Reconciling petty cash is a crucial task for any organization that uses petty cash funds to cover small expenses. Petty cash reconciliation helps ensure that the company's financial records are accurate and up-to-date, and it also helps prevent errors, theft, or mismanagement of funds. In this article, we will discuss the importance of petty cash reconciliation, provide a petty cash reconciliation template, and guide you through the process.

The Importance of Petty Cash Reconciliation

Petty cash reconciliation is an essential process for any organization that uses petty cash funds. Petty cash funds are used to cover small expenses, such as office supplies, travel expenses, and entertainment expenses. Without proper reconciliation, petty cash funds can be mismanaged, leading to errors, theft, or misappropriation of funds.

Petty cash reconciliation helps ensure that the company's financial records are accurate and up-to-date. It also helps prevent errors, theft, or mismanagement of funds by ensuring that all transactions are accounted for and that the petty cash fund is properly managed.

Petty Cash Reconciliation Template

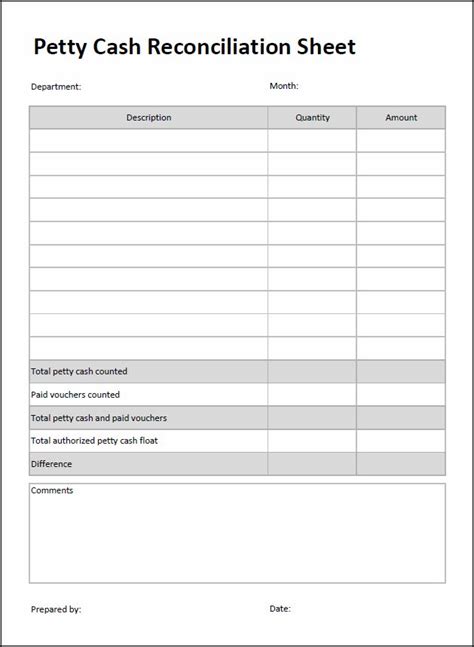

Here is a petty cash reconciliation template that you can use to reconcile your petty cash funds:

Petty Cash Reconciliation Template

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

Petty Cash Reconciliation Process

The petty cash reconciliation process involves the following steps:

Step 1: Gather Petty Cash Transactions

Gather all petty cash transactions, including receipts, invoices, and bank statements. Ensure that all transactions are properly documented and authorized.

Step 2: Verify Petty Cash Transactions

Verify each petty cash transaction to ensure that it is accurate and authorized. Check the receipts, invoices, and bank statements to ensure that the transactions are properly documented.

Step 3: Reconcile Petty Cash Transactions

Reconcile the petty cash transactions by comparing the transactions to the petty cash fund balance. Ensure that all transactions are accounted for and that the petty cash fund balance is accurate.

Step 4: Investigate Discrepancies

Investigate any discrepancies or errors found during the reconciliation process. Ensure that all discrepancies are properly documented and resolved.

Step 5: Update Petty Cash Records

Update the petty cash records to reflect the reconciled transactions. Ensure that the petty cash fund balance is accurate and up-to-date.

Benefits of Petty Cash Reconciliation

Petty cash reconciliation provides several benefits, including:

- Improved Accuracy: Petty cash reconciliation ensures that the company's financial records are accurate and up-to-date.

- Prevention of Errors: Petty cash reconciliation helps prevent errors, theft, or mismanagement of funds by ensuring that all transactions are accounted for and that the petty cash fund is properly managed.

- Enhanced Transparency: Petty cash reconciliation provides enhanced transparency by ensuring that all transactions are properly documented and authorized.

Best Practices for Petty Cash Reconciliation

Here are some best practices for petty cash reconciliation:

- Regular Reconciliation: Regularly reconcile petty cash transactions to ensure that the company's financial records are accurate and up-to-date.

- Proper Documentation: Ensure that all petty cash transactions are properly documented and authorized.

- Segregation of Duties: Segregate duties to ensure that no single individual has control over the entire petty cash process.

Common Mistakes to Avoid

Here are some common mistakes to avoid when reconciling petty cash:

- Incomplete Documentation: Ensure that all petty cash transactions are properly documented and authorized.

- Inaccurate Reconciliation: Ensure that the petty cash transactions are accurately reconciled to the petty cash fund balance.

- Lack of Segregation of Duties: Ensure that duties are segregated to prevent any single individual from having control over the entire petty cash process.

Gallery of Petty Cash Reconciliation Examples

FAQs

Here are some frequently asked questions about petty cash reconciliation:

Q: What is petty cash reconciliation?

A: Petty cash reconciliation is the process of verifying and reconciling petty cash transactions to ensure that the company's financial records are accurate and up-to-date.

Q: Why is petty cash reconciliation important?

A: Petty cash reconciliation is important because it helps prevent errors, theft, or mismanagement of funds and ensures that the company's financial records are accurate and up-to-date.

Q: What are the benefits of petty cash reconciliation?

A: The benefits of petty cash reconciliation include improved accuracy, prevention of errors, and enhanced transparency.

Q: What are some common mistakes to avoid when reconciling petty cash?

A: Some common mistakes to avoid when reconciling petty cash include incomplete documentation, inaccurate reconciliation, and lack of segregation of duties.

Q: How often should petty cash be reconciled?

A: Petty cash should be reconciled regularly, ideally on a monthly or quarterly basis, to ensure that the company's financial records are accurate and up-to-date.

Conclusion

Petty cash reconciliation is an essential process for any organization that uses petty cash funds. It helps ensure that the company's financial records are accurate and up-to-date, and it also helps prevent errors, theft, or mismanagement of funds. By following the steps outlined in this article and using the provided template, you can ensure that your petty cash reconciliation process is efficient and effective.