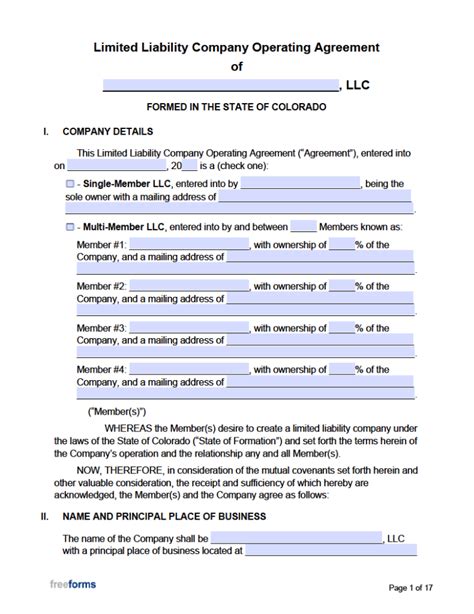

As the second-most popular state for businesses in the United States, Colorado is an attractive location for entrepreneurs looking to establish a Limited Liability Company (LLC). One crucial document that Colorado LLCs need to have in place is an Operating Agreement. This document outlines the ownership, management, and operational structure of the LLC, ensuring that all members are on the same page. In this article, we will discuss the five essential components of a Colorado LLC Operating Agreement.

Why is an Operating Agreement necessary for a Colorado LLC?

An Operating Agreement is a vital document that serves as a roadmap for the LLC's operation, management, and decision-making processes. It helps prevent misunderstandings and conflicts among members by clearly outlining their roles, responsibilities, and expectations. Additionally, having a well-drafted Operating Agreement can help protect the LLC's limited liability status, ensuring that members' personal assets remain separate from the business.

Component 1: Ownership Structure

The first essential component of a Colorado LLC Operating Agreement is the ownership structure. This section outlines the ownership percentages of each member, including their names, addresses, and contact information. It's crucial to include the following details:

- Ownership percentages

- Member names and addresses

- Member roles and responsibilities

- Capital contributions (initial and ongoing)

Having a clear ownership structure helps prevent disputes among members and ensures that everyone understands their stake in the business.

Component 2: Management and Control

The second essential component of a Colorado LLC Operating Agreement is the management and control section. This section outlines how the LLC will be managed, including the roles and responsibilities of each member. It's essential to include the following details:

- Management structure (member-managed or manager-managed)

- Member roles and responsibilities

- Decision-making processes

- Voting procedures

Having a clear management and control structure helps ensure that the LLC operates smoothly and efficiently, reducing the risk of conflicts among members.

Component 3: Capital Contributions and Distributions

The third essential component of a Colorado LLC Operating Agreement is the capital contributions and distributions section. This section outlines how the LLC will handle initial and ongoing capital contributions, as well as distributions of profits and losses. It's crucial to include the following details:

- Initial capital contributions

- Ongoing capital contributions

- Distribution of profits and losses

- Tax implications

Having a clear understanding of capital contributions and distributions helps ensure that members are aware of their financial obligations and benefits.

Component 4: Meetings and Voting

The fourth essential component of a Colorado LLC Operating Agreement is the meetings and voting section. This section outlines the procedures for holding meetings, including annual meetings, special meetings, and voting procedures. It's essential to include the following details:

- Meeting frequency and procedures

- Voting procedures

- Quorum requirements

- Proxy voting procedures

Having a clear understanding of meeting and voting procedures helps ensure that the LLC operates democratically and that all members have a voice in decision-making processes.

Component 5: Dispute Resolution and Dissolution

The fifth essential component of a Colorado LLC Operating Agreement is the dispute resolution and dissolution section. This section outlines the procedures for resolving disputes among members, as well as the procedures for dissolving the LLC. It's crucial to include the following details:

- Dispute resolution procedures

- Mediation and arbitration procedures

- Dissolution procedures

- Winding-up procedures

Having a clear understanding of dispute resolution and dissolution procedures helps ensure that the LLC can resolve conflicts and wind up its affairs efficiently and effectively.

Gallery of Colorado LLC Operating Agreement Templates

Frequently Asked Questions

What is an LLC Operating Agreement?

+An LLC Operating Agreement is a document that outlines the ownership, management, and operational structure of a Limited Liability Company (LLC).

Why is an Operating Agreement necessary for a Colorado LLC?

+An Operating Agreement helps prevent misunderstandings and conflicts among members, ensures that the LLC operates democratically, and protects the LLC's limited liability status.

What are the essential components of a Colorado LLC Operating Agreement?

+The essential components of a Colorado LLC Operating Agreement include ownership structure, management and control, capital contributions and distributions, meetings and voting, and dispute resolution and dissolution.

In conclusion, a Colorado LLC Operating Agreement is a vital document that helps ensure the smooth operation of a Limited Liability Company. By including the five essential components outlined in this article, LLC members can prevent conflicts, ensure democratic decision-making, and protect their personal assets. Remember to regularly review and update your Operating Agreement to ensure that it remains relevant and effective.