When it comes to lending or borrowing money, it's essential to have a clear agreement in place to avoid any potential disputes or misunderstandings. A promissory note is a legally binding document that outlines the terms of a loan, including the amount borrowed, interest rate, and repayment terms. In the state of Texas, a promissory note is a crucial document for both lenders and borrowers. In this article, we will discuss the importance of a promissory note, its key components, and provide a free Texas promissory note template for download.

What is a Promissory Note?

A promissory note is a written agreement between a lender and a borrower that outlines the terms of a loan. It is a legally binding document that requires the borrower to repay the loan, along with any interest or fees, to the lender. A promissory note typically includes the amount borrowed, interest rate, repayment terms, and any other conditions or requirements.

Why is a Promissory Note Important?

A promissory note is essential for both lenders and borrowers because it provides a clear understanding of the loan terms and helps to prevent disputes. Here are some reasons why a promissory note is important:

- Provides a clear understanding of the loan terms

- Helps to prevent disputes and misunderstandings

- Establishes a legally binding agreement between the lender and borrower

- Can be used as evidence in court if a dispute arises

Key Components of a Promissory Note

A promissory note typically includes the following key components:

- Amount Borrowed: The amount of money borrowed by the borrower

- Interest Rate: The rate of interest charged on the loan

- Repayment Terms: The terms of repayment, including the payment schedule and amount

- Date of Repayment: The date by which the loan must be repaid

- Default Provisions: The consequences of defaulting on the loan

- Governing Law: The laws of the state that govern the promissory note

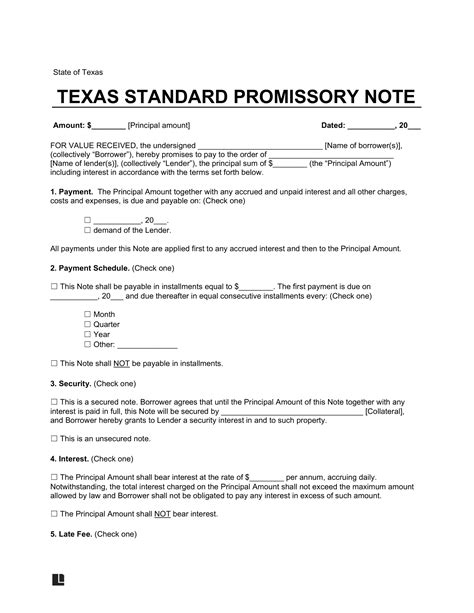

Free Texas Promissory Note Template

Below is a free Texas promissory note template that you can download and use. This template includes all the key components of a promissory note and is specifically designed for use in the state of Texas.

How to Use the Template

To use the template, simply download it and fill in the required information. Make sure to read and understand the terms of the promissory note before signing it. Both the lender and borrower should sign the promissory note in the presence of a notary public.

Benefits of Using a Promissory Note Template

Using a promissory note template provides several benefits, including:

- Saves time and effort

- Ensures that all key components are included

- Helps to prevent disputes and misunderstandings

- Provides a clear understanding of the loan terms

Conclusion

In conclusion, a promissory note is a crucial document for both lenders and borrowers in the state of Texas. It provides a clear understanding of the loan terms and helps to prevent disputes. By using a promissory note template, you can save time and effort, ensure that all key components are included, and provide a clear understanding of the loan terms. Download our free Texas promissory note template today and ensure that your loan is properly documented.

What is a promissory note?

+A promissory note is a written agreement between a lender and a borrower that outlines the terms of a loan.

Why is a promissory note important?

+A promissory note is important because it provides a clear understanding of the loan terms and helps to prevent disputes.

What are the key components of a promissory note?

+The key components of a promissory note include the amount borrowed, interest rate, repayment terms, date of repayment, default provisions, and governing law.