As a contractor, managing finances and keeping track of payments is crucial for the success of your business. One essential tool for achieving this is a pay stub template. In this article, we will discuss the importance of a contractor pay stub template in Microsoft Word and provide a comprehensive guide on how to create and use one.

Why Do You Need a Contractor Pay Stub Template?

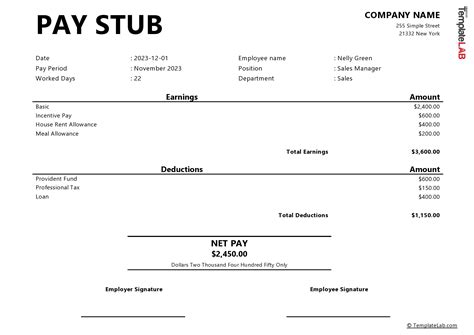

A pay stub template is a document that outlines the details of a payment made to a contractor or employee. It typically includes information such as the payment amount, payment date, and deductions. As a contractor, using a pay stub template can help you:

- Keep track of your payments and finances

- Provide a clear and transparent record of payments to your clients or contractors

- Meet tax and regulatory requirements

- Streamline your payment process and reduce errors

Benefits of Using a Contractor Pay Stub Template

Using a contractor pay stub template can have several benefits, including:

- Increased accuracy and efficiency in payment processing

- Improved transparency and trust with clients and contractors

- Enhanced financial management and record-keeping

- Compliance with tax and regulatory requirements

- Reduced errors and disputes

Creating a Contractor Pay Stub Template in Microsoft Word

Creating a contractor pay stub template in Microsoft Word is a straightforward process. Here's a step-by-step guide to help you get started:

- Open Microsoft Word and create a new document.

- Set up the page layout and formatting to suit your needs.

- Create a table or use a pre-designed template to outline the pay stub details.

- Include the following essential information:

- Payment amount

- Payment date

- Pay period

- Deductions (e.g., taxes, benefits)

- Net pay

- Gross pay

- Employee/contractor name and ID

- Customize the template to fit your specific needs and branding.

- Save the template as a Word document or PDF.

What to Include in a Contractor Pay Stub Template

When creating a contractor pay stub template, it's essential to include the following essential information:

- Payment amount: The total amount paid to the contractor or employee.

- Payment date: The date the payment was made.

- Pay period: The period covered by the payment (e.g., weekly, bi-weekly, monthly).

- Deductions: Any deductions made from the payment, such as taxes, benefits, or other withholdings.

- Net pay: The amount of the payment after deductions have been made.

- Gross pay: The total amount of the payment before deductions.

- Employee/contractor name and ID: The name and ID number of the contractor or employee receiving the payment.

How to Use a Contractor Pay Stub Template

Using a contractor pay stub template is straightforward. Here's a step-by-step guide to help you get started:

- Open the template and fill in the required information.

- Enter the payment amount, payment date, and pay period.

- Calculate the deductions and enter the net pay and gross pay.

- Include the employee/contractor name and ID.

- Review and verify the information for accuracy.

- Print or save the pay stub as a PDF.

- Provide the pay stub to the contractor or employee.

Common Mistakes to Avoid When Using a Contractor Pay Stub Template

When using a contractor pay stub template, it's essential to avoid common mistakes, such as:

- Inaccurate or incomplete information

- Failure to include required deductions or withholdings

- Incorrect payment dates or pay periods

- Missing or incorrect employee/contractor information

- Failure to review and verify the information for accuracy

FAQs

What is a contractor pay stub template?

+A contractor pay stub template is a document that outlines the details of a payment made to a contractor or employee.

Why do I need a contractor pay stub template?

+You need a contractor pay stub template to keep track of your payments and finances, provide a clear and transparent record of payments to your clients or contractors, and meet tax and regulatory requirements.

How do I create a contractor pay stub template in Microsoft Word?

+To create a contractor pay stub template in Microsoft Word, open a new document, set up the page layout and formatting, create a table or use a pre-designed template, and include the required information such as payment amount, payment date, and deductions.

We hope this article has provided you with a comprehensive guide on creating and using a contractor pay stub template in Microsoft Word. By following the steps outlined above, you can create a professional and accurate pay stub template that meets your business needs. Remember to include the required information, avoid common mistakes, and customize the template to fit your specific needs and branding.