As a landlord, managing rental properties can be a daunting task, especially when it comes to keeping track of payments, expenses, and income. A well-organized rental payment ledger is essential to ensure timely payments, avoid disputes, and make informed financial decisions. In this article, we'll discuss the importance of a rental payment ledger, its benefits, and provide a free template for landlords to get started.

A rental payment ledger is a record-keeping system that tracks all rental payments, charges, and credits for a specific property or tenant. It's a critical tool for landlords to monitor cash flow, identify payment patterns, and detect any discrepancies or issues early on. By maintaining an accurate and up-to-date ledger, landlords can:

- Ensure timely payments and reduce the risk of late or missed payments

- Easily identify and address any payment discrepancies or disputes

- Make informed financial decisions, such as adjusting rent or budgeting for expenses

- Provide transparent and accurate records for tax purposes or auditing

Benefits of Using a Rental Payment Ledger

Using a rental payment ledger offers numerous benefits for landlords, including:

- Improved cash flow management: By tracking payments and charges, landlords can better manage their cash flow and make informed decisions about investments or expenses.

- Reduced risk of disputes: A clear and accurate record of payments and charges helps prevent disputes and misunderstandings with tenants.

- Increased transparency: A rental payment ledger provides a transparent and auditable record of all transactions, making it easier to resolve any issues or disputes that may arise.

- Simplified tax preparation: Accurate records of income and expenses make it easier to prepare tax returns and claim deductions.

Key Components of a Rental Payment Ledger

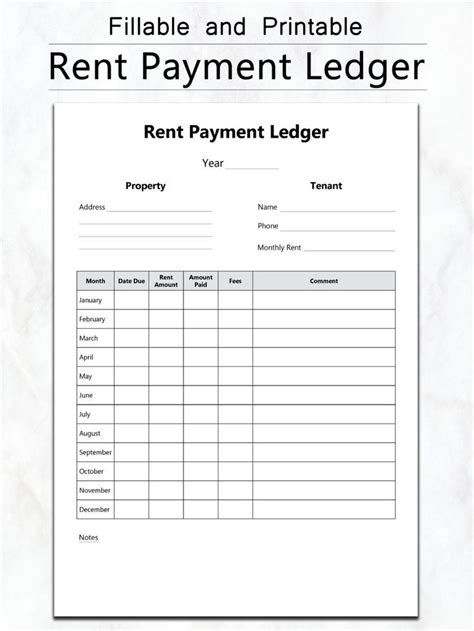

A comprehensive rental payment ledger should include the following key components:

- Tenant information: Name, address, contact details, and lease agreement details

- Payment schedule: Due dates, payment amounts, and frequency

- Payment history: Record of all payments, including dates, amounts, and payment methods

- Charges and credits: Record of any charges or credits, including late fees, repairs, or rent reductions

- Balance: Current balance owed by the tenant

- Notes: Space for additional notes or comments

Free Rental Payment Ledger Template

To help landlords get started, we're providing a free rental payment ledger template that can be downloaded and customized to suit specific needs. The template includes the following features:

- Easy-to-use format: Simple and intuitive layout makes it easy to track payments and charges

- Customizable: Editable fields allow landlords to tailor the template to their specific needs

- Space for notes: Additional space for notes or comments to keep track of any issues or disputes

To download the free rental payment ledger template, click the link below:

[Insert link to template]

How to Use the Template

To get the most out of the template, follow these steps:

- Download and save the template to your computer or cloud storage.

- Customize the template by editing the fields to suit your specific needs.

- Enter tenant information, payment schedule, and payment history.

- Regularly update the ledger to reflect new payments, charges, or credits.

- Review the ledger regularly to ensure accuracy and detect any discrepancies.

Best Practices for Maintaining a Rental Payment Ledger

To ensure accuracy and effectiveness, follow these best practices for maintaining a rental payment ledger:

- Regularly update the ledger: Ensure the ledger is up-to-date and reflects all new payments, charges, or credits.

- Verify payment information: Double-check payment information to ensure accuracy and detect any discrepancies.

- Use a secure storage system: Store the ledger in a secure location, such as a cloud storage service or a locked filing cabinet.

- Review and reconcile: Regularly review and reconcile the ledger to ensure accuracy and detect any issues.

By following these best practices and using the free rental payment ledger template, landlords can ensure accurate and transparent record-keeping, reduce the risk of disputes, and make informed financial decisions.

Conclusion

A rental payment ledger is a crucial tool for landlords to manage their rental properties effectively. By using the free template provided and following best practices, landlords can ensure accurate and transparent record-keeping, reduce the risk of disputes, and make informed financial decisions. Remember to regularly update the ledger, verify payment information, and use a secure storage system to ensure the accuracy and effectiveness of your rental payment ledger.

We hope this article has provided valuable insights and resources for landlords to manage their rental properties effectively. If you have any questions or comments, please feel free to share them below.

What is a rental payment ledger?

+A rental payment ledger is a record-keeping system that tracks all rental payments, charges, and credits for a specific property or tenant.

Why is a rental payment ledger important?

+A rental payment ledger helps landlords manage their cash flow, reduce the risk of disputes, and make informed financial decisions.

How do I use the rental payment ledger template?

+Download the template, customize it to suit your needs, and regularly update it to reflect new payments, charges, or credits.