Equity roll forward templates are a crucial tool for businesses, investors, and financial analysts to track and analyze the changes in a company's equity over time. Mastering the equity roll forward template can help you make informed decisions, identify trends, and optimize your financial strategies. In this article, we will explore five ways to master the equity roll forward template and unlock its full potential.

Understanding the Basics

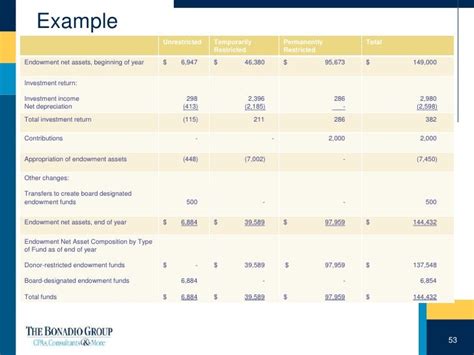

Before diving into the advanced techniques, it's essential to understand the basics of an equity roll forward template. The template typically consists of a table or spreadsheet that outlines the changes in a company's equity over a specific period, usually quarterly or annually. The template includes columns for the beginning balance, changes in equity, and ending balance, as well as rows for each type of equity, such as common stock, preferred stock, and retained earnings.

1. Setting Up the Template

To master the equity roll forward template, you need to set it up correctly. Here are some tips to help you get started:

- Use a spreadsheet software like Excel or Google Sheets to create the template.

- Set up the template with the correct columns and rows, including the beginning balance, changes in equity, and ending balance.

- Use formulas to calculate the changes in equity and the ending balance.

- Use formatting to make the template easy to read and understand.

[Image: Setting up the Equity Roll Forward Template]

2. Tracking Changes in Equity

Tracking changes in equity is a critical aspect of mastering the equity roll forward template. Here are some tips to help you track changes in equity effectively:

- Identify the types of changes that affect equity, such as stock issuances, stock repurchases, dividends, and net income.

- Use the template to track each type of change in equity, including the date, amount, and description of the change.

- Use formulas to calculate the total change in equity for each period.

- Analyze the changes in equity to identify trends and patterns.

[Image: Tracking Changes in Equity]

3. Analyzing the Template

Analyzing the equity roll forward template is essential to gaining insights into a company's financial performance. Here are some tips to help you analyze the template effectively:

- Use the template to calculate key metrics, such as the return on equity (ROE) and the dividend payout ratio.

- Analyze the trends and patterns in the changes in equity to identify areas for improvement.

- Compare the company's financial performance to industry benchmarks and competitors.

- Use the template to identify potential risks and opportunities.

[Image: Analyzing the Equity Roll Forward Template]

4. Using the Template for Forecasting

The equity roll forward template can be used for forecasting a company's future financial performance. Here are some tips to help you use the template for forecasting:

- Use historical data to forecast future changes in equity.

- Use the template to calculate forecasted key metrics, such as the ROE and the dividend payout ratio.

- Analyze the forecasted trends and patterns in the changes in equity to identify potential risks and opportunities.

- Use the template to create scenarios and sensitivity analyses.

[Image: Using the Equity Roll Forward Template for Forecasting]

5. Automating the Template

Automating the equity roll forward template can save time and reduce errors. Here are some tips to help you automate the template:

- Use spreadsheet software to automate calculations and formatting.

- Use macros to automate tasks, such as updating the template with new data.

- Use add-ins and plugins to automate tasks, such as data import and analysis.

- Use cloud-based software to automate collaboration and sharing.

[Image: Automating the Equity Roll Forward Template]

Gallery of Equity Roll Forward Templates

Frequently Asked Questions

What is an equity roll forward template?

+An equity roll forward template is a table or spreadsheet that outlines the changes in a company's equity over a specific period.

Why is it important to track changes in equity?

+Tracking changes in equity is important because it helps to identify trends and patterns in a company's financial performance.

How can I automate the equity roll forward template?

+You can automate the equity roll forward template using spreadsheet software, macros, add-ins, and plugins.

By following these five ways to master the equity roll forward template, you can unlock its full potential and gain valuable insights into a company's financial performance. Remember to set up the template correctly, track changes in equity, analyze the template, use it for forecasting, and automate it to save time and reduce errors.