A silent auction donation receipt template is a crucial document for non-profit organizations, charities, and event planners who host silent auctions to raise funds for their causes. This template serves as a formal acknowledgement of a donor's contribution, providing essential details about the donation and the tax implications. In this article, we will delve into the six essential elements that should be included in a silent auction donation receipt template.

Understanding the Importance of a Silent Auction Donation Receipt Template

A silent auction donation receipt template is more than just a simple acknowledgement of a donation. It is a legal document that provides a formal record of the transaction, which can be used by the donor for tax purposes. In the United States, for example, the Internal Revenue Service (IRS) requires that non-profit organizations provide donors with a written acknowledgement of their contributions, including certain details about the donation.

6 Essential Elements of a Silent Auction Donation Receipt Template

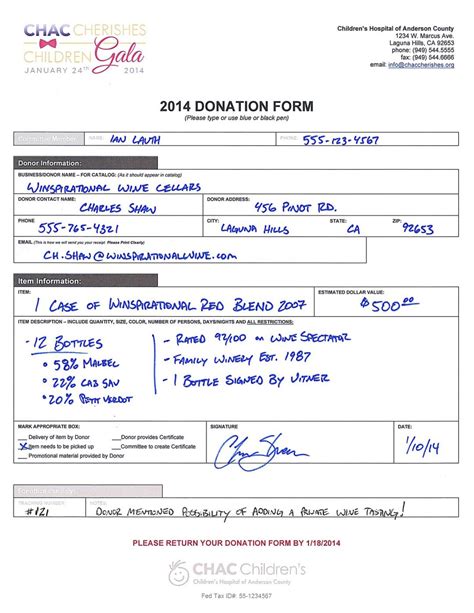

- Donor Information

A silent auction donation receipt template should include the donor's name, address, and contact information. This information is essential for sending the donor a formal acknowledgement of their contribution and for maintaining a record of their donation.

- Donation Details

The template should include details about the donation, such as the date of the donation, the type of item donated (e.g., artwork, collectible, etc.), and the fair market value of the item. The fair market value is the price that a buyer would pay for the item in an open market.

- Acknowledgement of Donation

The template should include a formal acknowledgement of the donation, stating that the organization has received the donation and expressing gratitude to the donor for their contribution.

- Tax Deductibility Information

The template should include information about the tax deductibility of the donation, including a statement indicating whether the donation is tax deductible and the amount of the deduction. This information is essential for donors who want to claim a tax deduction for their contribution.

- Organizational Information

The template should include information about the organization, such as its name, address, and tax identification number. This information is essential for donors who want to verify the organization's legitimacy and for maintaining a record of the donation.

- Signature and Date

Finally, the template should include a signature and date from an authorized representative of the organization, confirming that the donation has been received and acknowledged.

Gallery of Silent Auction Donation Receipt Templates

FAQs

What is a silent auction donation receipt template?

+A silent auction donation receipt template is a document that acknowledges a donor's contribution to a silent auction, providing essential details about the donation and the tax implications.

Why is a silent auction donation receipt template important?

+A silent auction donation receipt template is important because it provides a formal acknowledgement of a donor's contribution, which can be used for tax purposes, and helps to maintain a record of the donation.

What should be included in a silent auction donation receipt template?

+A silent auction donation receipt template should include donor information, donation details, acknowledgement of donation, tax deductibility information, organizational information, and signature and date.

We hope this article has provided you with a comprehensive understanding of the essential elements that should be included in a silent auction donation receipt template. By including these elements, you can ensure that your organization provides donors with a formal acknowledgement of their contributions, which can be used for tax purposes.