Creating a binding Louisiana promissory note in 5 easy steps requires careful consideration of the terms and conditions of the agreement. A promissory note is a written promise to repay a debt, and it serves as a legally binding contract between the borrower (or maker) and the lender (or payee). Here's a step-by-step guide to help you create a binding Louisiana promissory note:

The Importance of a Promissory Note

Before we dive into the steps, it's essential to understand the significance of a promissory note. A promissory note provides a clear record of the debt, including the amount borrowed, interest rate, repayment terms, and any collateral or security. This document helps prevent misunderstandings and ensures that both parties are aware of their obligations. In Louisiana, a promissory note can be enforced in court if the borrower fails to repay the debt.

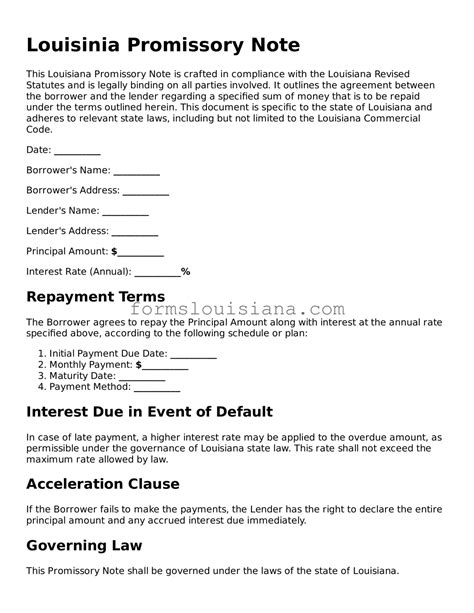

Step 1: Identify the Parties and the Debt

To create a binding promissory note, you need to identify the parties involved and the debt being created. This includes:

- The borrower (or maker): The individual or entity borrowing the money.

- The lender (or payee): The individual or entity lending the money.

- The amount borrowed: The principal amount of the debt.

- The purpose of the loan: A brief description of the reason for the loan.

Make sure to include the names, addresses, and contact information of both parties.

Example:

"Borrower: John Doe Address: 123 Main St, Anytown, LA 70001 Lender: Jane Smith Address: 456 Elm St, Anytown, LA 70001 Amount Borrowed: $10,000 Purpose of the Loan: To finance the purchase of a vehicle"

Step 2: Specify the Repayment Terms

The repayment terms outline the conditions under which the borrower will repay the debt. This includes:

- The interest rate: The rate at which interest will accrue on the outstanding balance.

- The repayment schedule: The frequency and amount of payments, including the due date for each payment.

- The maturity date: The final date by which the debt must be repaid in full.

In Louisiana, the maximum allowable interest rate for a promissory note is 12% per annum. You can choose a lower interest rate, but it must be specified in the note.

Example:

"Repayment Terms: Interest Rate: 10% per annum Repayment Schedule: Monthly payments of $200 due on the 15th day of each month Maturity Date: 24 months from the date of signing"

Step 3: Include Any Collateral or Security

If the borrower is offering collateral or security to secure the debt, you need to describe it in the promissory note. This can include:

- A description of the collateral: The type of property or asset being used as collateral.

- The value of the collateral: An estimate of the collateral's value.

In Louisiana, the most common types of collateral are real estate, vehicles, and equipment.

Example:

"Collateral: The borrower pledges the following collateral to secure the debt: A 2015 Toyota Camry, VIN #1234567890 Value of the Collateral: $8,000"

Step 4: Specify the Default and Acceleration Clauses

A default clause outlines the circumstances under which the lender can declare the borrower in default. An acceleration clause allows the lender to demand immediate repayment of the entire debt if the borrower defaults.

In Louisiana, a promissory note can include a default clause that allows the lender to declare default if the borrower fails to make a payment within a specified period, usually 30 days.

Example:

"Default and Acceleration: If the borrower fails to make a payment within 30 days of the due date, the lender can declare default. Upon default, the entire debt becomes immediately due and payable."

Step 5: Sign and Date the Promissory Note

Finally, both parties must sign and date the promissory note. This creates a binding contract between the borrower and the lender.

Example:

"Signature: Borrower: ________________________________ Date: __________________________________ Lender: __________________________________ Date: __________________________________"

Gallery of Promissory Note Examples

FAQs

What is a promissory note?

+A promissory note is a written promise to repay a debt. It serves as a legally binding contract between the borrower and the lender.

What is the maximum allowable interest rate for a promissory note in Louisiana?

+The maximum allowable interest rate for a promissory note in Louisiana is 12% per annum.

Can I use a promissory note for a personal loan?

+Yes, you can use a promissory note for a personal loan. It provides a clear record of the debt and serves as a legally binding contract between the borrower and the lender.

We hope this article has provided you with a comprehensive guide to creating a binding Louisiana promissory note in 5 easy steps. Remember to carefully consider the terms and conditions of the agreement and seek legal advice if necessary.