Creating a solid financial plan is essential for any restaurant, whether you're a seasoned restaurateur or just starting out. A well-structured financial model helps you navigate the competitive restaurant industry by providing a clear picture of your business's financial health and growth potential. Here, we'll delve into the world of restaurant financial modeling, exploring its importance, key components, and how to leverage a restaurant financial model Excel template to simplify your financial planning.

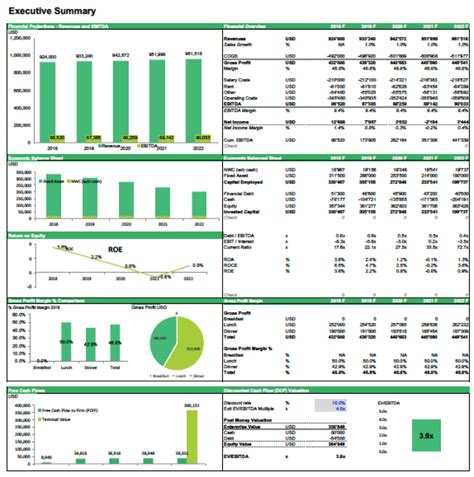

A restaurant financial model is a dynamic forecast of your business's financial performance over a specific period, usually three to five years. It's a tool that helps you understand the financial implications of your operational decisions, assess risks, and make informed strategic choices. This model is particularly useful for startups and growing restaurants, as it allows them to anticipate challenges, capitalize on opportunities, and secure funding from investors.

A comprehensive restaurant financial model typically includes several key components:

-

Revenue Projections: This involves estimating your restaurant's income from various sources, such as food sales, beverage sales, catering, and events. Your projections should be based on market research, competitive analysis, and historical data if available.

-

Cost of Goods Sold (COGS): COGS includes the direct costs associated with producing your menu items, such as ingredients, labor costs for kitchen staff, and the cost of beverages.

-

Operating Expenses: These are the expenses necessary to keep your restaurant running, excluding COGS. Examples include labor costs for front-of-house staff, marketing expenses, rent, utilities, and equipment costs.

-

Capital Expenditures: This section outlines the investments you plan to make in your restaurant, such as purchasing equipment, renovating the space, or expanding to new locations.

-

Cash Flow Statement: A cash flow statement shows the inflows and outflows of cash and cash equivalents over time. It's crucial for understanding your restaurant's liquidity and ability to meet financial obligations.

-

Break-even Analysis: This analysis calculates the point at which your restaurant's total revenue equals its total fixed and variable costs. It helps you understand how much you need to sell to cover your expenses.

-

Sensitivity Analysis: This involves testing how changes in key assumptions affect your restaurant's financial performance. It helps in understanding the risks and opportunities associated with different scenarios.

Utilizing a restaurant financial model Excel template can greatly simplify the process of creating a financial plan. These templates are pre-designed spreadsheets that guide you through the various components of your financial model, ensuring that you don't miss any critical elements. Here are some benefits of using a template:

-

Saves Time: Starting from scratch can be overwhelming. A template provides a structure, saving you time and reducing the complexity of building a financial model.

-

Reduces Errors: Templates often include formulas and links that help prevent common errors in financial modeling, such as incorrect calculations or mismatched data.

-

Enhances Consistency: Using a template ensures that your financial model is well-organized and easy to follow, making it simpler for investors, lenders, or other stakeholders to understand your business plan.

-

Allows for Flexibility: While templates provide a structure, they can be tailored to fit the specific needs of your restaurant. You can adjust assumptions, add scenarios, and modify the model as your business evolves.

Where to Find a Restaurant Financial Model Excel Template?

There are several ways to obtain a restaurant financial model Excel template:

-

Online Marketplaces: Websites like Etsy or eBay may offer restaurant financial model templates for sale. Be cautious and ensure you're purchasing from a reputable seller.

-

Financial Planning Websites: Some financial planning and accounting websites offer free or paid templates for various businesses, including restaurants.

-

Microsoft Excel Templates: Microsoft often provides a range of free templates, including some for business and financial planning. While not specifically designed for restaurants, these can be adapted.

-

Specialized Business Planning Platforms: Some platforms specialize in business planning and financial modeling, offering industry-specific templates, including for restaurants.

Tips for Using a Restaurant Financial Model Excel Template

-

Customize: Don't be afraid to adjust the template to fit your specific needs. This includes changing assumptions, adding new revenue streams, or modifying expense categories.

-

Keep it Simple: While it's tempting to include every possible scenario, keep your model focused and avoid unnecessary complexity.

-

Regularly Update: As your restaurant grows or market conditions change, update your financial model to reflect these changes.

-

Seek Professional Advice: If you're not familiar with financial modeling or need specific guidance, consider consulting with a financial advisor or accountant.

In conclusion, a restaurant financial model Excel template is a valuable tool for any restaurant looking to solidify its financial foundation. By understanding the components of a financial model and leveraging a template, you can create a robust financial plan that guides your business decisions and ensures long-term success.