Creating a small nonprofit budget template is an essential step in managing your organization's finances effectively. A well-structured budget helps you make informed decisions, allocate resources efficiently, and achieve your mission. In this article, we will guide you through the 7 essential steps to create a small nonprofit budget template.

Understanding the Importance of Budgeting for Nonprofits

Before we dive into the steps, it's crucial to understand the significance of budgeting for nonprofits. A budget serves as a roadmap for your organization's financial activities, ensuring that you're using your resources wisely. It helps you:

- Identify revenue streams and expenses

- Allocate funds to different programs and activities

- Make informed decisions about investments and expenditures

- Measure financial performance and make adjustments as needed

By creating a comprehensive budget template, you'll be able to manage your nonprofit's finances more effectively, reduce financial risks, and achieve your goals.

Step 1: Define Your Budgeting Goals and Objectives

The first step in creating a small nonprofit budget template is to define your budgeting goals and objectives. Consider the following:

- What are your organization's short-term and long-term goals?

- What programs or activities do you want to fund?

- What are your financial priorities?

- What are the key performance indicators (KPIs) you want to track?

By establishing clear goals and objectives, you'll be able to create a budget that aligns with your organization's mission and vision.

Step 2: Gather Financial Data and Information

To create an accurate budget template, you'll need to gather financial data and information. This includes:

- Historical financial statements (income statements, balance sheets, and cash flow statements)

- Current financial reports (income statements, balance sheets, and cash flow statements)

- Budgeting assumptions (e.g., inflation rates, revenue growth rates)

- Program-specific financial data (e.g., program revenues, expenses, and budgets)

Step 3: Categorize Revenue and Expenses

Once you have gathered financial data and information, categorize your revenue and expenses into different groups. This will help you to:

- Identify revenue streams and expenses

- Allocate funds to different programs and activities

- Track financial performance and make adjustments as needed

Common revenue categories for nonprofits include:

- Donations and grants

- Program services revenue

- Membership fees

- Sales revenue

Common expense categories for nonprofits include:

- Program expenses

- Administrative expenses

- Fundraising expenses

- Marketing expenses

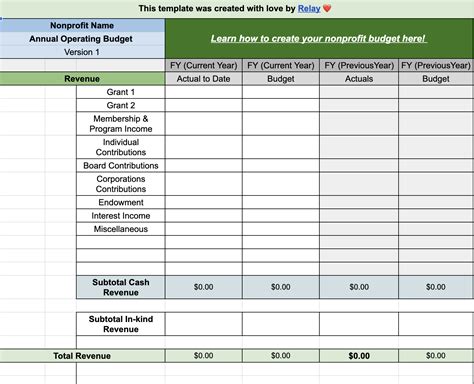

Step 4: Create a Budget Template

Using the financial data and information you've gathered, create a budget template that includes:

- Revenue projections

- Expense projections

- Budgeted cash inflows and outflows

- Budgeted financial statements (income statements, balance sheets, and cash flow statements)

You can use spreadsheet software like Excel or Google Sheets to create a budget template. Consider using a budgeting template specifically designed for nonprofits, which can help you to streamline the budgeting process.

Step 5: Establish Budgeting Assumptions and Parameters

Establish budgeting assumptions and parameters to ensure that your budget template is accurate and realistic. This includes:

- Inflation rates

- Revenue growth rates

- Expense growth rates

- Program-specific budgeting assumptions

By establishing clear budgeting assumptions and parameters, you'll be able to create a budget that is tailored to your organization's specific needs and circumstances.

Step 6: Review and Revise the Budget Template

Once you've created a budget template, review and revise it to ensure that it is accurate and effective. Consider:

- Reviewing financial statements and reports to ensure accuracy

- Revising budgeting assumptions and parameters as needed

- Updating the budget template to reflect changes in revenue and expenses

Step 7: Implement and Monitor the Budget

The final step is to implement and monitor the budget. This includes:

- Allocating funds to different programs and activities

- Tracking financial performance and making adjustments as needed

- Reviewing and revising the budget template regularly

By implementing and monitoring the budget, you'll be able to ensure that your nonprofit is using its resources effectively and achieving its financial goals.

By following these 7 essential steps, you'll be able to create a comprehensive budget template that helps your nonprofit achieve its financial goals and mission.

What is the purpose of a nonprofit budget template?

+A nonprofit budget template helps organizations to manage their finances effectively, allocate resources efficiently, and achieve their mission.

What are the essential steps to create a nonprofit budget template?

+The essential steps to create a nonprofit budget template include defining budgeting goals and objectives, gathering financial data and information, categorizing revenue and expenses, creating a budget template, establishing budgeting assumptions and parameters, reviewing and revising the budget template, and implementing and monitoring the budget.

What are some common revenue categories for nonprofits?

+Common revenue categories for nonprofits include donations and grants, program services revenue, membership fees, and sales revenue.