A standard promissory note word template is a crucial document in loan agreements, serving as a written promise by the borrower to repay a loan to the lender. This template outlines the essential terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and late payment fees. In this article, we will delve into the world of promissory notes, exploring their importance, key components, and providing a comprehensive template for loan agreements.

What is a Promissory Note?

A promissory note is a written agreement between two parties, where one party (the borrower) promises to pay a certain amount of money to the other party (the lender) on a specified date or according to a specific repayment schedule. Promissory notes are commonly used in various financial transactions, including personal loans, business loans, and mortgages.

Importance of a Promissory Note

A promissory note is a vital document in loan agreements, offering several benefits to both lenders and borrowers. Some of the key advantages of using a promissory note include:

- Provides a clear understanding of the loan terms and conditions

- Offers a written record of the loan agreement

- Helps to prevent misunderstandings and disputes

- Can be used as evidence in court if the borrower defaults on the loan

Key Components of a Promissory Note

A standard promissory note word template typically includes the following key components:

- Loan Amount: The total amount borrowed by the borrower

- Interest Rate: The rate at which interest is charged on the loan

- Repayment Schedule: The frequency and amount of each payment

- Maturity Date: The date by which the loan must be repaid in full

- Late Payment Fees: The charges applied if the borrower fails to make timely payments

- Prepayment Terms: The conditions under which the borrower can repay the loan early

- Default Provisions: The consequences of the borrower defaulting on the loan

Standard Promissory Note Word Template

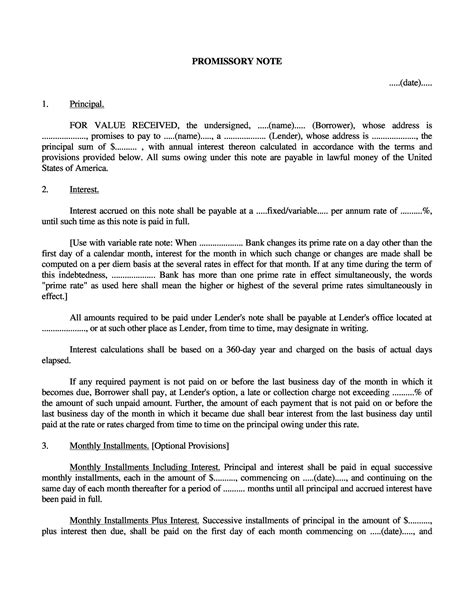

Below is a comprehensive template for a standard promissory note:

PROMISSORY NOTE

This Promissory Note ("Note") is made and entered into on [DATE] ("Effective Date") by and between [LENDER'S NAME] ("Lender") and [BORROWER'S NAME] ("Borrower").

1. Loan Amount

The Lender agrees to lend the Borrower a total amount of $[LOAN AMOUNT] ("Loan Amount").

2. Interest Rate

The Borrower shall pay interest on the Loan Amount at a rate of [INTEREST RATE]% per annum, compounded monthly.

3. Repayment Schedule

The Borrower shall repay the Loan Amount, together with interest, in [NUMBER] monthly installments of $[INSTALLMENT AMOUNT] each, commencing on [FIRST PAYMENT DATE] and ending on [FINAL PAYMENT DATE].

4. Maturity Date

The Borrower shall repay the Loan Amount in full on or before [MATURITY DATE].

5. Late Payment Fees

If the Borrower fails to make any payment on or before the due date, the Borrower shall pay a late payment fee of $[LATE PAYMENT FEE].

6. Prepayment Terms

The Borrower may prepay the Loan Amount in full or in part at any time without penalty.

7. Default Provisions

If the Borrower defaults on the loan, the Lender may declare the entire Loan Amount immediately due and payable.

By signing below, the parties acknowledge that they have read, understand, and agree to the terms and conditions of this Promissory Note.

LENDER'S SIGNATURE

[LENDER'S SIGNATURE]

BORROWER'S SIGNATURE

[BORROWER'S SIGNATURE]

Date: [DATE]

Gallery of Promissory Note Templates

Frequently Asked Questions

What is a promissory note?

+A promissory note is a written agreement between two parties, where one party promises to pay a certain amount of money to the other party on a specified date or according to a specific repayment schedule.

What are the key components of a promissory note?

+The key components of a promissory note include the loan amount, interest rate, repayment schedule, maturity date, late payment fees, prepayment terms, and default provisions.

Why is a promissory note important?

+A promissory note is important because it provides a clear understanding of the loan terms and conditions, offers a written record of the loan agreement, and helps to prevent misunderstandings and disputes.

We hope this comprehensive guide to standard promissory note word templates has been informative and helpful. Whether you're a lender or a borrower, understanding the importance and key components of a promissory note can help you navigate the world of loan agreements with confidence.