House flipping can be a lucrative venture, but it requires careful planning and budgeting to ensure success. A well-structured budget spreadsheet is essential for tracking expenses, projecting profits, and making informed decisions. In this article, we will discuss the 7 essential columns for a house flipping budget spreadsheet.

The Importance of a Budget Spreadsheet

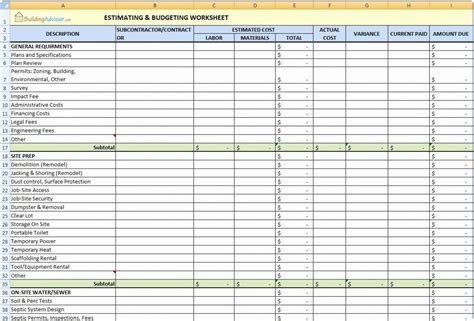

A budget spreadsheet is a vital tool for house flippers, as it helps to organize and track expenses, income, and profits. It provides a clear picture of the project's financial performance, enabling flippers to make adjustments and optimize their strategy. A budget spreadsheet also helps to identify potential risks and opportunities, ensuring that the project stays on track and profitable.

Column 1: Project Details

The first column should include essential project details, such as:

- Project name

- Property address

- Purchase date

- Purchase price

- Project timeline

This information provides context for the rest of the budget spreadsheet and helps to keep track of multiple projects.

Column 2: Acquisition Costs

Acquisition costs include expenses related to purchasing the property, such as:

- Purchase price

- Closing costs

- Inspections and tests

- Appraisal fees

- Title insurance and escrow fees

These costs are typically one-time expenses and should be carefully tracked to ensure accurate budgeting.

Column 3: Rehabilitation Costs

Rehabilitation costs include expenses related to renovating and improving the property, such as:

- Materials and supplies

- Labor costs

- Permits and inspections

- Electrical, plumbing, and HVAC work

- Flooring, painting, and finishing costs

These costs can be significant, and accurate tracking is essential to avoid cost overruns.

Column 4: Holding Costs

Holding costs include expenses related to owning and maintaining the property during the project, such as:

- Mortgage payments

- Property taxes

- Insurance premiums

- Utilities and maintenance costs

- Property management fees

These costs can add up quickly, and it's essential to factor them into the budget to avoid unexpected expenses.

Column 5: Selling Costs

Selling costs include expenses related to marketing and selling the property, such as:

- Real estate agent commissions

- Marketing and advertising expenses

- Staging and furniture costs

- Closing costs (seller's side)

These costs can be significant, and accurate tracking is essential to ensure a smooth sale process.

Column 6: Projected Income

Projected income includes estimated revenue from the sale of the property, such as:

- Selling price

- Net proceeds (after selling costs)

- Projected profit

This column provides a clear picture of the project's potential profitability and helps to make informed decisions.

Column 7: Contingency Funds

Contingency funds include a buffer for unexpected expenses and risks, such as:

- Renovation cost overruns

- Unforeseen repairs or damages

- Changes in market conditions

A contingency fund provides a safety net and helps to mitigate risks, ensuring that the project stays on track and profitable.

Best Practices for Using a House Flipping Budget Spreadsheet

To get the most out of a house flipping budget spreadsheet, follow these best practices:

- Regularly update the spreadsheet to reflect changes in expenses, income, and profits.

- Use formulas and automation to simplify calculations and reduce errors.

- Track expenses and income by category to ensure accurate budgeting.

- Review and revise the budget regularly to ensure the project stays on track.

- Use historical data and industry benchmarks to inform budgeting decisions.

By including these 7 essential columns in a house flipping budget spreadsheet, flippers can ensure accurate budgeting, track expenses and income, and make informed decisions to optimize their strategy. A well-structured budget spreadsheet is a vital tool for success in the competitive world of house flipping.

Gallery of House Flipping Budget Templates

FAQs

What is the most important column in a house flipping budget spreadsheet?

+The most important column in a house flipping budget spreadsheet is the contingency fund column. This column provides a buffer for unexpected expenses and risks, ensuring that the project stays on track and profitable.

How often should I update my house flipping budget spreadsheet?

+It's recommended to update your house flipping budget spreadsheet regularly, ideally weekly or bi-weekly, to reflect changes in expenses, income, and profits.

What is the best way to track expenses in a house flipping budget spreadsheet?

+The best way to track expenses in a house flipping budget spreadsheet is to use categories and subcategories to organize expenses. This allows for easy tracking and analysis of expenses.

By following these best practices and including the 7 essential columns in a house flipping budget spreadsheet, flippers can ensure accurate budgeting, track expenses and income, and make informed decisions to optimize their strategy.