Mississippi promissory notes are legally binding agreements that outline the terms of a loan between a lender and a borrower. These documents are essential for securing loans, as they provide a clear understanding of the borrower's obligations and the lender's expectations. In this article, we will explore the importance of promissory notes, the key components of a Mississippi promissory note template, and provide guidance on how to create a secure loan agreement.

Why Use a Promissory Note?

A promissory note is a crucial document in any lending transaction. It serves as a written promise by the borrower to repay the loan, along with any interest and fees, to the lender. This document provides a level of security for the lender, as it outlines the terms of the loan and the borrower's obligations. A promissory note can also help prevent disputes and provide a clear understanding of the loan agreement.

Benefits of a Promissory Note

There are several benefits to using a promissory note, including:

- Provides a clear understanding of the loan agreement

- Outlines the borrower's obligations and the lender's expectations

- Offers a level of security for the lender

- Helps prevent disputes and misunderstandings

- Can be used as evidence in court if necessary

Key Components of a Mississippi Promissory Note Template

A Mississippi promissory note template should include the following key components:

1. Parties Involved

- The lender's name and address

- The borrower's name and address

- The date of the agreement

2. Loan Terms

- The loan amount

- The interest rate

- The repayment terms, including the frequency and amount of payments

- The maturity date of the loan

3. Payment Terms

- The payment method, such as check or electronic transfer

- The payment schedule, including the due date and amount of each payment

- Any late payment fees or penalties

4. Security

- A description of any collateral or security provided by the borrower

- The lender's rights and remedies in the event of default

5. Default and Remedies

- The events that constitute default, such as failure to make payments

- The lender's remedies in the event of default, such as acceleration of the loan or foreclosure

6. Governing Law

- The state and federal laws that govern the agreement

- The jurisdiction and venue for any disputes or litigation

Creating a Secure Loan Agreement

To create a secure loan agreement, it's essential to include the following:

1. Clear and Concise Language

- Use simple and straightforward language to avoid misunderstandings

- Avoid using ambiguous or vague terms

2. Specific Details

- Include specific details about the loan, such as the amount and interest rate

- Provide a clear repayment schedule and payment terms

3. Security and Collateral

- Include a description of any collateral or security provided by the borrower

- Outline the lender's rights and remedies in the event of default

4. Default and Remedies

- Clearly outline the events that constitute default

- Provide a clear understanding of the lender's remedies in the event of default

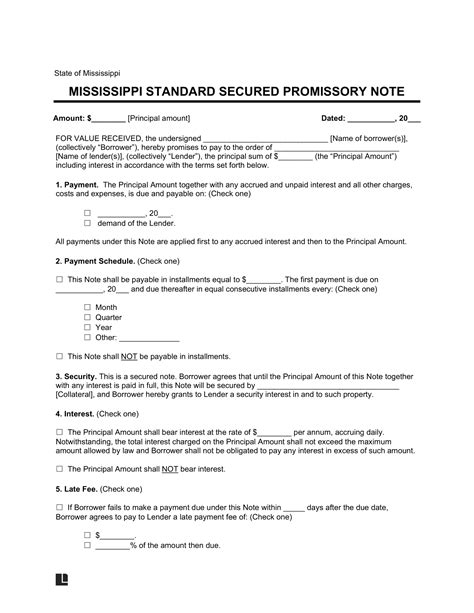

Mississippi Promissory Note Template

Here is a sample Mississippi promissory note template:

[Image: Mississippi Promissory Note Template]

Gallery of Promissory Note Templates

Frequently Asked Questions

What is a promissory note?

+A promissory note is a legally binding agreement that outlines the terms of a loan between a lender and a borrower.

Why is a promissory note important?

+A promissory note provides a clear understanding of the loan agreement and offers a level of security for the lender.

What should be included in a promissory note?

+A promissory note should include the parties involved, loan terms, payment terms, security, and default and remedies.

By following the guidelines outlined in this article, you can create a secure loan agreement that protects both the lender and the borrower. Remember to include clear and concise language, specific details, security and collateral, and default and remedies. With a well-crafted promissory note, you can ensure a successful and stress-free lending experience.