The process of reconciling a general ledger can be a daunting task, especially when working with a large volume of transactions. However, with the use of Microsoft Excel, this task can be significantly simplified. In this article, we will explore five ways to simplify general ledger reconciliation in Excel.

Reconciling a general ledger is a crucial step in the accounting process. It involves comparing the balance in the general ledger with the balance in the company's external bank statement or other financial statements to ensure accuracy and detect any discrepancies. This process can be time-consuming and prone to errors, but with the right techniques and tools, it can be made more efficient.

One of the most significant advantages of using Excel for general ledger reconciliation is its ability to automate repetitive tasks and perform calculations quickly and accurately. By leveraging Excel's features and functions, you can streamline the reconciliation process and reduce the risk of errors.

Why Excel is the Best Tool for General Ledger Reconciliation

Before we dive into the five ways to simplify general ledger reconciliation in Excel, let's first explore why Excel is the best tool for this task.

Excel is a powerful spreadsheet software that offers a wide range of features and functions that make it ideal for general ledger reconciliation. Here are some of the reasons why Excel stands out:

- Flexibility: Excel allows you to create custom templates and formulas tailored to your specific needs.

- Automation: Excel's automation features, such as macros and conditional formatting, can help you streamline the reconciliation process and reduce manual errors.

- Data analysis: Excel's data analysis tools, such as pivot tables and charts, make it easy to identify trends and discrepancies in your data.

- Collaboration: Excel allows multiple users to work on the same spreadsheet simultaneously, making it easy to collaborate with colleagues and stakeholders.

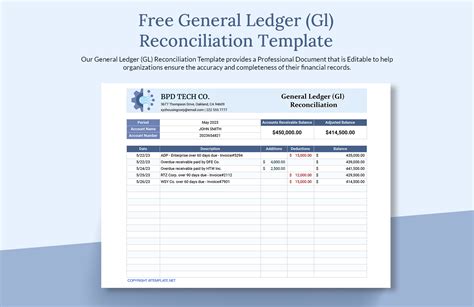

Image: Excel spreadsheet with general ledger data

5 Ways to Simplify General Ledger Reconciliation in Excel

Now that we've explored the benefits of using Excel for general ledger reconciliation, let's dive into the five ways to simplify this process.

1. Use a Template

Using a template can save you a significant amount of time and effort when reconciling a general ledger in Excel. A template can help you organize your data, automate calculations, and ensure consistency in your reconciliation process.

You can create your own template or use a pre-built template available online. When creating a template, make sure to include the following:

- Column headers: Include column headers for the date, description, debit, credit, and balance.

- Formulas: Use formulas to calculate the balance and detect discrepancies.

- Conditional formatting: Use conditional formatting to highlight discrepancies and errors.

2. Automate Reconciliation with Macros

Macros can help you automate repetitive tasks and streamline the reconciliation process. A macro is a set of instructions that can be recorded and played back to perform a specific task.

To create a macro, follow these steps:

- Record a macro: Go to the Developer tab and click on Record Macro.

- Perform the task: Perform the task you want to automate, such as reconciling a specific account.

- Stop the macro: Go back to the Developer tab and click on Stop Recording.

- Save the macro: Save the macro to a specific location, such as a separate worksheet or a new workbook.

3. Use Conditional Formatting to Highlight Discrepancies

Conditional formatting can help you quickly identify discrepancies and errors in your data. This feature allows you to format cells based on specific conditions, such as values, formulas, or formatting.

To use conditional formatting, follow these steps:

- Select the cells: Select the cells you want to format.

- Go to the Home tab: Go to the Home tab and click on Conditional Formatting.

- Select the rule: Select the rule you want to apply, such as "Highlight Cells Rules" or "Top/Bottom Rules".

- Format the cells: Format the cells based on the rule you selected.

Image: Conditional formatting in Excel

4. Use Pivot Tables to Analyze Data

Pivot tables can help you analyze large datasets and identify trends and discrepancies. A pivot table is a powerful tool that allows you to summarize and analyze data from multiple sources.

To create a pivot table, follow these steps:

- Select the data: Select the data you want to analyze.

- Go to the Insert tab: Go to the Insert tab and click on PivotTable.

- Create the pivot table: Create the pivot table and select the fields you want to analyze.

- Analyze the data: Analyze the data and identify trends and discrepancies.

5. Use Excel Formulas to Automate Calculations

Excel formulas can help you automate calculations and streamline the reconciliation process. Formulas can be used to calculate balances, detect discrepancies, and perform other calculations.

To use Excel formulas, follow these steps:

- Select the cells: Select the cells you want to calculate.

- Enter the formula: Enter the formula you want to use, such as the SUM or AVERAGE function.

- Format the cells: Format the cells based on the formula you entered.

Conclusion

Reconciling a general ledger can be a complex and time-consuming process, but with the right techniques and tools, it can be made more efficient. Excel is a powerful tool that offers a wide range of features and functions that make it ideal for general ledger reconciliation.

By using a template, automating reconciliation with macros, using conditional formatting to highlight discrepancies, using pivot tables to analyze data, and using Excel formulas to automate calculations, you can simplify the reconciliation process and reduce the risk of errors.

Remember to always backup your data and use caution when working with macros and formulas. With practice and patience, you can master the art of general ledger reconciliation in Excel.

Gallery of General Ledger Reconciliation in Excel

What is general ledger reconciliation?

+General ledger reconciliation is the process of comparing the balance in the general ledger with the balance in the company's external bank statement or other financial statements to ensure accuracy and detect any discrepancies.

Why is general ledger reconciliation important?

+General ledger reconciliation is important because it helps ensure the accuracy of the company's financial statements and detects any discrepancies or errors that may have occurred during the accounting process.

What are some common challenges in general ledger reconciliation?

+Some common challenges in general ledger reconciliation include data errors, discrepancies between the general ledger and external bank statements, and the need for manual reconciliation.