Managing an estate can be a daunting task, especially when it comes to keeping track of finances. An estate accounting spreadsheet template can be a valuable tool in helping you stay organized and ensuring that all financial matters are properly taken care of. In this article, we will explore the importance of estate accounting, the benefits of using a spreadsheet template, and provide a step-by-step guide on how to create an estate accounting spreadsheet template.

Why Estate Accounting is Important

Estate accounting is the process of managing and tracking the financial affairs of an estate, including income, expenses, assets, and liabilities. It is essential to ensure that the estate is managed efficiently and effectively, and that all financial matters are properly taken care of. Estate accounting involves a range of tasks, including:

- Tracking income and expenses

- Managing assets and liabilities

- Preparing tax returns

- Distributing assets to beneficiaries

Proper estate accounting can help prevent financial disputes, ensure that taxes are paid on time, and ensure that the estate is distributed according to the wishes of the deceased.

Benefits of Using an Estate Accounting Spreadsheet Template

Using an estate accounting spreadsheet template can help make the estate accounting process easier and more efficient. Some of the benefits of using a spreadsheet template include:

- Improved organization: A spreadsheet template can help you keep track of all financial matters related to the estate, including income, expenses, assets, and liabilities.

- Time-saving: A spreadsheet template can save you time and effort by providing a pre-formatted template that you can use to track financial information.

- Accuracy: A spreadsheet template can help reduce errors and ensure that financial information is accurate and up-to-date.

- Customization: A spreadsheet template can be customized to meet the specific needs of the estate.

Creating an Estate Accounting Spreadsheet Template

Creating an estate accounting spreadsheet template is a relatively straightforward process. Here are the steps you can follow:

- Choose a spreadsheet software: You can use a spreadsheet software such as Microsoft Excel, Google Sheets, or LibreOffice Calc to create an estate accounting spreadsheet template.

- Set up a new spreadsheet: Create a new spreadsheet and give it a title, such as "Estate Accounting Template".

- Create a table: Create a table with columns for the following information:

- Date

- Description

- Income

- Expenses

- Assets

- Liabilities

- Add formulas: Add formulas to calculate totals and percentages, such as the total income, total expenses, and net worth.

- Customize the template: Customize the template to meet the specific needs of the estate. For example, you may want to add columns for specific types of income or expenses.

- Format the template: Format the template to make it easy to read and understand.

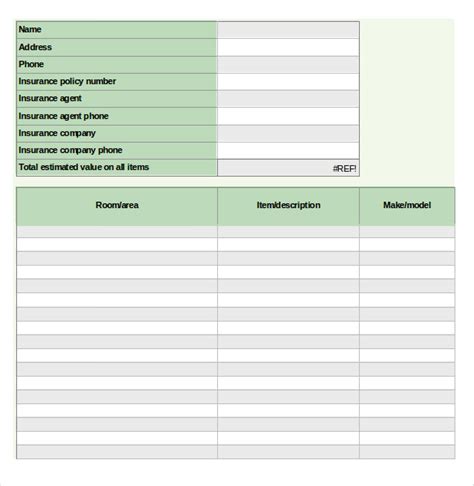

Example of an Estate Accounting Spreadsheet Template

Here is an example of what an estate accounting spreadsheet template might look like:

| Date | Description | Income | Expenses | Assets | Liabilities |

|---|---|---|---|---|---|

| 2022-01-01 | Rent | $1,000 | $10,000 | $5,000 | |

| 2022-01-15 | Utilities | $150 | |||

| 2022-02-01 | Interest | $500 | $15,000 |

Best Practices for Using an Estate Accounting Spreadsheet Template

Here are some best practices for using an estate accounting spreadsheet template:

- Keep it up-to-date: Make sure to update the spreadsheet regularly to ensure that financial information is accurate and up-to-date.

- Use formulas: Use formulas to calculate totals and percentages, such as the total income, total expenses, and net worth.

- Customize the template: Customize the template to meet the specific needs of the estate.

- Keep it organized: Keep the spreadsheet organized by using clear headings and labels.

- Seek professional help: If you are unsure about how to use the spreadsheet template or need help with estate accounting, seek professional help from an accountant or attorney.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using an estate accounting spreadsheet template:

- Not keeping it up-to-date: Failing to update the spreadsheet regularly can lead to inaccurate financial information.

- Not using formulas: Not using formulas to calculate totals and percentages can lead to errors and inaccuracies.

- Not customizing the template: Not customizing the template to meet the specific needs of the estate can lead to inaccuracies and omissions.

- Not keeping it organized: Not keeping the spreadsheet organized can lead to errors and inaccuracies.

Conclusion

Creating an estate accounting spreadsheet template can be a valuable tool in helping you manage the financial affairs of an estate. By following the steps outlined in this article, you can create a customized template that meets the specific needs of the estate. Remember to keep it up-to-date, use formulas, customize the template, and keep it organized to ensure that financial information is accurate and up-to-date.

What is estate accounting?

+Estate accounting is the process of managing and tracking the financial affairs of an estate, including income, expenses, assets, and liabilities.

Why is estate accounting important?

+Estate accounting is important because it helps ensure that the estate is managed efficiently and effectively, and that all financial matters are properly taken care of.

How do I create an estate accounting spreadsheet template?

+Creating an estate accounting spreadsheet template involves setting up a new spreadsheet, creating a table with columns for income, expenses, assets, and liabilities, and adding formulas to calculate totals and percentages.