Real estate investing can be a lucrative venture, but it requires careful planning and analysis to ensure that investments are profitable. One of the most effective tools for real estate investors is the Discounted Cash Flow (DCF) model. In this article, we will explore the concept of DCF models, their importance in real estate investing, and provide a step-by-step guide on how to create a real estate DCF model in Excel.

What is a Discounted Cash Flow (DCF) Model?

A DCF model is a financial modeling technique used to estimate the present value of future cash flows. It takes into account the time value of money, risk, and uncertainty associated with future cash flows. In real estate investing, a DCF model helps investors evaluate the potential returns on investment (ROI) of a property by forecasting future cash flows, such as rental income, expenses, and sale proceeds.

Why is a DCF Model Important in Real Estate Investing?

A DCF model is essential in real estate investing because it helps investors make informed decisions by:

- Evaluating investment potential: A DCF model enables investors to assess the potential returns on investment of a property and compare it to other investment opportunities.

- Identifying risks and opportunities: By analyzing future cash flows, investors can identify potential risks and opportunities associated with a property investment.

- Optimizing investment strategies: A DCF model can help investors optimize their investment strategies by evaluating different scenarios, such as rental income growth rates, expense levels, and holding periods.

Creating a Real Estate DCF Model in Excel

To create a real estate DCF model in Excel, follow these steps:

Step 1: Set up the Input Sheet

Create a new Excel worksheet and set up an input sheet to collect relevant data for the model. The input sheet should include the following:

- Property details:

- Property type (residential, commercial, etc.)

- Location

- Purchase price

- Financing terms (loan amount, interest rate, etc.)

- Cash flow assumptions:

- Rental income growth rate

- Expense levels (maintenance, taxes, insurance, etc.)

- Capital expenditures (renovations, upgrades, etc.)

- Discount rate and holding period:

- Discount rate (cost of capital)

- Holding period (years)

Step 2: Create the Cash Flow Statement

Create a cash flow statement that outlines the projected cash inflows and outflows for the property over the holding period. The cash flow statement should include the following:

- Rental income: Projected rental income for each year of the holding period

- Expenses: Projected expenses, such as maintenance, taxes, insurance, and capital expenditures

- Net operating income (NOI): Rental income minus expenses

- Cash flow: NOI minus debt service (loan payments)

Step 3: Calculate the Present Value of Future Cash Flows

Use the XNPV function in Excel to calculate the present value of future cash flows. The XNPV function takes into account the discount rate, cash flows, and timing of cash flows.

Step 4: Calculate the Net Present Value (NPV)

Calculate the NPV of the investment by subtracting the initial investment (purchase price) from the present value of future cash flows.

Step 5: Evaluate the Investment

Evaluate the investment by analyzing the NPV, internal rate of return (IRR), and cash-on-cash return. These metrics will help investors determine whether the investment is attractive and aligns with their investment goals.

Real Estate DCF Model Excel Template

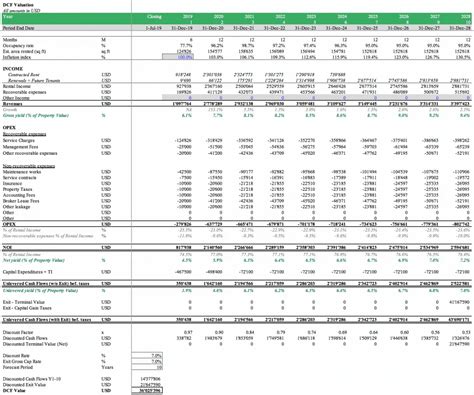

Here is a sample real estate DCF model Excel template:

Gallery of Real Estate DCF Model Examples

Frequently Asked Questions

What is a Discounted Cash Flow (DCF) model?

+A DCF model is a financial modeling technique used to estimate the present value of future cash flows.

Why is a DCF model important in real estate investing?

+A DCF model helps investors evaluate the potential returns on investment of a property and make informed decisions.

How do I create a real estate DCF model in Excel?

+Follow the steps outlined in this article to create a real estate DCF model in Excel.

By following the steps outlined in this article, real estate investors can create a comprehensive DCF model in Excel to evaluate potential investments and make informed decisions. Remember to regularly review and update your model to ensure that it remains accurate and relevant.