A promissory note is a written agreement between a lender and a borrower that outlines the terms of a loan. In the state of Michigan, a promissory note serves as a binding contract that requires the borrower to repay the loan amount, plus interest and fees, according to the agreed-upon terms. If you are a lender or a borrower in Michigan, it is essential to understand the components of a promissory note and how to use a Michigan promissory note template.

Why Use a Michigan Promissory Note Template?

Using a Michigan promissory note template can save you time and effort when creating a loan agreement. A template provides a standard format that ensures all necessary information is included, and it helps prevent disputes or misunderstandings that may arise during the loan repayment process. A promissory note template can be used for various types of loans, including personal loans, business loans, and mortgages.

Components of a Michigan Promissory Note

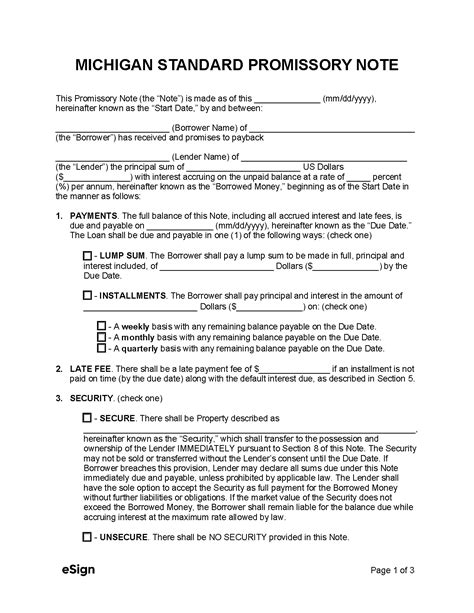

A Michigan promissory note typically includes the following essential components:

- Parties involved: The names and addresses of the lender and borrower.

- Loan amount: The amount borrowed by the borrower.

- Interest rate: The rate of interest charged on the loan amount.

- Repayment terms: The schedule for repaying the loan, including the payment amount, frequency, and due date.

- Collateral: Any assets or property used to secure the loan.

- Default provisions: The consequences of failing to repay the loan, such as late fees and collection costs.

- Governing law: The laws of the state of Michigan that govern the agreement.

Michigan Promissory Note Template Structure

A Michigan promissory note template typically follows this structure:

- Introduction: The template begins with a statement that identifies the agreement as a promissory note, followed by the names and addresses of the parties involved.

- Loan terms: The template outlines the loan amount, interest rate, and repayment terms, including the payment schedule and due date.

- Collateral: The template specifies any collateral used to secure the loan, if applicable.

- Default provisions: The template explains the consequences of defaulting on the loan, including late fees and collection costs.

- Governing law: The template states that the agreement is governed by the laws of the state of Michigan.

- Signatures: The template concludes with a section for the signatures of the lender and borrower.

How to Download a Michigan Promissory Note Template

You can download a Michigan promissory note template from various online sources, including law firms, business websites, and template repositories. When selecting a template, ensure that it meets the requirements of the state of Michigan and is tailored to your specific needs.

Here are a few options to download a Michigan promissory note template:

- Law firms: Many law firms offer free or paid promissory note templates on their websites. These templates are often reviewed by attorneys and comply with Michigan state laws.

- Business websites: Websites that specialize in business templates and forms often provide promissory note templates that can be customized for Michigan.

- Template repositories: Online template repositories, such as Microsoft Office or Google Templates, offer a range of promissory note templates that can be adapted for Michigan.

Tips for Using a Michigan Promissory Note Template

When using a Michigan promissory note template, keep the following tips in mind:

- Read the template carefully: Before using the template, read it carefully to ensure it meets your needs and complies with Michigan state laws.

- Customize the template: Tailor the template to your specific requirements, including the loan amount, interest rate, and repayment terms.

- Seek professional advice: If you are unsure about any aspect of the template, consult with an attorney or financial advisor to ensure you are using the template correctly.

- Keep a record: Keep a copy of the signed promissory note and any supporting documents, such as loan applications and payment records.

Gallery of Michigan Promissory Note Templates

What is a promissory note in Michigan?

+A promissory note in Michigan is a written agreement between a lender and a borrower that outlines the terms of a loan, including the loan amount, interest rate, and repayment terms.

How do I use a Michigan promissory note template?

+To use a Michigan promissory note template, download the template, customize it to fit your needs, and have both parties sign the agreement.

What are the consequences of defaulting on a promissory note in Michigan?

+The consequences of defaulting on a promissory note in Michigan may include late fees, collection costs, and damage to your credit score.

By using a Michigan promissory note template, you can create a binding loan agreement that protects both parties involved. Remember to customize the template to fit your specific needs, and seek professional advice if you are unsure about any aspect of the agreement.