In the rapidly evolving world of technology, startups and established companies alike are navigating the complex landscape of taxation. With the increasing importance of technology in modern business, it's crucial to understand the tax forms that apply to the tech industry. In this article, we'll delve into the first five tech tax forms you need to know, providing you with a comprehensive understanding of the tax requirements that affect your business.

The tech industry is a significant contributor to the global economy, with companies like Google, Amazon, and Facebook leading the charge. However, the tech sector is not immune to tax laws and regulations. In fact, the tax landscape for tech companies is becoming increasingly complex, with governments around the world introducing new tax laws and regulations to address the digital economy.

As a tech company, it's essential to stay ahead of the curve when it comes to tax compliance. Failure to comply with tax laws can result in penalties, fines, and even reputational damage. In this article, we'll explore the first five tech tax forms you need to know, providing you with a solid foundation for navigating the complex world of tech taxation.

Understanding the Basics of Tech Taxation

Before we dive into the specifics of tech tax forms, it's essential to understand the basics of tech taxation. The tech industry is a broad term that encompasses a wide range of businesses, from software development to e-commerce and digital marketing. As a result, the tax laws and regulations that apply to the tech industry are equally diverse.

In general, tech companies are subject to the same tax laws and regulations as other businesses. However, there are some unique aspects of the tech industry that require special attention. For example, tech companies often rely on intellectual property (IP) to drive their business, and IP can be a complex area of taxation.

Additionally, tech companies often operate globally, which can create tax complexities. With the rise of cloud computing and digital services, it's not uncommon for tech companies to have customers and operations in multiple countries. This can create tax obligations in multiple jurisdictions, making it essential to understand the tax laws and regulations that apply to your business.

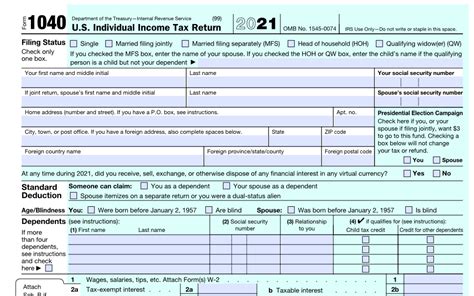

Form 1: Form 1040 - U.S. Individual Income Tax Return

The first tech tax form you need to know is Form 1040, the U.S. Individual Income Tax Return. While this form is not exclusive to the tech industry, it's a critical form for tech entrepreneurs and employees who need to report their income.

Form 1040 is used to report an individual's income, deductions, and credits, and it's a requirement for anyone who earns income in the United States. For tech entrepreneurs, Form 1040 is used to report business income, as well as any capital gains or losses from the sale of IP or other business assets.

Image:

Form 2: Form W-9 - Request for Taxpayer Identification Number and Certification

The second tech tax form you need to know is Form W-9, the Request for Taxpayer Identification Number and Certification. This form is used to provide a taxpayer identification number (TIN) to the IRS, and it's a requirement for anyone who receives income in the United States.

For tech companies, Form W-9 is used to provide a TIN to the IRS, as well as to certify that the company is not subject to backup withholding. This form is critical for tech companies that receive income from customers or clients, as it ensures that the company is compliant with tax laws and regulations.

Image:

Form 3: Form 1099-MISC - Miscellaneous Income

The third tech tax form you need to know is Form 1099-MISC, the Miscellaneous Income form. This form is used to report miscellaneous income, such as freelance work or royalties, and it's a requirement for anyone who receives miscellaneous income.

For tech companies, Form 1099-MISC is used to report income from freelance work, such as software development or consulting services. This form is critical for tech companies that rely on freelance work, as it ensures that the company is compliant with tax laws and regulations.

Image:

Form 4: Form 4562 - Depreciation and Amortization

The fourth tech tax form you need to know is Form 4562, the Depreciation and Amortization form. This form is used to report depreciation and amortization of business assets, such as equipment or IP.

For tech companies, Form 4562 is used to report depreciation and amortization of business assets, such as software development costs or IP acquisition costs. This form is critical for tech companies that rely on IP to drive their business, as it ensures that the company is compliant with tax laws and regulations.

Image:

Form 5: Form 8949 - Sales and Other Dispositions of Capital Assets

The fifth tech tax form you need to know is Form 8949, the Sales and Other Dispositions of Capital Assets form. This form is used to report sales and other dispositions of capital assets, such as IP or business assets.

For tech companies, Form 8949 is used to report sales and other dispositions of capital assets, such as the sale of IP or business assets. This form is critical for tech companies that rely on IP to drive their business, as it ensures that the company is compliant with tax laws and regulations.

Image:

Conclusion

In conclusion, the tech industry is a complex and rapidly evolving field that requires a deep understanding of tax laws and regulations. By understanding the first five tech tax forms you need to know, you can ensure that your business is compliant with tax laws and regulations.

Whether you're a tech entrepreneur or a seasoned business owner, it's essential to stay ahead of the curve when it comes to tax compliance. By staying informed and seeking professional advice when needed, you can navigate the complex world of tech taxation with confidence.

Gallery of Tech Tax Forms

FAQ Section

What is the purpose of Form 1040?

+Form 1040 is used to report an individual's income, deductions, and credits.

What is the purpose of Form W-9?

+Form W-9 is used to provide a taxpayer identification number (TIN) to the IRS.

What is the purpose of Form 1099-MISC?

+Form 1099-MISC is used to report miscellaneous income, such as freelance work or royalties.