Creating a budget can be a daunting task, but with the right tools and guidance, it can be a straightforward process that helps you manage your finances effectively. One of the most popular and widely used budgeting tools is Microsoft Excel, and a free Excel budgeting template can be a great starting point for anyone looking to create a personalized budget.

On Reddit, a community of experts and enthusiasts share their knowledge and experiences on various topics, including personal finance and budgeting. In this article, we will explore some of the best free Excel budgeting templates shared by Reddit experts, and provide a comprehensive guide on how to use them to create a budget that works for you.

Why Use a Budgeting Template?

A budgeting template can help you create a budget quickly and easily, without having to start from scratch. It provides a structured format for tracking your income and expenses, and can help you identify areas where you can cut back and save money. With a budgeting template, you can:

- Track your income and expenses accurately

- Identify areas where you can cut back and save money

- Create a personalized budget that works for you

- Make adjustments to your budget as your financial situation changes

Benefits of Using an Excel Budgeting Template

Using an Excel budgeting template offers several benefits, including:

- Flexibility: Excel templates can be customized to fit your specific financial needs and goals.

- Accuracy: Excel formulas and functions can help you calculate your income and expenses accurately.

- Ease of use: Excel templates are easy to use, even for those who are not familiar with budgeting or accounting.

- Accessibility: Excel templates can be accessed and edited from anywhere, at any time.

Free Excel Budgeting Templates from Reddit Experts

Here are some of the best free Excel budgeting templates shared by Reddit experts:

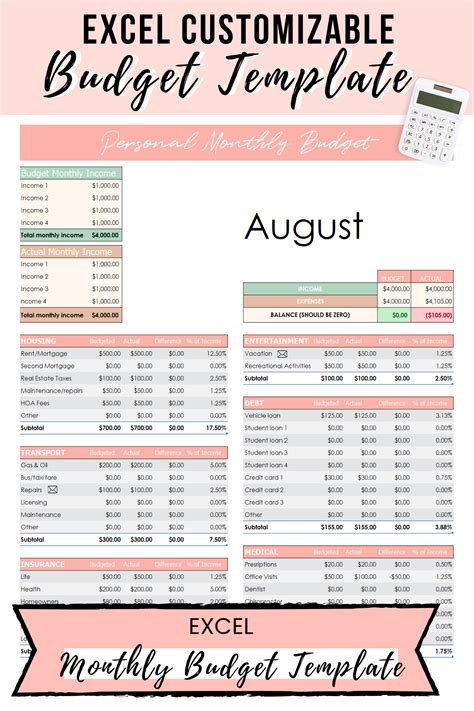

- Budgeting Template by u/personalfinance: This template is a comprehensive budgeting tool that includes columns for income, fixed expenses, variable expenses, and savings. It also includes a section for tracking debt and credit card payments.

- Zero-Based Budgeting Template by u/zerobasedbudget: This template is designed for those who want to follow a zero-based budgeting approach, where every dollar is accounted for and allocated to a specific category.

- 50/30/20 Budgeting Template by u/budgetingtemplate: This template is based on the 50/30/20 rule, where 50% of your income goes towards fixed expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.

How to Use a Budgeting Template

Using a budgeting template is straightforward. Here are the steps to follow:

- Download the template: Click on the link to download the template to your computer.

- Open the template: Open the template in Excel and take a look at the different columns and sections.

- Enter your income: Enter your income in the income column, including any irregular income or bonuses.

- Enter your expenses: Enter your fixed and variable expenses in the corresponding columns.

- Track your debt: Enter your debt and credit card payments in the debt section.

- Adjust the template: Adjust the template to fit your specific financial needs and goals.

- Review and adjust: Review your budget regularly and make adjustments as needed.

Tips for Creating a Successful Budget

Creating a successful budget requires more than just using a template. Here are some tips to help you create a budget that works for you:

- Track your expenses: Tracking your expenses is essential to creating a successful budget. Use a budgeting app or spreadsheet to track your income and expenses.

- Set financial goals: Set specific financial goals, such as saving for a down payment on a house or paying off debt.

- Prioritize needs over wants: Prioritize your needs over your wants, and make sure to allocate enough money for essential expenses such as rent/mortgage, utilities, and food.

- Review and adjust: Review your budget regularly and make adjustments as needed.

Common Budgeting Mistakes to Avoid

Here are some common budgeting mistakes to avoid:

- Not tracking expenses: Not tracking your expenses can lead to overspending and financial stress.

- Not prioritizing needs over wants: Failing to prioritize your needs over your wants can lead to financial instability.

- Not reviewing and adjusting: Not reviewing and adjusting your budget regularly can lead to financial stagnation.

Conclusion

Creating a budget can be a daunting task, but with the right tools and guidance, it can be a straightforward process that helps you manage your finances effectively. A free Excel budgeting template can be a great starting point for anyone looking to create a personalized budget. By following the tips and avoiding common budgeting mistakes, you can create a budget that works for you and helps you achieve your financial goals.

What is a budgeting template?

+A budgeting template is a pre-designed spreadsheet that helps you track your income and expenses and create a budget.

Why use a budgeting template?

+A budgeting template can help you create a budget quickly and easily, and can help you track your income and expenses accurately.

What are some common budgeting mistakes to avoid?

+Common budgeting mistakes to avoid include not tracking expenses, not prioritizing needs over wants, and not reviewing and adjusting your budget regularly.