As a business owner, investor, or financial analyst, you're likely familiar with the importance of financial analysis in making informed decisions. One of the most effective tools for financial analysis is the Discounted Cash Flow (DCF) model. In this article, we'll explore the concept of DCF analysis, its benefits, and provide a free DCF Excel template to simplify your financial analysis.

Understanding Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) analysis is a valuation method used to estimate the present value of future cash flows. This approach helps investors and businesses determine the intrinsic value of a company or project by forecasting its future cash inflows and outflows. The DCF model takes into account the time value of money, risk, and the cost of capital to provide a comprehensive picture of a company's financial health.

Benefits of DCF Analysis

DCF analysis offers several benefits, including:

- Accurate valuation: DCF analysis provides a more accurate estimate of a company's value by considering the time value of money and the risk associated with future cash flows.

- Improved decision-making: By evaluating the present value of future cash flows, DCF analysis helps investors and businesses make informed decisions about investments, mergers and acquisitions, and other strategic initiatives.

- Risk assessment: DCF analysis allows you to assess the risk associated with a company or project by evaluating the probability of achieving forecasted cash flows.

Key Components of DCF Analysis

A typical DCF analysis involves the following key components:

- Forecasting cash flows: Estimating the future cash inflows and outflows of a company or project.

- Determining the discount rate: Calculating the discount rate, which reflects the time value of money and the risk associated with future cash flows.

- Calculating the present value: Discounting the forecasted cash flows to their present value using the discount rate.

Steps to Perform DCF Analysis

To perform a DCF analysis, follow these steps:

- Gather historical data: Collect financial statements and other relevant data to estimate future cash flows.

- Forecast cash flows: Use historical data and industry trends to estimate future cash inflows and outflows.

- Determine the discount rate: Calculate the discount rate based on the company's cost of capital, risk-free rate, and market risk premium.

- Calculate the present value: Discount the forecasted cash flows to their present value using the discount rate.

- Evaluate the results: Compare the present value of future cash flows to the company's current market value to determine its intrinsic value.

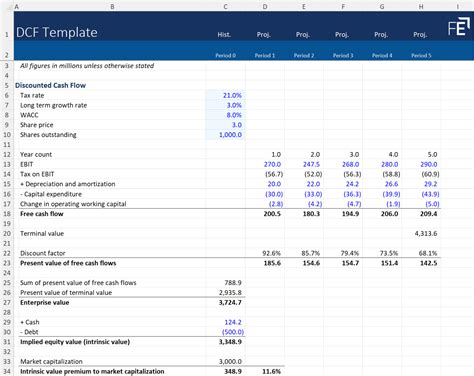

Free DCF Excel Template

To simplify your DCF analysis, we've created a free DCF Excel template that you can download and use. The template includes the following features:

- Forecasting cash flows: A worksheet to estimate future cash inflows and outflows.

- Discount rate calculation: A worksheet to calculate the discount rate based on the company's cost of capital, risk-free rate, and market risk premium.

- Present value calculation: A worksheet to discount the forecasted cash flows to their present value using the discount rate.

- Results summary: A worksheet to evaluate the results of the DCF analysis.

You can download the free DCF Excel template here: [insert link]

Example of DCF Analysis Using the Template

To illustrate the use of the DCF Excel template, let's consider an example of a company that expects to generate the following cash flows over the next five years:

| Year | Cash Flow |

|---|---|

| 1 | $100,000 |

| 2 | $120,000 |

| 3 | $150,000 |

| 4 | $180,000 |

| 5 | $200,000 |

Using the template, we can estimate the present value of these cash flows as follows:

- Forecast cash flows: Enter the cash flows into the "Forecasting Cash Flows" worksheet.

- Determine the discount rate: Calculate the discount rate based on the company's cost of capital, risk-free rate, and market risk premium.

- Calculate the present value: Discount the forecasted cash flows to their present value using the discount rate.

The results of the DCF analysis are summarized in the "Results Summary" worksheet.

Conclusion

Discounted Cash Flow (DCF) analysis is a powerful tool for estimating the intrinsic value of a company or project. By following the steps outlined in this article and using our free DCF Excel template, you can simplify your financial analysis and make more informed decisions.

Take Action

Download our free DCF Excel template and start performing your own DCF analysis today. Share your experiences and questions in the comments below.

What is DCF analysis?

+DCF analysis is a valuation method used to estimate the present value of future cash flows.

What are the benefits of DCF analysis?

+DCF analysis provides a more accurate estimate of a company's value, helps investors and businesses make informed decisions, and allows for risk assessment.

How do I perform a DCF analysis?

+Performing a DCF analysis involves forecasting cash flows, determining the discount rate, and calculating the present value.