A private placement memorandum (PPM) is a critical document used by real estate developers and sponsors to attract investors for their projects. It provides a comprehensive overview of the investment opportunity, including the project's details, risks, and potential returns. In this article, we will discuss the 7 essential elements of a private placement memorandum template for real estate.

Real estate investing can be a lucrative opportunity for individuals and institutions looking to diversify their portfolios. However, it comes with its own set of risks and complexities. A well-crafted PPM helps mitigate these risks by providing transparency and clarity to potential investors. Whether you are a seasoned developer or a newcomer to the real estate industry, understanding the essential elements of a PPM is crucial for success.

A PPM is not just a regulatory requirement; it is a marketing tool that helps you showcase your project's potential and attract the right investors. In this article, we will delve into the 7 essential elements of a private placement memorandum template for real estate, providing you with a comprehensive guide to creating a compelling and effective PPM.

1. Executive Summary

The executive summary is a brief overview of the project, highlighting its key features, objectives, and investment potential. This section should provide a concise summary of the project, including its location, size, and expected returns. The executive summary should be no more than 2-3 pages and should entice readers to continue reading the PPM.

Key Components of an Executive Summary

- Project overview

- Investment highlights

- Expected returns

- Project timeline

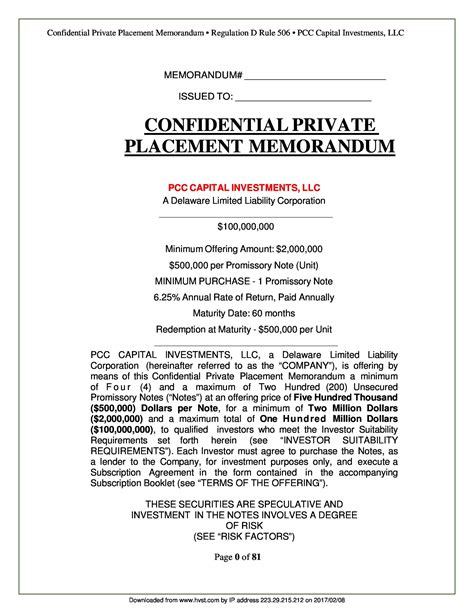

2. Company Overview

The company overview section provides an in-depth look at the developer's or sponsor's company, including its history, experience, and track record. This section should establish credibility and trust with potential investors, highlighting the company's strengths and expertise in the real estate industry.

Key Components of a Company Overview

- Company history

- Management team profiles

- Project portfolio

- Awards and recognition

3. Project Description

The project description section provides a detailed overview of the project, including its location, size, and features. This section should include information on the project's design, layout, and amenities, as well as its expected completion date and budget.

Key Components of a Project Description

- Project location

- Project size and layout

- Amenities and features

- Expected completion date and budget

4. Investment Strategy

The investment strategy section outlines the developer's or sponsor's approach to investing in the project, including the expected returns and risks. This section should provide a clear understanding of the investment potential and the strategies in place to mitigate risks.

Key Components of an Investment Strategy

- Investment objectives

- Expected returns

- Risk management strategies

- Exit strategy

5. Financial Projections

The financial projections section provides a detailed breakdown of the project's expected financial performance, including revenue, expenses, and cash flow. This section should include historical data, if available, as well as projected financial statements.

Key Components of Financial Projections

- Historical financial data

- Projected financial statements

- Break-even analysis

- Cash flow projections

6. Risk Factors

The risk factors section outlines the potential risks associated with the project, including market risks, regulatory risks, and operational risks. This section should provide a clear understanding of the potential risks and the strategies in place to mitigate them.

Key Components of Risk Factors

- Market risks

- Regulatory risks

- Operational risks

- Mitigation strategies

7. Subscription Agreement

The subscription agreement section outlines the terms and conditions of the investment, including the subscription process, payment terms, and investor obligations. This section should provide a clear understanding of the investment process and the obligations of both the developer or sponsor and the investor.

Key Components of a Subscription Agreement

- Subscription process

- Payment terms

- Investor obligations

- Termination clauses

In conclusion, a well-crafted private placement memorandum template for real estate is essential for attracting investors and securing funding for your project. By including these 7 essential elements, you can create a comprehensive and effective PPM that showcases your project's potential and provides transparency and clarity to potential investors.

We hope this article has provided you with a comprehensive guide to creating a private placement memorandum template for real estate. If you have any questions or need further clarification, please do not hesitate to ask.

Please share your thoughts and experiences with private placement memorandums in the comments section below.

What is a private placement memorandum?

+A private placement memorandum is a document used by real estate developers and sponsors to attract investors for their projects.

What are the essential elements of a private placement memorandum template for real estate?

+The essential elements of a private placement memorandum template for real estate include the executive summary, company overview, project description, investment strategy, financial projections, risk factors, and subscription agreement.

Why is a private placement memorandum important?

+A private placement memorandum is important because it provides transparency and clarity to potential investors, helping to mitigate risks and attract funding for the project.