As a contractor, managing your finances and keeping track of your payments is crucial for your business's success. One essential tool for achieving this is a pay stub. A pay stub is a document that shows the details of a payment made to an employee or contractor, including the amount of pay, taxes withheld, and other deductions. In this article, we will provide you with 5 free contractor pay stub templates that you can use for your business.

Why Do Contractors Need Pay Stubs?

As a contractor, you may not receive a traditional paycheck like employees do. However, you still need to keep track of your payments and provide proof of income for tax purposes, loans, or other financial transactions. A pay stub serves as a record of your payment history and provides a clear breakdown of your earnings and deductions.

Using a pay stub template can help you:

- Keep accurate records of your payments

- Provide proof of income for tax purposes or loan applications

- Simplify your accounting and bookkeeping

- Ensure compliance with tax laws and regulations

Benefits of Using a Pay Stub Template

Using a pay stub template offers several benefits, including:

- Time-saving: A pay stub template saves you time and effort in creating a pay stub from scratch.

- Accuracy: A template helps you ensure accuracy in calculating your payments and deductions.

- Professionalism: A well-designed pay stub template presents a professional image of your business.

- Compliance: A template helps you comply with tax laws and regulations.

5 Free Contractor Pay Stub Templates

Here are 5 free contractor pay stub templates that you can use for your business:

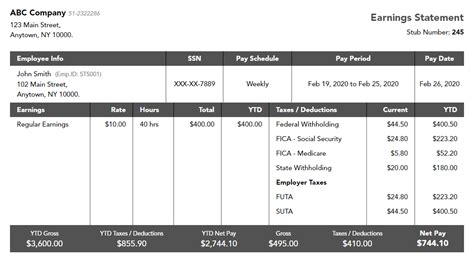

Template 1: Basic Contractor Pay Stub Template

This template provides a simple and basic layout for creating a pay stub. It includes fields for the contractor's name, payment date, payment amount, and deductions.

Template 2: Contractor Pay Stub Template with Breakdown of Earnings

This template provides a detailed breakdown of the contractor's earnings, including the payment amount, taxes withheld, and other deductions.

Template 3: Contractor Pay Stub Template with Tax Deductions

This template includes fields for calculating tax deductions, including federal income tax, state income tax, and social security tax.

Template 4: Contractor Pay Stub Template with Benefits and Deductions

This template includes fields for calculating benefits and deductions, including health insurance, retirement plan contributions, and other benefits.

Template 5: Contractor Pay Stub Template with Payment History

This template includes a payment history section, which provides a record of the contractor's past payments.

How to Use a Pay Stub Template

Using a pay stub template is easy. Simply follow these steps:

- Choose a template that suits your needs.

- Download the template and open it in a spreadsheet or word processing program.

- Enter the contractor's information, including their name, address, and payment details.

- Calculate the payment amount and deductions using the formulas provided in the template.

- Print or save the pay stub for your records.

Gallery of Contractor Pay Stub Templates

Frequently Asked Questions

What is a pay stub?

+A pay stub is a document that shows the details of a payment made to an employee or contractor, including the amount of pay, taxes withheld, and other deductions.

Why do contractors need pay stubs?

+Contractors need pay stubs to keep track of their payments and provide proof of income for tax purposes, loans, or other financial transactions.

How do I use a pay stub template?

+Simply choose a template that suits your needs, download it, and enter the contractor's information. Calculate the payment amount and deductions using the formulas provided in the template.

We hope this article has provided you with useful information on contractor pay stub templates. By using a pay stub template, you can simplify your accounting and bookkeeping, ensure compliance with tax laws and regulations, and provide proof of income for your contractors.