Creating a last will in North Carolina can be a daunting task, but with the right guidance, it can be a straightforward process. A last will, also known as a will, is a legal document that outlines how you want your assets to be distributed after your passing. In North Carolina, having a valid will in place can help ensure that your wishes are respected and that your loved ones are taken care of.

Here are 7 tips for creating a last will in North Carolina:

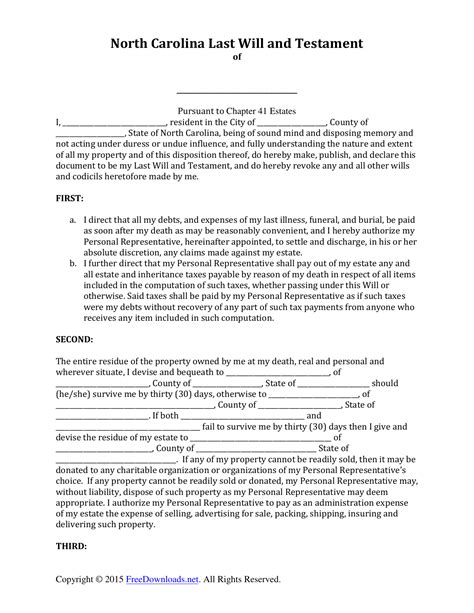

Tip 1: Understand the Requirements for a Valid Will in North Carolina

In North Carolina, a will must meet certain requirements to be considered valid. These requirements include:

- The will must be in writing

- The will must be signed by the testator (the person making the will)

- The will must be witnessed by at least two individuals who are not beneficiaries of the will

- The witnesses must sign the will in the presence of the testator

What Happens if I Die Without a Will in North Carolina?

If you die without a will in North Carolina, your assets will be distributed according to the state's intestacy laws. This means that the court will decide how your assets are distributed, which may not be in line with your wishes.

Tip 2: Choose the Right Executor for Your Will

The executor of your will is responsible for carrying out the instructions outlined in your will. This person will be responsible for managing your estate, paying off debts, and distributing your assets to your beneficiaries.

When choosing an executor, consider the following:

- Choose someone who is trustworthy and responsible

- Choose someone who is familiar with your financial situation and assets

- Consider choosing a professional executor, such as a lawyer or accountant, if you have a complex estate

What are the Responsibilities of an Executor in North Carolina?

The executor of a will in North Carolina has several responsibilities, including:

- Managing the estate and paying off debts

- Distributing assets to beneficiaries

- Filing tax returns and paying taxes

- Handling any disputes or contests to the will

Tip 3: Name Beneficiaries for Your Assets

When creating a will, you will need to name beneficiaries for your assets. This includes:

- Real estate

- Bank accounts

- Investments

- Personal property

Consider the following when naming beneficiaries:

- Make sure to name specific beneficiaries for each asset

- Consider naming alternate beneficiaries in case the primary beneficiary predeceases you

- Make sure to update your beneficiaries if your circumstances change

What Happens if I Name a Minor as a Beneficiary in North Carolina?

If you name a minor as a beneficiary in North Carolina, the court may appoint a guardian to manage the assets on behalf of the minor. This can be a complex and time-consuming process, so it's essential to consider alternative options, such as establishing a trust.

Tip 4: Consider Establishing a Trust

A trust can be a useful tool for managing assets and avoiding probate in North Carolina. There are several types of trusts, including:

- Revocable trusts

- Irrevocable trusts

- Testamentary trusts

Consider the following when establishing a trust:

- Consult with an attorney to determine the best type of trust for your situation

- Make sure to fund the trust with assets

- Consider naming a trustee to manage the trust

What are the Benefits of Establishing a Trust in North Carolina?

Establishing a trust in North Carolina can provide several benefits, including:

- Avoiding probate

- Managing assets for minors or incapacitated individuals

- Reducing taxes

- Protecting assets from creditors

Tip 5: Keep Your Will Up-to-Date

It's essential to keep your will up-to-date to reflect any changes in your circumstances. This includes:

- Updating beneficiaries

- Changing the executor

- Adding or removing assets

Consider the following when updating your will:

- Consult with an attorney to ensure the updates are valid

- Make sure to sign and witness the updated will

- Store the updated will in a safe place

What Happens if I Move to a Different State?

If you move to a different state, your will may still be valid, but it's essential to consult with an attorney to ensure it complies with the new state's laws.

Tip 6: Consider a Living Will and Healthcare Power of Attorney

A living will and healthcare power of attorney are essential documents that outline your wishes for end-of-life care and appoint someone to make medical decisions on your behalf.

Consider the following:

- Consult with an attorney to create a living will and healthcare power of attorney

- Make sure to sign and witness the documents

- Store the documents in a safe place

What is the Difference Between a Living Will and a Healthcare Power of Attorney?

A living will outlines your wishes for end-of-life care, while a healthcare power of attorney appoints someone to make medical decisions on your behalf.

Tip 7: Seek Professional Advice

Creating a last will in North Carolina can be a complex process, and it's essential to seek professional advice to ensure your will is valid and reflects your wishes.

Consider the following:

- Consult with an attorney who specializes in estate planning

- Make sure to ask questions and seek clarification on any concerns

- Consider seeking a second opinion if needed

By following these 7 tips, you can create a valid and effective last will in North Carolina that reflects your wishes and provides for your loved ones.

Conclusion

Creating a last will in North Carolina can seem daunting, but by understanding the requirements, choosing the right executor, naming beneficiaries, considering a trust, keeping your will up-to-date, considering a living will and healthcare power of attorney, and seeking professional advice, you can create a valid and effective will that provides for your loved ones.

If you have any questions or concerns about creating a last will in North Carolina, don't hesitate to reach out to a qualified attorney for guidance.

What is the difference between a will and a trust?

+A will is a document that outlines how you want your assets to be distributed after your passing, while a trust is a separate entity that holds and manages assets for the benefit of beneficiaries.

Do I need a lawyer to create a will in North Carolina?

+While it's not required to have a lawyer create a will in North Carolina, it's highly recommended to ensure your will is valid and reflects your wishes.

How often should I update my will?

+It's recommended to update your will every 5-10 years or when your circumstances change, such as getting married, having children, or acquiring new assets.