As a small business owner, managing finances effectively is crucial to the success of your organization. One of the most important financial management tools is a job cost sheet template. A job cost sheet template helps you track the costs associated with specific projects or jobs, enabling you to make informed decisions about pricing, budgeting, and resource allocation.

In this article, we will provide you with a free job cost sheet template for small business owners, along with a comprehensive guide on how to use it. We will also discuss the importance of job costing, its benefits, and how to implement it in your small business.

What is Job Costing?

Job costing is a method of tracking and managing the costs associated with specific projects or jobs. It involves identifying and recording all the costs incurred during the project, including labor, materials, overheads, and other expenses. Job costing helps you to determine the profitability of each project, identify areas for cost reduction, and make informed decisions about pricing and resource allocation.

Benefits of Job Costing

Job costing offers several benefits to small business owners, including:

- Improved profitability: By accurately tracking costs, you can identify areas for cost reduction and improve profitability.

- Better decision-making: Job costing provides you with accurate and timely information, enabling you to make informed decisions about pricing, budgeting, and resource allocation.

- Enhanced transparency: Job costing helps you to track costs in real-time, providing you with a clear picture of your financial performance.

- Increased efficiency: By identifying areas for cost reduction, you can streamline your operations and improve efficiency.

Free Job Cost Sheet Template

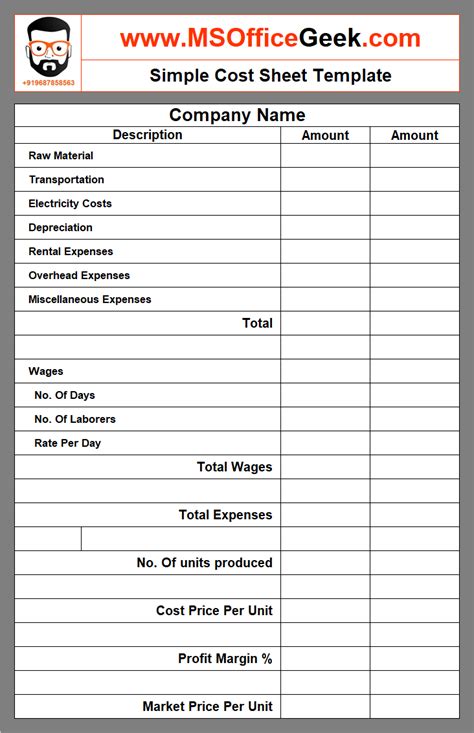

Here is a free job cost sheet template that you can use in your small business:

This template includes the following columns:

- Job Number: A unique identifier for each job or project.

- Job Description: A brief description of the job or project.

- Start Date: The start date of the job or project.

- End Date: The end date of the job or project.

- Labor Costs: The total labor costs incurred during the job or project.

- Material Costs: The total material costs incurred during the job or project.

- Overhead Costs: The total overhead costs incurred during the job or project.

- Total Costs: The total costs incurred during the job or project.

- Revenue: The total revenue generated by the job or project.

- Profit: The total profit generated by the job or project.

How to Use the Job Cost Sheet Template

To use the job cost sheet template, follow these steps:

- Identify the job or project: Enter the job number and description in the relevant columns.

- Track labor costs: Record the labor costs incurred during the job or project, including employee wages, benefits, and payroll taxes.

- Track material costs: Record the material costs incurred during the job or project, including the cost of raw materials, supplies, and equipment.

- Track overhead costs: Record the overhead costs incurred during the job or project, including rent, utilities, insurance, and other expenses.

- Calculate total costs: Calculate the total costs incurred during the job or project by adding up the labor, material, and overhead costs.

- Calculate revenue: Record the total revenue generated by the job or project.

- Calculate profit: Calculate the total profit generated by the job or project by subtracting the total costs from the revenue.

Implementing Job Costing in Your Small Business

To implement job costing in your small business, follow these steps:

- Identify your costs: Identify all the costs associated with each job or project, including labor, materials, overheads, and other expenses.

- Set up a job costing system: Set up a job costing system that tracks costs in real-time, providing you with accurate and timely information.

- Assign job numbers: Assign a unique job number to each job or project, enabling you to track costs and revenue separately.

- Track costs: Track costs incurred during each job or project, including labor, materials, overheads, and other expenses.

- Analyze costs: Analyze costs incurred during each job or project, identifying areas for cost reduction and improving profitability.

Conclusion

Job costing is a powerful financial management tool that helps small business owners track costs, improve profitability, and make informed decisions about pricing, budgeting, and resource allocation. By using the free job cost sheet template provided in this article, you can implement job costing in your small business and start achieving your financial goals.

We hope you found this article helpful. If you have any questions or need further assistance, please don't hesitate to comment below. Share this article with your friends and colleagues who may benefit from it.

What is job costing?

+Job costing is a method of tracking and managing the costs associated with specific projects or jobs.

Why is job costing important for small business owners?

+Job costing helps small business owners track costs, improve profitability, and make informed decisions about pricing, budgeting, and resource allocation.

How do I implement job costing in my small business?

+To implement job costing in your small business, identify your costs, set up a job costing system, assign job numbers, track costs, and analyze costs.