Paying off debt can be a significant milestone in one's financial journey. When a debt is fully paid, it's essential to obtain a payoff letter from the lender to confirm the debt's closure. A payoff letter serves as proof that the debt has been fully satisfied, and it can be used to update credit reports, close accounts, and even boost credit scores.

What is a Payoff Letter?

A payoff letter, also known as a satisfaction letter, is a document issued by a lender to a borrower confirming that a debt has been fully paid. The letter typically includes essential details such as:

- The borrower's name and address

- The account number or loan ID

- The original loan amount

- The payoff amount

- The payment date

- A statement confirming that the debt has been fully satisfied

Why is a Payoff Letter Important?

A payoff letter is crucial for several reasons:

- It serves as proof that the debt has been fully paid, which can help to update credit reports and improve credit scores.

- It helps to prevent any further collection activities or late fees.

- It provides a record of the debt's closure, which can be useful for future reference.

5 Essential Payoff Letter Templates in Word

Here are five essential payoff letter templates in Word that you can use as a starting point:

Template 1: Basic Payoff Letter Template

This template includes the essential details required in a payoff letter, such as the borrower's name and address, account number, original loan amount, payoff amount, and payment date.

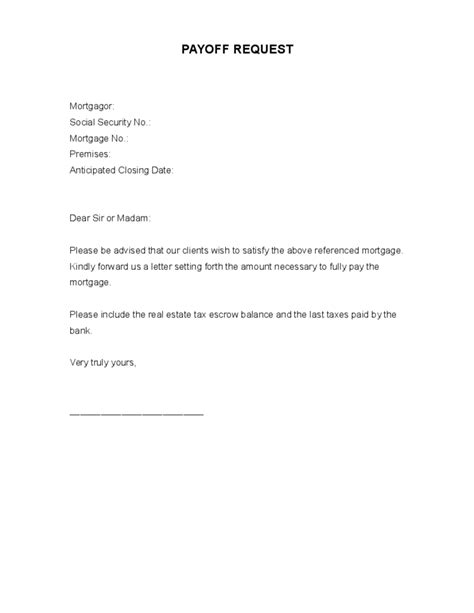

Template 2: Mortgage Payoff Letter Template

This template is specifically designed for mortgage payoff letters and includes additional details such as the property address, loan ID, and a statement confirming that the mortgage has been fully satisfied.

Template 3: Auto Loan Payoff Letter Template

This template is designed for auto loan payoff letters and includes details such as the vehicle's make and model, loan ID, and a statement confirming that the auto loan has been fully satisfied.

Template 4: Credit Card Payoff Letter Template

This template is designed for credit card payoff letters and includes details such as the credit card account number, original balance, payoff amount, and a statement confirming that the credit card account has been fully satisfied.

Template 5: Student Loan Payoff Letter Template

This template is designed for student loan payoff letters and includes details such as the loan ID, original loan amount, payoff amount, and a statement confirming that the student loan has been fully satisfied.

How to Use These Templates

To use these templates, simply download the Word file and fill in the required information. Make sure to customize the template according to your needs and ensure that all the details are accurate.

Gallery of Payoff Letter Templates

Frequently Asked Questions

What is a payoff letter?

+A payoff letter is a document issued by a lender to a borrower confirming that a debt has been fully paid.

Why is a payoff letter important?

+A payoff letter serves as proof that the debt has been fully paid, which can help to update credit reports and improve credit scores.

How do I obtain a payoff letter?

+You can obtain a payoff letter by contacting your lender and requesting one. You can also use the templates provided above to create your own payoff letter.

We hope this article has provided you with essential information on payoff letters and how to use the templates provided. Remember to customize the templates according to your needs and ensure that all the details are accurate.