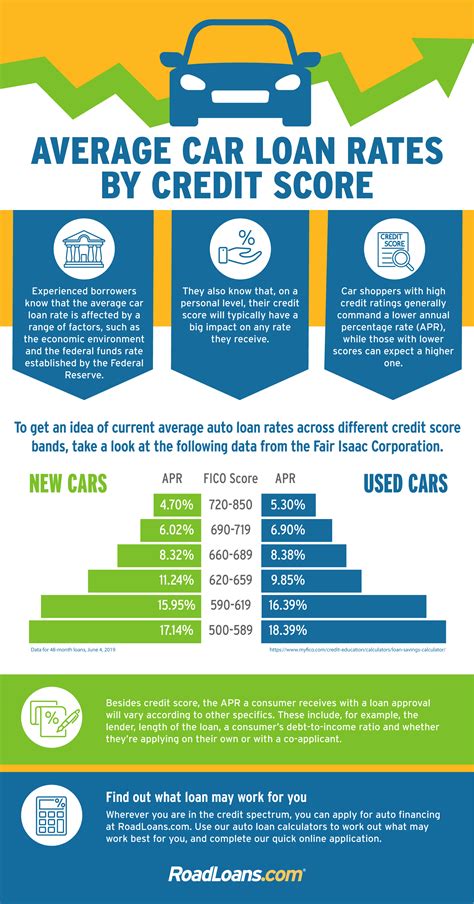

- Credit Score: Your credit score plays a significant role in determining the interest rate you'll qualify for. A good credit score can lead to lower interest rates, while a poor credit score may result in higher rates.

- Loan Term: The length of your loan term also affects the interest rate. Longer loan terms often come with higher interest rates, while shorter terms may offer lower rates.

- Vehicle Type: The type of vehicle you're purchasing can also impact the interest rate. For example, loans for new cars may have lower rates than those for used cars.

- Market Conditions: Market conditions, such as the overall economy and interest rates, can also influence Tech Cu Car Loan rates.

Benefits of Tech Cu Car Loan Rates

Choosing a Tech Cu Car Loan offers several benefits, including:

- Competitive Rates: Tech Cu Car Loan rates are competitive, making it easier to find an affordable financing option.

- Flexible Terms: Tech Cu offers flexible loan terms, allowing you to choose a repayment schedule that suits your needs.

- Convenient Application Process: The application process is straightforward and convenient, with online applications available.

- Membership Benefits: As a Tech Cu member, you'll have access to exclusive benefits, such as discounts on insurance and other financial products.

How to Get the Best Tech Cu Car Loan Rate

To get the best Tech Cu Car Loan rate, follow these tips:

- Check Your Credit Score: Ensure your credit score is accurate and up-to-date. A good credit score can lead to lower interest rates.

- Compare Rates: Research and compare rates from different lenders to find the best option.

- Choose a Shorter Loan Term: Opting for a shorter loan term can result in lower interest rates and less interest paid over the life of the loan.

- Consider a Co-Signer: If you have a limited credit history or a low credit score, consider adding a co-signer with a good credit score to your loan application.

Understanding Tech Cu Car Loan Rate Calculations

To calculate your Tech Cu Car Loan rate, you'll need to consider the following:

- Annual Percentage Rate (APR): The APR is the interest rate charged on your loan, including fees and other charges.

- Interest Rate: The interest rate is the percentage of the loan amount charged as interest over the loan term.

- Fees: Tech Cu may charge fees, such as origination fees or late payment fees, which can impact your overall loan cost.

Tech Cu Car Loan Rate Examples

Here are some examples of Tech Cu Car Loan rates:

- New Car Loan: 3.50% APR for a 60-month loan term

- Used Car Loan: 4.25% APR for a 60-month loan term

- Refinance Car Loan: 3.75% APR for a 60-month loan term

Gallery of Tech Cu Car Loan Rates

FAQs

What is the current interest rate for Tech Cu Car Loans?

+The current interest rate for Tech Cu Car Loans varies depending on the loan term and vehicle type. Please check the Tech Cu website for the most up-to-date rates.

How do I apply for a Tech Cu Car Loan?

+You can apply for a Tech Cu Car Loan online or in-person at a Tech Cu branch. You'll need to provide personal and financial information, as well as details about the vehicle you're purchasing.

What are the benefits of choosing a Tech Cu Car Loan?

+Choosing a Tech Cu Car Loan offers competitive rates, flexible terms, and convenient application process. You'll also have access to exclusive membership benefits.

In conclusion, understanding Tech Cu Car Loan rates is essential for making informed decisions when financing your next vehicle. By considering factors such as credit score, loan term, and vehicle type, you can get the best rate possible. Remember to compare rates, choose a shorter loan term, and consider a co-signer to get the most out of your Tech Cu Car Loan.