Payroll processing is a crucial aspect of any business, and having a clear and organized pay stub template is essential for maintaining transparency and compliance with labor laws. One popular payroll processing software used by many businesses is Intuit Payroll. In this article, we will discuss the importance of pay stubs, provide a free Intuit Payroll pay stub template, and guide you on how to use it.

The Importance of Pay Stubs

Pay stubs, also known as pay slips or salary slips, are documents provided by employers to their employees, detailing their salary and deductions for a specific pay period. Pay stubs serve several purposes:

- Transparency: Pay stubs provide employees with a clear understanding of their earnings and deductions, ensuring they are aware of any changes to their salary or benefits.

- Compliance: Pay stubs help employers comply with labor laws, which require employers to provide employees with a detailed record of their earnings and deductions.

- Record-keeping: Pay stubs serve as a permanent record of employee earnings, deductions, and benefits, making it easier for employers to track employee compensation and make adjustments as needed.

Intuit Payroll Pay Stub Template: Free Download

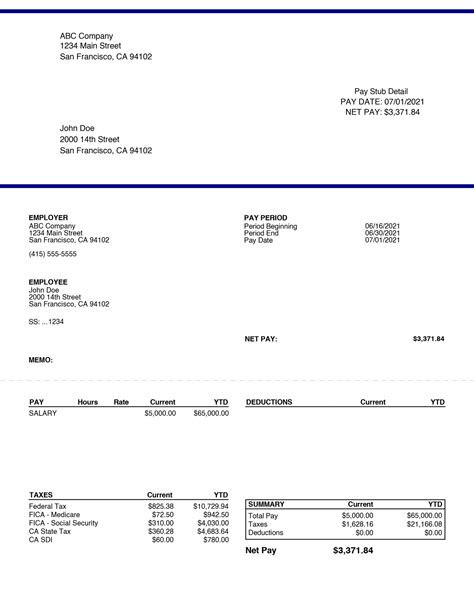

We provide a free Intuit Payroll pay stub template for you to download and use. This template is designed to be customizable and easy to use, ensuring you can create professional-looking pay stubs with ease.

[Insert image: Intuit Payroll Pay Stub Template Screenshot]

You can download the template here: [Insert link to download template]

How to Use the Intuit Payroll Pay Stub Template

Using the Intuit Payroll pay stub template is straightforward. Here's a step-by-step guide:

- Download and open the template: Download the template and open it in your preferred spreadsheet software, such as Microsoft Excel or Google Sheets.

- Enter employee information: Enter the employee's name, address, and other relevant information in the designated fields.

- Enter pay period information: Enter the pay period dates, pay frequency, and pay date in the designated fields.

- Enter earnings and deductions: Enter the employee's earnings and deductions, including gross pay, net pay, and any benefits or deductions.

- Customize the template: Customize the template to suit your business needs, including adding or removing fields as necessary.

- Save and print: Save the template and print out the pay stubs for distribution to employees.

Benefits of Using the Intuit Payroll Pay Stub Template

Using the Intuit Payroll pay stub template offers several benefits, including:

- Professional-looking pay stubs: Create professional-looking pay stubs that reflect your business's brand and reputation.

- Easy to use: The template is easy to use, even for those with limited spreadsheet experience.

- Customizable: Customize the template to suit your business needs, ensuring you can create pay stubs that meet your specific requirements.

- Compliance: The template is designed to ensure compliance with labor laws, reducing the risk of errors or fines.

Tips for Creating Effective Pay Stubs

Creating effective pay stubs requires attention to detail and a clear understanding of labor laws. Here are some tips to keep in mind:

- Use clear and concise language: Use clear and concise language when creating pay stubs, ensuring employees can easily understand their earnings and deductions.

- Include all necessary information: Ensure pay stubs include all necessary information, including employee information, pay period dates, and earnings and deductions.

- Use a consistent format: Use a consistent format when creating pay stubs, ensuring they are easy to read and understand.

- Keep records: Keep accurate records of pay stubs, ensuring you can easily track employee compensation and make adjustments as needed.

Common Pay Stub Mistakes to Avoid

When creating pay stubs, it's essential to avoid common mistakes that can lead to errors or fines. Here are some common pay stub mistakes to avoid:

- Inaccurate information: Ensure pay stubs contain accurate information, including employee information, pay period dates, and earnings and deductions.

- Missing information: Ensure pay stubs include all necessary information, including employee information, pay period dates, and earnings and deductions.

- Inconsistent format: Use a consistent format when creating pay stubs, ensuring they are easy to read and understand.

- Late or missed pay stubs: Ensure pay stubs are distributed to employees on time, avoiding late or missed pay stubs.

Gallery of Pay Stub Templates

Here is a gallery of pay stub templates you can use for inspiration:

FAQs

Here are some frequently asked questions about pay stubs and the Intuit Payroll pay stub template:

What is a pay stub?

+A pay stub is a document provided by employers to their employees, detailing their salary and deductions for a specific pay period.

Why do I need a pay stub template?

+A pay stub template helps you create professional-looking pay stubs that reflect your business's brand and reputation, while also ensuring compliance with labor laws.

How do I customize the Intuit Payroll pay stub template?

+You can customize the template to suit your business needs, including adding or removing fields as necessary.

In conclusion, creating effective pay stubs is crucial for maintaining transparency and compliance with labor laws. The Intuit Payroll pay stub template is a valuable resource for businesses, providing a professional-looking and customizable template for creating pay stubs. By following the tips and guidelines outlined in this article, you can ensure your pay stubs are accurate, easy to understand, and compliant with labor laws.