The lure of a quick fix or a way to circumvent the system can be tempting, but the consequences of using a Texas fake insurance card template can be severe. In this article, we will explore the concept of fake insurance cards, the risks associated with using them, and the potential consequences of getting caught.

The Importance of Car Insurance in Texas

Car insurance is a mandatory requirement in Texas, and for good reason. It provides financial protection in the event of an accident, helping to cover medical expenses, vehicle repairs, and other related costs. Without car insurance, drivers may be left with significant financial burdens, not to mention the risk of legal penalties.

The Rise of Fake Insurance Cards

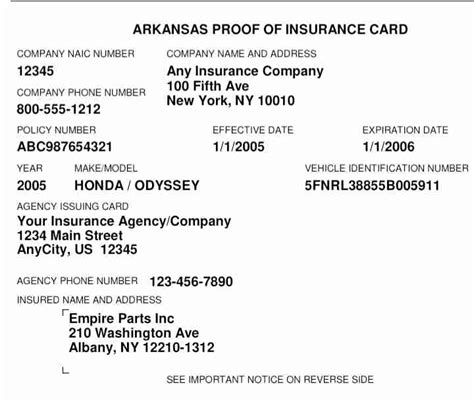

In recent years, there has been a growing trend of individuals attempting to circumvent the car insurance requirement by using fake insurance cards. These cards, often created using templates found online, can appear convincing, but they are essentially worthless.

The risks associated with using a fake insurance card are significant. Not only can drivers face fines and penalties, but they may also be left without financial protection in the event of an accident.

What is a Texas Fake Insurance Card Template?

A Texas fake insurance card template is a document designed to mimic the appearance of a legitimate car insurance card. These templates can be found online and are often created using software programs such as Adobe Photoshop or Microsoft Word.

While fake insurance card templates may appear convincing, they are not legitimate and can lead to serious consequences if used.

Risks Associated with Using a Fake Insurance Card

Using a fake insurance card can have serious consequences, including:

- Fines and penalties: Drivers caught using a fake insurance card can face significant fines and penalties, including the suspension of their driver's license.

- Financial burdens: In the event of an accident, drivers without legitimate car insurance may be left with significant financial burdens, including medical expenses and vehicle repairs.

- Legal action: Drivers caught using a fake insurance card may face legal action, including fines and penalties.

Consequences of Getting Caught

The consequences of getting caught using a fake insurance card can be severe. In Texas, drivers caught using a fake insurance card can face:

- A fine of up to $350

- The suspension of their driver's license

- A penalty of up to $1,000

- The possibility of being required to file an SR-22 form, which can lead to higher car insurance premiums

Alternatives to Fake Insurance Cards

While the temptation to use a fake insurance card may be strong, there are alternatives. Drivers who are struggling to afford car insurance can explore options such as:

- Low-cost car insurance programs

- Government-sponsored car insurance programs

- Non-profit car insurance programs

Conclusion: The Dangers of Texas Fake Insurance Card Templates

In conclusion, using a Texas fake insurance card template is not a viable solution for drivers who are struggling to afford car insurance. The risks associated with using a fake insurance card are significant, and the consequences of getting caught can be severe.

Instead of using a fake insurance card, drivers should explore alternative options, such as low-cost car insurance programs or government-sponsored car insurance programs.

By making informed decisions and exploring legitimate options, drivers can ensure they have the financial protection they need in the event of an accident.

What is the penalty for using a fake insurance card in Texas?

+The penalty for using a fake insurance card in Texas can include a fine of up to $350, the suspension of your driver's license, and a penalty of up to $1,000.

What are some alternatives to fake insurance cards?

+Some alternatives to fake insurance cards include low-cost car insurance programs, government-sponsored car insurance programs, and non-profit car insurance programs.

What is the minimum car insurance requirement in Texas?

+The minimum car insurance requirement in Texas is $30,000 per person and $60,000 per accident for bodily injury liability, and $25,000 for property damage liability.