In the state of Utah, a promissory note is a binding contract between two parties where one party (the borrower) promises to repay a loan or debt to another party (the lender). A promissory note template is a pre-drafted document that outlines the terms and conditions of the loan, making it easier for both parties to understand their obligations. Here are five essentials that should be included in a Utah promissory note template.

Essential 1: Parties Involved and Loan Amount

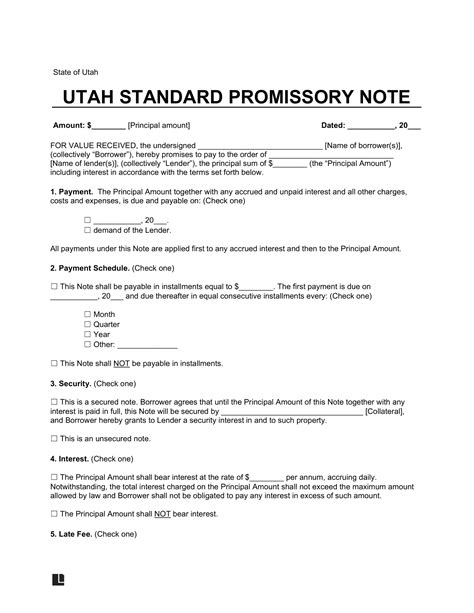

The promissory note should clearly identify the parties involved, including the borrower and lender, along with their addresses. The loan amount, including the principal amount and interest rate, should also be specified. This information is crucial to establish the terms of the loan and prevent any potential disputes.

Essential 2: Repayment Terms

Understanding Repayment Terms

The repayment terms, including the frequency of payments, due dates, and total number of payments, should be clearly outlined in the promissory note. The note should also specify whether the loan is an installment loan or a balloon loan. In an installment loan, the borrower makes regular payments over a set period, while in a balloon loan, the borrower makes smaller payments over a set period, followed by a large final payment.

Essential 3: Interest Rate and Fees

Understanding Interest Rates and Fees

The promissory note should specify the interest rate and any applicable fees. In Utah, the maximum interest rate allowed is 10% per annum, although lenders may charge lower rates. The note should also specify any late payment fees or other charges that may apply.

Essential 4: Security and Collateral

Understanding Security and Collateral

The promissory note should specify whether the loan is secured or unsecured. A secured loan requires the borrower to provide collateral, such as property or equipment, to guarantee the loan. The note should also specify the type of collateral and its value.

Essential 5: Default and Acceleration

Understanding Default and Acceleration

The promissory note should specify the events that constitute a default, such as failure to make payments or bankruptcy. The note should also specify the consequences of default, including acceleration of the loan, where the lender may demand immediate repayment of the entire loan balance.

In conclusion, a Utah promissory note template should include these five essentials to ensure a clear understanding of the loan terms and conditions. By including these essential elements, both parties can avoid potential disputes and ensure a smooth repayment process.

FAQ Section

What is a promissory note?

+A promissory note is a binding contract between two parties where one party promises to repay a loan or debt to another party.

What are the essential elements of a Utah promissory note template?

+The essential elements of a Utah promissory note template include parties involved and loan amount, repayment terms, interest rate and fees, security and collateral, and default and acceleration.

Can I use a Utah promissory note template for a business loan?

+Yes, you can use a Utah promissory note template for a business loan, but it's recommended to consult with a lawyer or financial advisor to ensure the template meets your specific needs.